Reply To:

Name - Reply Comment

World No Tobacco Day is celebrated annually on May 31, to inform the public on the dangers of using tobacco, the business practices of tobacco companies, what the World Health Organisation (WHO) is doing to fight the tobacco epidemic, and what people around the world can do to claim their right to health and healthy living and to protect future generations. The Member States of WHO created World No Tobacco Day in 1987 to draw global attention to the tobacco epidemic and the preventable death and disease it causes.

World No Tobacco Day is celebrated annually on May 31, to inform the public on the dangers of using tobacco, the business practices of tobacco companies, what the World Health Organisation (WHO) is doing to fight the tobacco epidemic, and what people around the world can do to claim their right to health and healthy living and to protect future generations. The Member States of WHO created World No Tobacco Day in 1987 to draw global attention to the tobacco epidemic and the preventable death and disease it causes.

WHO has announced the 2022 global campaign for World No Tobacco Day under the theme, “Tobacco: Threat to our environment.” The objective of the campaign is to increase awareness among the public regarding the environmental impact of tobacco with regard to cultivation, production, distribution and waste. Even though tobacco is harmful in many aspects, the tobacco industry takes efforts to ‘greenwash’ its reputation as environmentally friendly, which will also be addressed through this year’s campaign.

According to the WHO, tobacco kills about eight million people every year globally. While tobacco products are deadly and largely contribute to health issues within a country, tobacco causes more damage to the environment in terms of air, water and land pollution.

With an annual greenhouse gas contribution of 84 megatons carbon dioxide equivalent, the tobacco industry contributes to climate change and reduces climate resilience, wasting resources and damaging ecosystems. In the year 2020, the usage of cigarette sticks was reported as 2,300 million, while more than 35,000 million cigarettes have been used during the last decade, in Sri Lanka. Cigarette butts, being the world’s second most littered item after food wrappers, contain several toxic chemicals, heavy metals and residual nicotine.

They also have a very low biodegradability. Therefore, improper disposal of cigarette butts largely contributes to contamination of air, land and water. This adds a substantial cost of cleanup, creating an additional burden on the country’s economy.

The sloping lands of mid and up-country areas of Sri Lanka are commonly used for tobacco cultivation. Tobacco cultivation causes a reduction in land productivity due to severe soil erosion, downstream sedimentation and depletion of water resources. The soil erosion rate is highest in tobacco when compared to other crops. Apart from the reduced quality of soil, environmental pollution due to heavy chemical application is another aspect causing a threat to the environment. Furthermore, tobacco depletes soil nutrients due to rapid intake of nutrients from the soil. Therefore, tobacco cultivation directly influences reduction in soil fertility, causing the land to become less suitable to grow other important food crops. This will reduce profits gained over time from crop cultivation as the soil becomes less suitable for growing agricultural food crops.

Sri Lanka has been successful as a nation in controlling tobacco use through effective policy implementation, which has resulted in an overall reduction in tobacco consumption during the past decade. The Global Adult Tobacco Survey (GAT Survey), a collaborative effort between the World Health Organisation (WHO), National Authority on Tobacco and Alcohol (NATA), Ministry of Health and Department of Census and Statistics has revealed that smoking has reduced to 9.1% in Sri Lanka, making it a leading nation in reduced tobacco usage which marks a remarkable success in tobacco control measures which have been implemented within the country. With such an achievement, attention needs to be focused on more ways to strengthen the population of our country to further reduce tobacco usage, thereby reducing the burden on the country’s health care system as well.

Even though Sri Lanka has reported a considerably lower rate of tobacco use, implementation of further tobacco control measures is required due to several reasons. In Sri Lanka, still LKR 40 million is spent daily on cigarettes, causing it to become a heavy burden on the country’s economy. As Sri Lanka is facing an economic crisis at present, the government urgently needs to implement crucial policy solutions to address the issues in the fiscal sector. As tobacco consumption causes several diseases among the users, it adds an unnecessary burden on the country’s health system as well. Also, improper disposal of tobacco products is causing rapid environmental pollution, adding a substantial cost of clean-up to the country’s economy. Therefore, as a solution to the ongoing economic crisis, reducing costs related to tobacco usage can be identified as an important aspect.

Due to inflation, the price of essential goods has been drastically increased, but the price of a cigarette, the main tobacco-related product has only been increased by 8%. A substantial revenue can be generated by increasing the tax for tobacco products alone, without elevating the prices of essential goods to levels that are unbearable for the public.

