Reply To:

Name - Reply Comment

"In Sri Lanka, majority of tobacco related deaths occur in males in the workforce"

The multinational tobacco corporation and tobacco monopoly British American Tobacco (BAT) owns 84.13% shares of Ceylon Tobacco Company (CTC). Which places CTC in the holds of the foreign company BAT.

The government sets the tax for tobacco while the final price of the product is set by the tobacco industry. Therefore, it is the government’s duty to tax a product to the maximum amount possible for the relevant product.

In Sri Lanka, consumption is sensitive to prices. It is a global fact that a 10% increase in prices of tobacco leads to 5% decrease in tobacco use, this applies in Sri Lanka as well. Therefore, tobacco must be taxed to the maximum amount possible. However even if it was taxed to the maximum amount possible, tobacco does not incur a revenue due to the negative externalities of tobacco. In Sri Lanka, majority of tobacco related deaths occur in males in the workforce. This incurs a loss for the family due to the death of the father who is often the breadwinner of the house. At national level the country incurs a loss due to productivity losses from tobacco attributable morbidity and mortality. Therefore, negative externalities of tobacco as a product is higher than the revenue it can generate even if tobacco is taxed to the maximum amount possible.

The 2019 tobacco tax increase was not done according to a rational formula. In the 2019 budget the Ministry of Finance increased tobacco tax by 12%. Due to this increase the price of a Gold Leaf cigarette increased by Rs. 5.33. The tobacco industry who understood this price increase will not affect them added an additional Rs. 4.65 to the price of a stick. Therefore, the price of one Gold Leaf cigarette increased by Rs. 10.00. Due to the added Rs. 4.65 by the tobacco industry the company is able to earn about Rs. 12 billion more in profits per year. This Rs. 12 billion could have been earned by the government as tax revenue if the Ministry of Finance had a rational tax policy for tobacco.

The 2016 tobacco tax increase was done rationally. At that time the tobacco industry threatened the government it will close business as the tax burden is too heavy. While claiming this the tobacco industry added Rs 1.70 to the price of a cigarette. Evidently, the tax burden was not as heavy as claimed, as the industry was still able to increase their share of the price even further, indicating the taxes were still lower than the maximum amount possible for the product.

Over the last five years incorrect and irrational taxing of tobacco has led to a loss of Rs. 100 billion for the Sri Lankan government. This indicates that the Ministry of Finance lacks competence in formulating a rational tobacco tax policy. If they possess the competency and are still continuing with irrational tobacco taxation it is a fraudulent act as it incurs a massive loss of tax revenue for the country. Whichever the reason the current taxation for tobacco is too late, too low and flawed. As tobacco taxes are decided by the Ministry of Finance, they cannot escape the responsibility for this loss of revenue to the country. If the government was able to collect the Rs. 100 billion as tax revenue, the money could have been invested in development projects. Rs. 100 billion is equal to the cost of building the entire Southern Highway (Airport Expressway – Rs. 39 billion, Moragahakanda Project – Rs. 91 billion, Samurdhi Fund (annual) – Rs. 39 billion). This depicts the magnitude of the loss incurred due to irrational tobacco taxation.

Cigarette prices in Sri Lanka have been fluctuating over time. The increases in price relies on the government and Ministry of Finance and currently these increases are done to the liking of those who are in power. The percentage of the tobacco tax for the government has been declining over the years. Currently the percentage of tax for the government and percentage of company share for tobacco are almost at 50:50.

