Reply To:

Name - Reply Comment

Liquor licences have been granted in Sri Lanka in the past based on political connections

|

According to the Excise Ordinance and the orders made under it, only two licences can be issued to a single person or organization within one district Contrary to the existing law, it has been observed that more than two liquor licences have been issued to individuals and institutions in almost every district Starting in 2023, liquor licences were issued targeting the upcoming presidential elections |

Liquor licences in Sri Lanka are issued in accordance with Extraordinary Gazette No. 1544/17 of the Democratic Socialist Republic of Sri Lanka and Excise Notification No. 902, dated 04-10-2008 which outlines the excise guidelines and conditions. These regulations are further clarified by Extraordinary Gazette No. 2366/39 and Gazette Notification No. 02/2024, dated 12-01-2008. The Act was passed and enforced by Parliament, but was amended again in August 2024. Despite the revisions, liquor licences had been previously issued under Excise Notification 902, dated 04-10-2008.

Liquor licences in Sri Lanka are issued in accordance with Extraordinary Gazette No. 1544/17 of the Democratic Socialist Republic of Sri Lanka and Excise Notification No. 902, dated 04-10-2008 which outlines the excise guidelines and conditions. These regulations are further clarified by Extraordinary Gazette No. 2366/39 and Gazette Notification No. 02/2024, dated 12-01-2008. The Act was passed and enforced by Parliament, but was amended again in August 2024. Despite the revisions, liquor licences had been previously issued under Excise Notification 902, dated 04-10-2008.

The Supreme Court issued an order on August 6, 2023, under case number SCFR 116/2023, stating that no licence shall be granted in violation of the law when issuing liquor licences in accordance with Excise Notification 902. According to the Excise Ordinance and the orders made under it, only two licences can be issued to a single person or organisation within one district. The two licences can be granted only when there are no other qualified applicants. Condition 24 of Excise Notification 902 specifies that a request for an additional licence within the district by an applicant who already holds a licence will be considered only if there are no other suitable applicants for the same area. Condition 25 further states: “However, if the Commissioner-General of Excise believes that issuing more than two licences to an importer within the district could result in a liquor monopoly, undue control of liquor, or hinder the free distribution of supplies or consumption, no applicant shall be granted more than two licences within the district.”

These provisions clearly state that a person involved in the manufacture of alcohol cannot employ someone with a licence to sell alcohol. However, despite these laws, licences for the sale of alcohol have been issued in violation of Extraordinary Gazette 1544/17 and Excise Notification 902, dated 2008-04-10

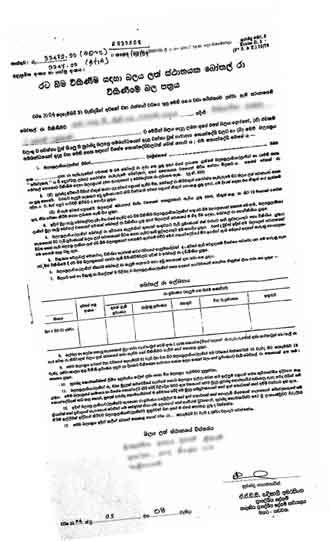

However, contrary to this law, it has been observed that more than two liquor licences have been issued to individuals and institutions in almost every district. Additionally, liquor licences were granted based on political connections, and some licences have been issued in the names of minors. There have also been instances where licences were issued in violation of the fundamental requirements for obtaining a liquor licence. As a result, liquor licences have been issued in recent years in violation of the provisions of the Excise Ordinance. Some of the licence numbers issued in this manner include A-065287, A-083301, A-058320, A-062181, A-079571, A-091755, A-080156, A-091755, A-077587, A-090827, and A-062180.

However, contrary to this law, it has been observed that more than two liquor licences have been issued to individuals and institutions in almost every district. Additionally, liquor licences were granted based on political connections, and some licences have been issued in the names of minors. There have also been instances where licences were issued in violation of the fundamental requirements for obtaining a liquor licence. As a result, liquor licences have been issued in recent years in violation of the provisions of the Excise Ordinance. Some of the licence numbers issued in this manner include A-065287, A-083301, A-058320, A-062181, A-079571, A-091755, A-080156, A-091755, A-077587, A-090827, and A-062180.