In the past, in line with the global best practices, Sri Lanka has taken several important positive measures to control tobacco use, including tax increases, leading to significant revenue boosts for Government as well as public health benefits for the public. The responsible parties including the Ministry of Finance have not taken steps to increase the tax for cigarettes since the year 2019, causing a loss of approximately LKR 100 billion, the revenue which could have been earned by the government at a period when the country is at a difficult economic juncture. Institute of Policy Studies (IPS) estimates that by increasing tobacco taxes by LKR 20 for all cigarettes (irrespective of length), the government could have earned nearly LKR 5 billion. In the Budget-2022, the government raised the tobacco tax for most cigarettes. However, with this revision, the price of the cheapest, and most harmful (unfiltered) cigarettes was reduced by 50% increasing its’ affordability for any individual including school children, where the revised price is now just LKR 10. This change means tax revenue for the government is reduced and the price reduction could lead to an increase in smoking initiations, prevalence rates and associated health problems.

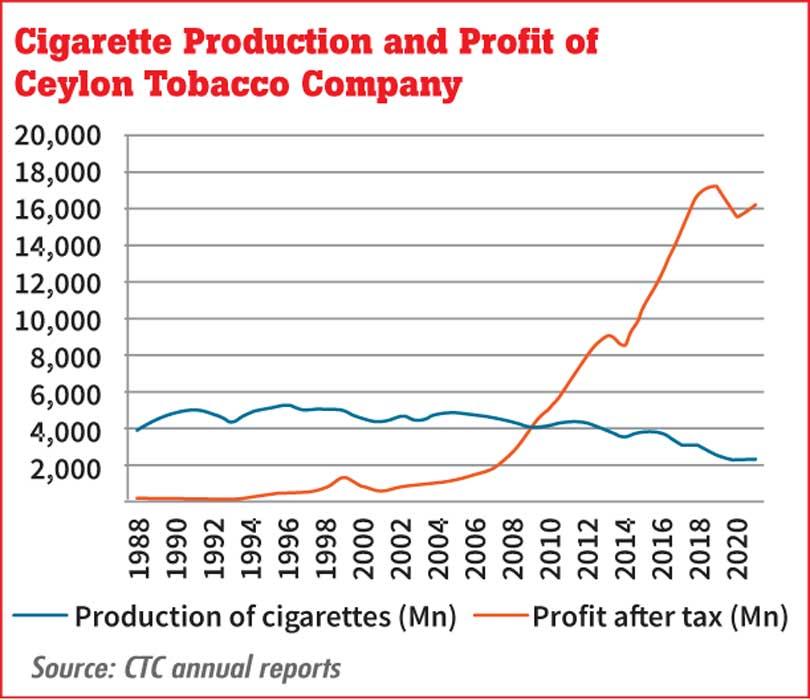

Within the last 10 years, production of cigarette sticks has been reduced by 45%. But the profits earned by the Ceylon Tobacco Company (CTC) has increased by 121%. Most of the other industries face a loss of profit when production levels are reduced, but the tobacco company faces a situation that is contradictory. Using this to their advantage, the tobacco company obtains large sums of money as profits and the reason can be clearly identified as the absence of a rational tax policy for tobacco-related products.

Ministry of Finance, the government body responsible for functioning towards developing a solution to the economic crisis in the country, should be working towards increasing the revenue to the government through proper tax policy implementations. Unfortunately, during the past few years, it was observed that the implemented strategies were in favour of the tobacco company, thereby losing large tax revenue to the country, while the tobacco company accumulated this amount as profits.

In a survey conducted by Alcohol and Drug Information Centre (ADIC) in September 2021, 89.3% of the respondents have mentioned that they would support a move to increase tobacco taxation to improve government revenue. As smoking is directly linked to the social and economic status of a population, tobacco taxation is an essential component in extensive tobacco control strategies. Increased tax results in increased prices of tobacco-related products, which in turn makes it less available for the consumers. This method is quite effective in reducing smoking and its adverse health consequences as well. Reducing tobacco consumption by increasing prices through increased taxation, will reduce tobacco-caused illnesses and ease the pressure on the health system at a time when Sri Lanka’s healthcare system is severely overburdened. Therefore, the best strategy to be implemented at a time when Sri Lanka is facing an economic crisis is, increasing the tax on cigarettes and obtaining the maximum income for the government.

While the newly appointed Prime Minister and other responsible individuals are making an effort to develop alternative measures to bring revenue to the government, we would like to propose to implement a proper tax policy for tobacco products, which would bring a large revenue to the country, thereby providing a satisfactory solution to the prevailing economic crisis.

Alcohol & Drug Information Centre (ADIC) – Sri Lanka