Reply To:

Name - Reply Comment

Highlights growing lack of visibility on government’s progress on IMF programme

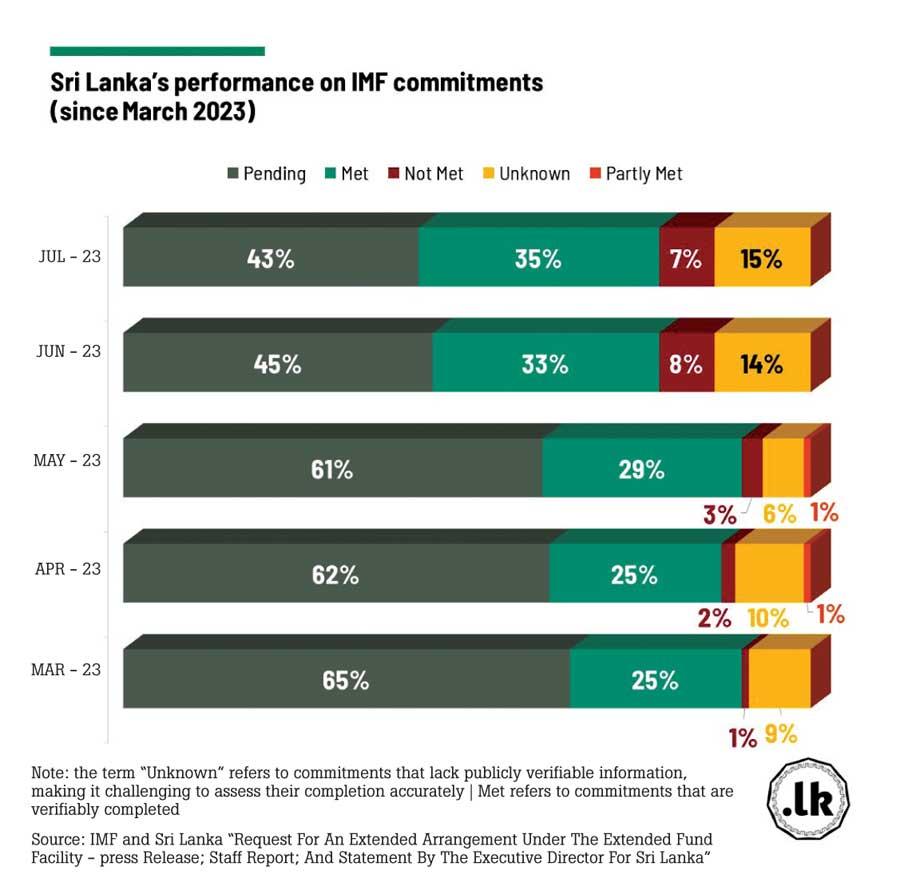

What can explain the increase in “Unknown” progress?

The findings are based on the IMF Tracker of Verité Research, which tracks the programme’s progress and classifies commitments as “met”, “not met”, or “unknown” on verifiable criteria.

Verité Research points out that the rise in the number of commitments, on which the achievement is “unknown”, could mean one of two things. One, the government has failed to meet these commitments and is not making the information public to delay the recognition of failure. Two, the government does not see the public or parliament as important stakeholders in programme implementation — and is uninterested in providing them with critical information.

Can Sri Lanka pick-up the rate of progress?

