Reply To:

Name - Reply Comment

Low-income earners need urgent support - Pic by Pradeep Pathirana

The cost of the nationwide COVID-19 lockdown of five weeks and counting is causing tremendous hardships for low-income citizens. Households in the five lowest income deciles are the hardest hit. Due to the inconsistency of  income streams of breadwinners in these households and the inelastic nature of basic expenditure, their budgetary gaps have become significant even after adjusting for spending cuts wherever possible.

income streams of breadwinners in these households and the inelastic nature of basic expenditure, their budgetary gaps have become significant even after adjusting for spending cuts wherever possible.

The Government must provide income-support for these households that include an estimated 4 million workers. The proposed package would cost approximately Rs. 45.5 billion (US$ 233 million). Part of this can be financed through specific COVID-19 support from multilateral financial institutions or expected debt suspension, while part of it can be long-term concessionary loans via the domestic financial system. The duration of support cannot be estimated, and will depend on how long the lockdown remains and what the normalisation rate would be. That will become clearer in the coming days.

The objective of this article is two-fold. First, it is to provide a realistic assessment of the massive impact the economic fallout of COVID-19 will have from a household economy perspective, particularly low-income families. The second is to propose an adequate income-support programme while providing possible financing options. Both must be considered in the short-term, until the economy is able to bounce back in the medium-term.

The uneasy truth about Sri Lanka’s household economy is that most families are struggling to make ends meet. While not admitting it openly, many families struggle to put enough food on the table and take care of their children. This was true prior to COVID-19. What the pandemic has done is exacerbate an already difficult situation.

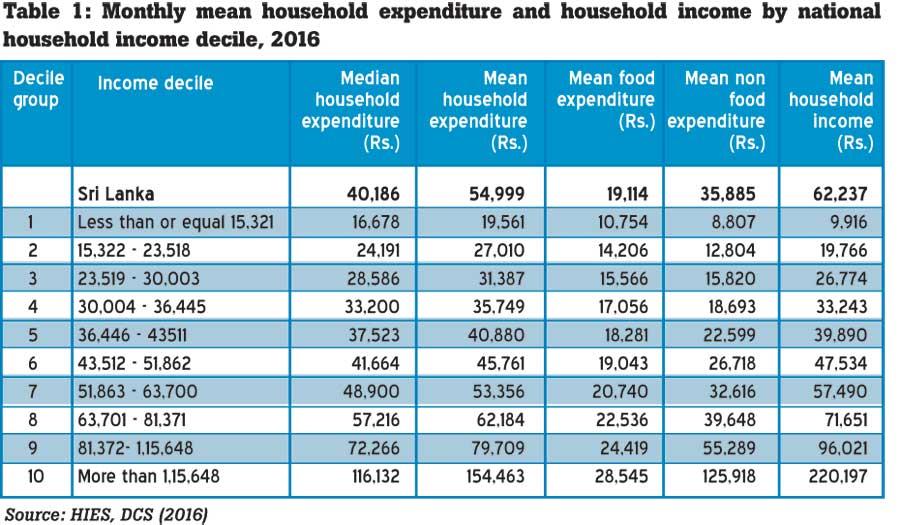

The latest available (2016) Household Income and Expenditure Survey (HIES) of the Department of Census and Statistics (DCS) indicates (see Table 1) that the monthly household income of half of our families (lowest five deciles by income) were, on average, inadequate to meet their monthly expenses. A comparison of the mean household income and mean household expenditure illustrates this unfortunate reality.

What Table 1 shows is that 50% of households, or the bottom five deciles earning up to an upper limit of Rs.43,500 a month (in 2016), on average could not make ends meet with their regular income. For example, the lowest income decile was, on average, short by almost Rs.10,000 a month (difference between mean expenditure of Rs.19,561 and mean income of Rs.9,916). The fifth decile was, on average, short by about Rs.1,000 a month. It is only the highest income decile which seems to have a significant amount left over after household expenses. And this is not surprising as the richest 20% enjoys 51% of total household income, while the poorest 20% only gets 5%.