According to Excise Notification No. 795, the licensee is prohibited from holding any rights in the retail sale of liquor or toddy or employing anyone with such rights if they hold a licence for the production or wholesale sale of coconut liquor. Sections 794, 795, and 796 reinforce this matter. These provisions clearly state that a person involved in the manufacture of alcohol cannot employ someone with a licence to sell alcohol. However, despite these laws, licences for the sale of alcohol have been issued in violation of Extraordinary Gazette 1544/17 and Excise Notification 902, dated 2008-04-10. A licence to sell liquor had been granted by the Kothmale Divisional Secretary to an individual who is the managing director of a liquor manufacturing company. This managing director had obtained his licence from a former Excise Commissioner General. Additionally, another company was granted a liquor licence, and the licensee is a shareholder of a liquor company, while the liquor manufacturing company is registered under his wife’s name. These licences were issued in violation of Sections 791, 792, 793, and 794 of Excise Notification 902.. This violates the regulation that limits a person to hold only two licences. Additionally, a private establishment in Kalutara was granted a liquor licence despite being only 94 metres away from a school; this breaches the provisions of the Excise Ordinance. Similarly, a well-known establishment near Ratnapura received a liquor licence even though it is located near a mosque, a government school, and an international school. The tracing number for issuing these licences is 363/2024.

In Gampaha district, three liquor licences were issued to the same company under different names; covering locations in Wattala, Peliyagoda and Gampaha

In Gampaha district, three liquor licences were issued to the same company under different names; covering locations in Wattala, Peliyagoda and Gampaha

Section 19 of the Excise Ordinance underscores that the granting of a liquor licence is an exclusive privilege. According to Section 19:1, with the approval of the Minister, the Commissioner General of Excise is authorised to grant exclusive privileges to any individual under conditions he deems appropriate and for a specific period of time. The Supreme Court’s decision in the case of YMH W Bandara vs. Dayaratne (924/77), effective from October 3, 1978, to 1983, is significant in this context. This judgment served as a basis for the ruling in the case of Sudhakaran vs. Bharathi, through CA/87-2SLR 243 and SL/89-1-SLR 46. The decision in this case was appealed, ultimately affirming that a liquor licence is a property right.

Bribing during election period

Under Section 19 of the Excise Ordinance, the Commissioner General of Excise, with the advice of the Minister, grants liquor licences as an exclusive privilege. During the last presidential election, the country’s finance minister, who was also a presidential candidate, allegedly granted liquor licences with property rights to his associates as exclusive privileges, which is seen as a form of bribery during the election season. This act was highlighted in relation to the Election Law. During the run-up to the last election, the Election Commission halted a candidate’s plan to provide a meal of fried rice to participants at a rally after the authorities deemed it as related to elections related activities and thus considered it as a bribe. When even providing a meal was prohibited during the election period under Election Law, the granting of liquor licences by the finance minister, who was a presidential candidate, as an exclusive privilege was also in violation of the Election Laws. A complaint was filed with the Election Commission regarding this matter, and as a result, the Election Commission instructed the Excise Commissioner General to stop issuing liquor licences during the election period; considering it an act of bribery.

Starting in 2023, liquor licences were issued targeting the last presidential elections. Three individuals, not politically affiliated, who were qualified to receive liquor licences, also applied, but were denied. They took legal action, arguing that licences were instead given to political allies. It is under case number SCFR 131/2023.

Starting in 2023, liquor licences were issued targeting the last presidential elections. Three individuals, not politically affiliated, who were qualified to receive liquor licences, also applied, but were denied. They took legal action, arguing that licences were instead given to political allies. It is under case number SCFR 131/2023.

An amendment was introduced on 13-08-2024 under sub-section V of the fifth condition of Excise Notification 666 from the Extraordinary Gazette issued on 01-12-1979. Section V stipulates that alcohol must not be sold to anyone under the age of 18. It also specifies that only women over 18 years of age can work as hotel maids in licensed establishments approved by the Commissioner General of Excise. These positions may be permitted at the discretion of the Commissioner General.