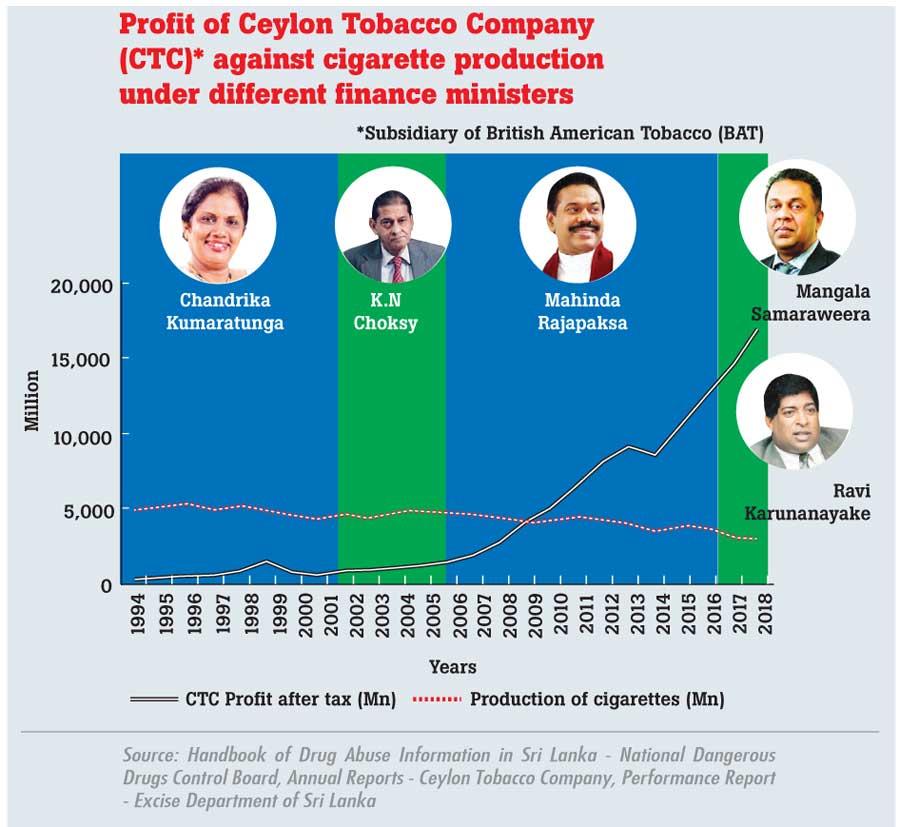

The sale of cigarettes in Sri Lanka has been decreasing over time. A rational global phenomenon is that when the sale of a product decreases the profit of the company manufacturing the product also decreases. For the tobacco industry the opposite is true. The profit of the tobacco industry has been disproportionately increasing while the cigarette sale in the country continues to decrease.

The reason for this reversed phenomenon observed in the tobacco industry is due to irrational tobacco taxation by the government. As the government does not use a rational formula for tobacco taxation the tobacco industry increases their profit disproportionately to the actual sale of cigarettes.

A correct tobacco taxation formula should be adjusted to purchasing power and inflation rate. Economists, researchers and many other experts in the field have continuously urged the government and the ministry of finance to formulate and implement a correct tax formula for tobacco. There is no rational reason for such a formula to not exist for tobacco especially considering the sizeable amount of money involved.

The National Authority on Tobacco and Alcohol (NATA) states they have taken great efforts to formulate a rational tobacco tax policy with the expert support of the World Health Organization. However NATA stated that no individual with decision making power attends discussions on formulating and implementing a rational tax formula for tobacco.

Evidence suggests the tobacco industry manipulates the Ministry of Finance. For example the editorial on the Island newspaper dated 11.03.2019 reported when the Chairman of the Committee on Public Finance Mr. M. A. Sumanthiran inquired about tobacco price control, he received a letter and calls by the Ceylon Tobacco Company (CTC) requesting a meeting to provide answers. This incident occurred despite the meetings of the Committee on Public Finance being confidential.

Furthermore it can be observed that often the tobacco industry and the Ministry of Finance provides similar and false data. Both the tobacco industry and the Ministry of Finance state tobacco tax increases led to increase of sales in beedi and illicit cigarettes even though there is no scientific evidence to support these claims. Another claim is that people substitute to lower priced cigarettes when tobacco taxes are increased, but observing the sales of lower priced cigarettes manufactured by the tobacco industry itself it is evident that no such substitution has happened as sales of these low priced cigarettes have not increased significantly.

There is also evidence of the tobacco industry collaborating with various public and private sector organizations and conducting flawed research to prove their views and influence tax policy for their benefit. These research are often published strategically just before a budget.

The Alcohol and Drug Information Centre (ADIC) – Sri Lanka urgently calls for the formulation and implementation of a rational, transparent tax policy by the parliament. This policy must tax tobacco adjusted according to purchasing power and inflation and should tax all cigarettes equally without discriminating between low priced and high priced cigarettes. In conclusion, Sri Lanka needs a rational tax policy which is beneficial to the country.