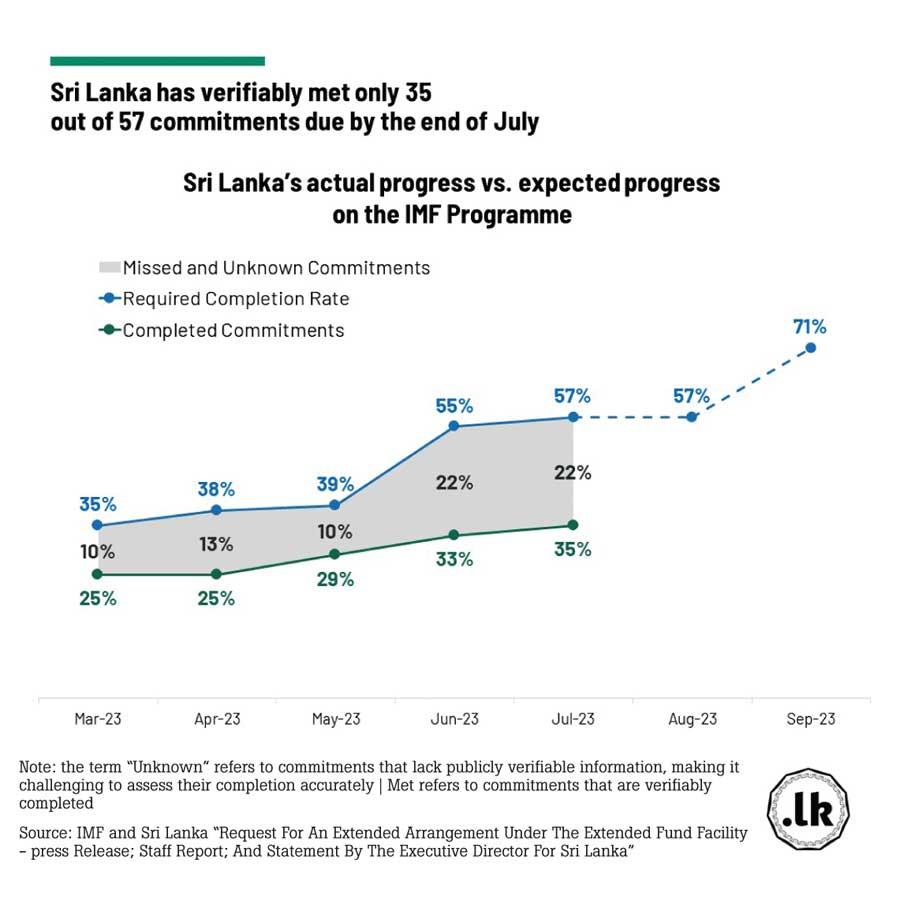

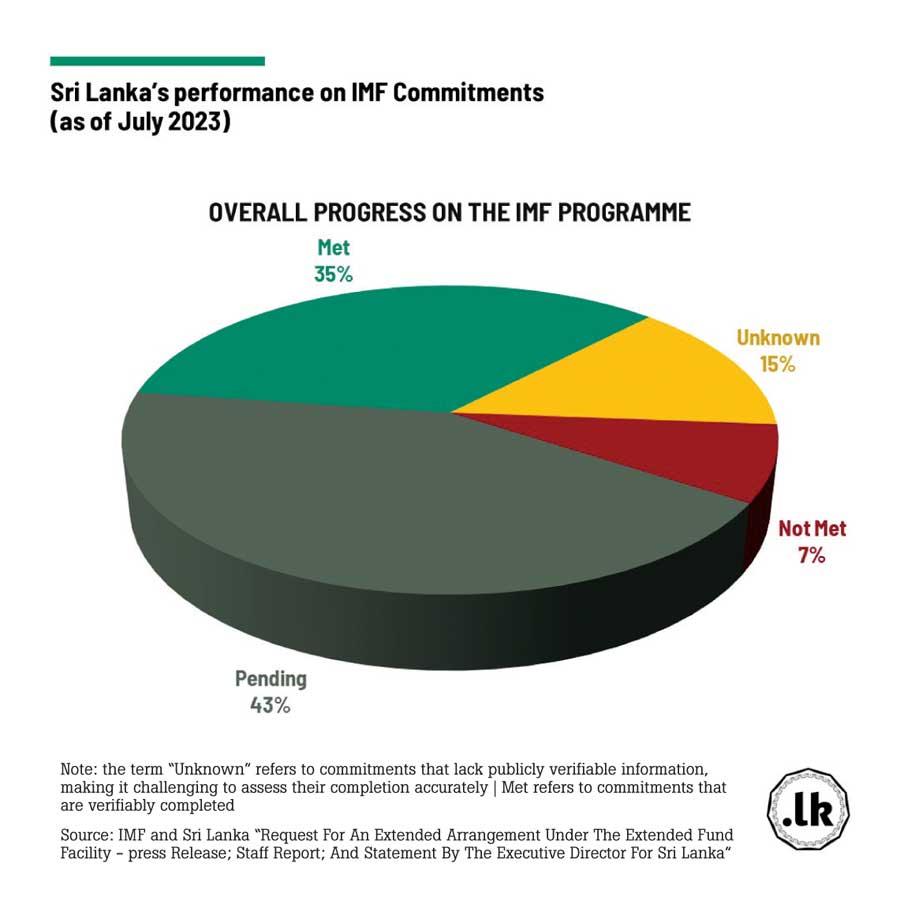

Sri Lanka had verifiably met 35 of the 57 commitments on the IMF programme that were due to be completed by the end of July; up from 33 in June. In July, the parliament approved the Central Bank of Sri Lanka Bill and the Anti-Corruption Bill. These bills were originally due to be approved in April and June 2023, respectively. This means that Sri Lanka is moving forward slowly and with a significant delay against the agreed timelines.

Since March, when Sri Lanka started off well with 25 commitments already completed, the average rate of verifiable completion has been less than three per month. There are 71 commitments due to be completed by the end of September, when the IMF conducts its first review of the programme and would normally disburse the second tranche of funding. To get there, Sri Lanka needs to verifiably complete 18 commitments a month in August and September.

In evaluating progress, any policy-related action that lacks public disclosure of their completion status even two months after the due date is deemed not met. Consequently, the commitment set for April regarding the “completion of the asset quality review component of the diagnostic exercise for the two largest state-owned banks and the three leading private sector banks” has been reclassified from “unknown” to “not met.” A total of seven commitments were classified as “Not Met” at the end of July.

The IMF Tracker is now available for the public on manthri.lk. For more information, please visit: https://manthri.lk/en/imf_tracker