To understand how income and expenditure is categorised it is necessary to note that HIES includes both monetary and non-monetary components as income. Monetary income comprises salaries (38%), income from agricultural activities (8%), non-agricultural (17%), other cash incomes (13%) and ad-hoc receipts (9%). Non-monetary income includes rent value if occupying own home (10%) and value of home-grown agricultural produce and all ‘in-kind’ income (5%). Expenditure on the other hand is broken down by food expenses (35%) and non-food (65%). The major non-food components include housing (19%), transport (12%), loan payments (11%), personal care and health (7%), education (6%), durables (6%) etc.

- "The cost of the nationwide COVID-19 lockdown of five weeks and counting is causing tremendous hardships for low-income citizens"

- "The risk of loss of net income is lowest among 1.2 million public sector and 0.2 million private sector essential-workers, and the need for government relief is minimum"

Another important issue to be considered is the level of indebtedness of our household economy. According to the same study, 60% of Sri Lankan households were in debt. Urban was at 50%, rural at 61% and estate at 73% respectively. The most indebted families were in Vavuniya (81%) perhaps due to the absolute harsh post-war reality, while Polonnaruwa (78%) and Matale (72%) followed, perhaps due to volatility in agricultural income. The mean household debt per indebted household was Rs. 428,000 to leasing or finance companies, Rs. 338,000 to banks, Rs 230,000 to place of work and Rs 225,000 to money lenders and pawn brokers and so on. Most households had taken out loans for either building or repairing their dwelling, for consumption, to start or expand a business activity or to purchase a durable good, in that order. The bottom line is that not only our low-income  families are facing challenges in meeting their daily expenses, but they are fairly indebted, thereby claiming a stake on future income as well.

families are facing challenges in meeting their daily expenses, but they are fairly indebted, thereby claiming a stake on future income as well.

So, this was the pre-COVID-19 ‘old-normal’ as it stood in 2016. The situation could have improved somewhat until 2020, in real terms, given the sharp increase in public sector salaries in the last couple of years, while wages in the informal private sector were also rising. The just released 2019 Central Bank Annual Report indicates the overall increase in public sector salaries for the last two years was 4.9%, for private sector wages boards 3.5% and for the informal private sector it was 19.4%. But expenses would have also increased inline. So, let’s assume the 2017 situation as good a proxy as we can get for the immediate pre-COVID-19 situation in real terms. However, in nominal terms, using the Consumer Price Inflation (CPI) for 2018 and 2019 would give us a sense of rupee figures that is meaningful in terms of calculating necessary relief measures. Assuming the CPI at 5% for each year since mid-2017, we could adjust all figures by 15% to reflect nominal prices (income, expenditure, debt etc.) to reflect the current mid-2020 situation.

Let us now consider the post-COVID-19 situation to assess how Sri Lankan families could be impacted. First, consider the income side of the equation. According to the 2019 DCS Fourth Quarter Labour Force Survey, just over 8.2 million Sri Lankans were in employment. That’s 2.2 million in agriculture, 2.2 million in industry and 3.8 million in services. In agriculture, almost all are farmer families with about 400,000 working without remuneration, i.e. contributing family workers. Outside agriculture, in industry and services, 4 million were employed (1.2 million by the state and 2.8 million by the private sector). A further 1.6 million were self-employed. Some 175,000 were employees, meaning entrepreneurs with at least one employee, and 200,000 were contributing family workers.

Another way to segment the labour force is that of the 8.2 million employed, only about 3 million receive a monthly salary. A further 2.6 million get remunerated based on the success of their self-employment venture - be it farming or running a food cart or driving a three-wheel taxi etc., and 1.7 million are daily-wage workers like labourers, construction workers, daily domestic helpers and so on. Of the 8.2 million, a total 600,000 do not get paid as explained earlier.

The COVID-19 economic impact is felt on both the supply and demand side. On the supply side, factories, hotels, shops and offices are closed due to lockdowns. The self-employed and daily-wage workers are unable to engage in their trade as markets are closed and transport is restricted. On the demand side, people are at home. So there are no customers, no tourists, no shoppers and no passengers. Most of Sri Lanka has been in complete lockdown for over five weeks, with only absolute essential services like healthcare, security and law enforcement in operation. In recent days there was some relaxation like reopening factories outside high-risk areas, with daytime lockdowns removed in 21 of the 25 districts. This allowed 14.8 million of the 21.8 million population limited access beyond the immediate confines of their homes. But tonight (6 May) the entire country will go into lockdown again. Valid questions are being raised regarding the cost-benefit of the lockdown, given the rise, instead of fall, in new cases.