Moreover, the 11th condition of Excise Notification 666 clearly outlines the individuals to whom alcohol can be sold. It states that alcohol must not be sold or given to anyone under 21 years of age or to a person who is intoxicated or suspected of being intoxicated. The Excise Department sought to amend this section through Gazette 2024/04. However, in this amendment, the provision in section “d” of Section 11, which prohibits the sale or supply of alcohol to anyone under 21 or to an intoxicated person, was removed. Although this amendment was submitted to Parliament in August 2024, it has not yet been passed. Therefore, the previous law, Section 11 of Excise Notification 666, remains in effect.

There is also a question of whether this change complies with Section 31 of the National Authority on Tobacco and Alcohol Act, No. 27 of 2006. Section 31(1) explicitly states that no person shall sell, offer for sale, or permit the sale or promotion of tobacco products or alcohol to anyone under 21 years of age. Sub-section (ii) of the Act specifies that any individual who violates these provisions will be guilty of an offence and, upon conviction by a Magistrate, will be liable to a fine not exceeding 4,000 rupees or imprisonment for a term not exceeding one year, or both. The Act further grants enforcement powers to the police, excise officers, and public health inspectors.

Despite these provisions, the Excise Department issued a liquor licence (No. A073857) on 12-09-2024 in the name of a 19-year-old child of a former state minister from the Kurunegala district. This licence is valid from 11-09-2024 to 31-12-2024, and it was issued in clear violation of Section 31 of the National Authority on Tobacco and Alcohol Act, which prohibits issuing licenses to individuals under 21. Furthermore, although Section 11 of Excise Notification 666 has been amended, the amendment hasn’t yet been passed by Parliament or published as a gazette, meaning the existing law remains in effect.

A liquor licence obtained through the intervention of a Deputy Minister from the Kandy district has led to the establishment of a liquor store in that area, and the licence was sold to an egg trader from the Kuliyapitiya area. Additionally, through the influence of a former leader of the North, representing the Tamil Alliance, and a former Member of Parliament, a woman from that region was granted a licence to sell alcohol. An officer from the Excise Department, who is connected to a former minister from the Gampaha district, also secured a liquor licence in his wife’s name, which was later sold to an individual from Minuwangoda for 100 million rupees.

All these licences were issued targeting the last presidential election and in violation of the provisions and laws of the Excise Ordinance since 2023. It is now the responsibility of the Commissioner General of Excise to investigate these cases, identify those who obtained such licences, and examine how they gained unlimited privileges and property through this process.

All these licences were issued targeting the last presidential election and in violation of the provisions and laws of the Excise Ordinance since 2023. It is now the responsibility of the Commissioner General of Excise to investigate these cases, identify those who obtained such licences, and examine how they gained unlimited privileges and property through this process.

The excise revenue target set for 2024 is 232 billion rupees. However, the method of granting liquor licences to meet this target has faced criticism. If such licences are considered an exclusive privilege, any individual in Sri Lanka should be eligible to apply. So far, three individuals have initiated legal action, claiming that the selection process lacks transparency. This has created doubt regarding the methods used to issue these licences.

Case No. 4/2019, filed by liquor licence holders against the Excise Department, is also ongoing in the Appeal Court. They argue that, despite claims of generating 2 billion rupees in revenue from granting alcohol licences, the country has, in fact, lost 50 billion rupees in potential income so far.

When this newspaper attempted to contact the newly appointed Excise Commissioner General at 0112045033, the telephone operator connected this scribe to the Director General’s private secretary, who informed that the Director General was at a meeting. She redirected this writer to Excise Commissioner (Law), CJA Weerakkodi, at the same phone number, 0112045033. Several attempts made to contact this official over the phone proved futile. Although the Daily Mirror is yet to receive a response, this newspaper harbours hopes that the Excise Commissioner General will conduct investigations and clarify these issues for the benefit of the public.