Reply To:

Name - Reply Comment

In our editorial on Saturday this paper highlighted the fact that it would cost a family at least Rs. 126,000/- a month to have three meals - breakfast, lunch and dinner per day. This meal would not consist of fish, beef or chicken. In other words, the meal lacks proteins needed for the development of children.

The Department of Census and Statistics reports during the two years of the pandemic the country saw its incomes falling amid hyperinflation resulting in families losing 40 percent of the value of their nominal incomes within just one year through May 2022.

The survey adds that the poorest 20 percent of the households in our country were generating only Rs.17,572 while the middle 60 percent of the households generated an average monthly income of Rs.56, 079 for a family of 3.7 persons.

In short, the living standards of 80 percent of the households in Sri Lanka have been adversely affected, while the bottom 40 percent may have been plunged into dire poverty due to inflation which acts as an insidious tax on people’s incomes.

Meanwhile the richest 20 percent of the households in our country on average earn Rs.196,289 per month, which may have grown in the last two years in nominal terms - again according to government’s own statistics. This number would include the members of our national cricket team. Their coaching staff, according to the Minister of Sports pockets around US $120,000 a month.

Tea estate workers who are up at the crack of dawn, work in the freezing cold in the hill country helped the country in 2022 to earn a record Rs.411 billion or $ 1.259 billion. Yet, according to the Department of Census and Statistics an estate sector family earns approximately Rs.46,865/- a month (around a fourth of the cash needed to feed a family of four).

On the other hand, our national cricket team in its last outing, scored a majestic 55 runs in its latest World Cup match against India, bringing shame to the whole island. It encapsulates in a nutshell the the unjust application of payments and taxes in our country.

Worse was yet to come, even before the ink on the aforementioned editorial had dried, the selfsame 80% of households were hit by another unconscionable price hike and dealt yet another deadly body blow. The price of cooking gas was increased by a hefty Rs. 70/- to Rs. 90/-. And, as though to twist a knife in the wound, the price of diesel has been increased yet again.

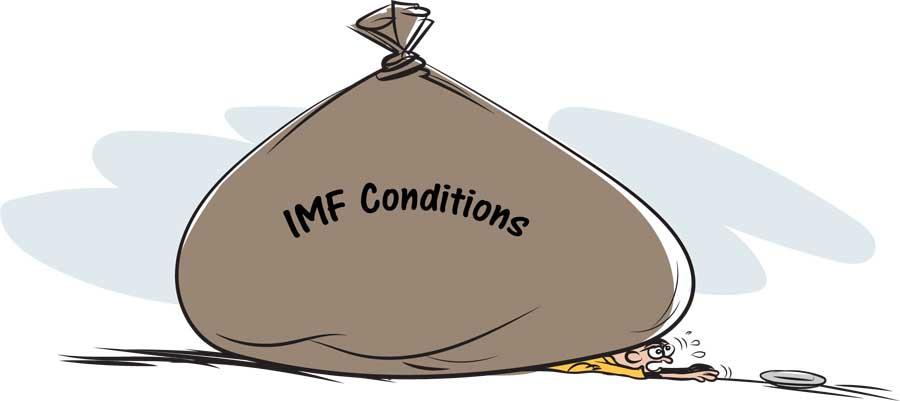

Our people have been pauperised, they can no longer afford to provide their children sufficient food. Our children are malnourished, anemic and their development retarded. Our rulers, the International Monetary Fund (IMF), speak of safety nets for the vulnerable sections of society. Sadly the promises have been limited to words and costs keep rising. A result of IMF insistence that costs reflect market prices.

In the late 1970s and 1980s the IMF imposed similar conditions on indebted Latin American countries which resulted in urban and peasant uprisings against rising costs and widespread hunger. It also saw the imposition of dictatorships, mass killings and human rights abuses. Two cases in point were dictatorships imposed in Chile and Argentina.

Today, we are watching this same failed IMF strategy being imposed on our country.

There is a need to make strategic changes. The IMF, if it is sincere in helping countries out of their indebted situation needs to change its age-old failed strategy. Countries need to be helped find new markets for their produce. They need to be guided into becoming part of the worldwide global chain of production.

More loans and restructuring debts alone is insufficient, as it sees the already burgeoning debts grow even bigger. What is needed is a means to earn more income to repay these debts. China’s Belt Road Initiative (BRI) linking markets from China to Indonesia, to Malaysia to Lanka, Pakistan, Afghanistan and then onto to Europe, offers one such a possibility.

Rather than simply claim the BRI is a debt trap, perhaps the IMF should promote ventures to practically help indebted countries earn their way out of indebtedness and bankruptcy.