During the lockdown, it is true some market exchanges are taking place online with physical delivery offline, particularly groceries, food and medicine. Some amount of services are also traded online, like education, entertainment and corporate meetings and so forth. However, the extent of such activities have not been measured. But it would be marginal, in terms of the huge negative impact of the physical lockdown.

The only category not impacted in terms of income are state employees. The 1.2 million workers of various government institutions and uniformed services will continue to draw monthly salaries. Perhaps the only loss would be their overtime and other allowances.

Of the 1.8 million remaining private sector monthly-salary earners, some would not be impacted. I presume they would be in essential services, particularly healthcare. It is likely most others will see some negative impact on their monthly earnings, ranging from a very heavy toll on tourism-related jobs to a marginal toll in strong financial institutions. Most others, whether apparel, trading, construction or banking, would have to renegotiate their contracts either explicitly or implicitly, immaterial of existing rigid labour laws. The next category would be the 220,000 business owners who employ others. Again, the impact will be relative to exposure, ranging from the worst affected to the least affected sectors. A small software company owner employing a few technical staff operating crucial online services to a big telco would have no impact, perhaps even greater demand. But an owner of an export apparel manufacturing plant employing several hundred staff supplying fashion clothing may have to fold up with no orders and unsustainable fixed costs. Here, both the owner and the monthly-salaried worker would be severely impacted.

Then consider the small entrepreneur or the self-employed person who does not employ anyone else. Here again the impact would be sector specific. A paddy farmer in Polonnaruwa would certainly be less effected than a rice-packet seller in Bambalapitiya or a three-wheel driver in Hikkaduwa. A dentist running an independent practice would see lower loss of relative income than an independent tour guide, and so on. But given the large number of self-employed persons (2.6 million), the impact on the household economy would be severe.

In the short term, the most significant negative impact would be on daily-wage earners. These are the 1.7 million men and women helpers at construction sites, loaders at the Pettah market, rubber tappers, daily domestic helpers and such who are suddenly without any income.

The expenditure side of the equation will certainly see a reduction. As explained earlier, the national food to non-food ratio is 35:65. However, in urban areas it is 31:69, in rural areas 35:65 and in estates it is 49:51. Also, food expenditure would vary in terms of income. Low-income homes would spend on essentials that cannot be reduced or substituted. For example, the estate sector spends half their income on food. Meanwhile high-income homes would have the option to reduce and substitute. The biggest non-food component of rent or mortgage payments will be fixed, and so will be loan or lease repayments to finance companies or banks, unless enjoying a moratorium. Other fixed expenses like healthcare would remain. Transport expenses will fall, but communication will rise with higher data usage. Expenses on durables, as well as on personal care products, clothes, lifestyle and other impulse products and services will reduce. But the share of such expenditure is much smaller in lower-income homes than higher-income homes.

So the reduction in expenditure will not be directly correlated to income, unless in the case of small entrepreneurs or the self-employed where a corresponding lowering of variable costs would be experienced. An example would be a three-wheel driver whose fuel costs are saved because he does not have hires. But his fixed costs would remain, like lease and insurance payments, unless waived by the finance company. So for most households the reduction in expenditure would be far less than the reduction in income. This would be particularly true for the low-income homes or the lowest five income deciles.

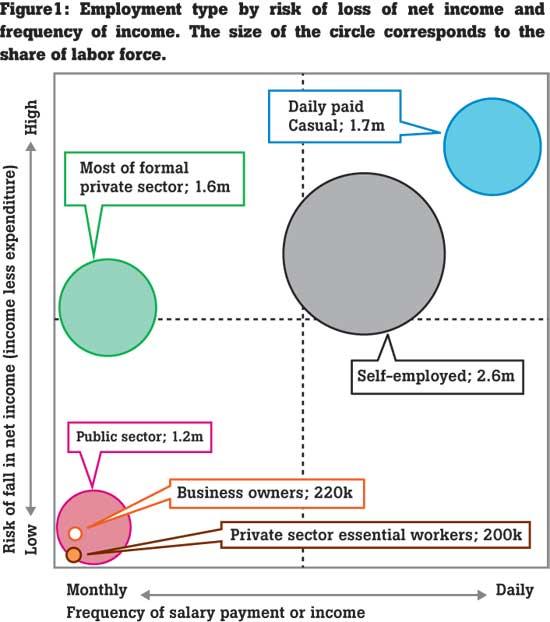

Figure 1 illustrates the level and number of households at risk, as well as the frequency in which they would have to be provided relief according to which quadrant the workers fall into.

For instance, the risk of loss of net income is lowest among 1.2 million public sector and 0.2 million private sector essential-workers, and the need for government relief is minimum. But the highest risk is among the 1.7 million daily-wage earners. So immediate and, at least weekly relief, is required to keep them abreast.

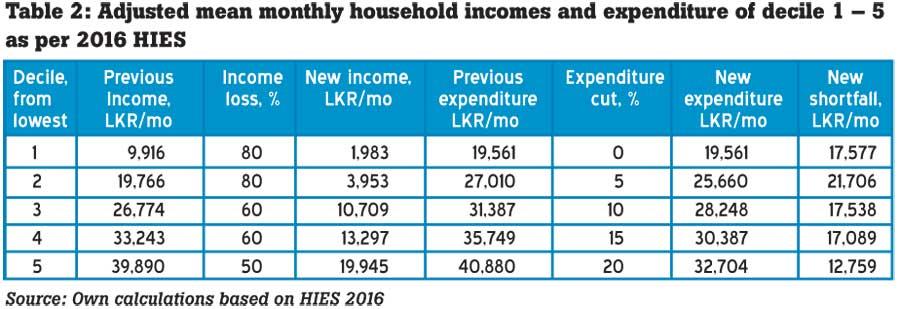

Assuming a loss of income of 80% each in the first two deciles, 60% each for the next two deciles and 50% for the fifth decile, would be a conservative estimate for the lowest income earning households given available data (Table 2). Also considering approximately 10% non-monetary income at the national level and reduction in expenditure of 0, 5, 10, 15 and 20% respectively for each decile, the following new income and expenditure levels and difference in monthly amounts are generated. Please note these assumptions can certainly be changed with more updated data.

If approximately 525,000 families are assumed for each household decile, the total to be given out as income-support to all needy households would be Rs 45.5 billion.

Without accounting for inflation between mid-2017 and mid-2020 of 5% per year, this total amount of roughly Rs. 45,500 million to be granted as income support for the Sri Lanka’s neediest households would be as follows: first - Rs 9.2 billion, second – Rs 11.4 billion, third – Rs 9.2b, fourth - Rs 9 billion and fifth – Rs 6.7 billion. Assuming the labour force is equally distributed among all households, then half the families representing the five lowest income deciles would account for half the workers. That is half of 8 million, or 4 million. Therefore, the Rs. 45,500 million would be distributed among 4 million workers, some getting more, and some less, based on their actual shortfall. If adjusted for inflation, the amount would be Rs 52,325 million. However, the actual amount would vary based on how much may be granted and for how many months it is provided. The duration of support cannot be estimated with available data, and will depend on how long the lockdown remains, and what the normalisation rate would be. That would become clearer in the coming days.

In terms of the 2019 Government share of revenue, Rs 45.5 billion is 2.6% of the 2019 tax revenue of Rs 1,735 million. From an expenditure perspective, Rs 45.5 billion works out to 1.6% of total recurrent and capital expenditure amounting to Rs. 2,932 billion or 2% of the recurrent amounts for 2019, which was Rs 2,301 billion. Looking at it another way, Rs 45 billion is 6.6% of the total salary bill of the public sector in 2019 amounting to Rs 686 billion.

At the current exchange rate, this is roughly US$ 233 million, and well within the expected US$ 800 million from the IMF’s Rapid Credit Facility for COVID-19 budgetary support, or the US$ 300 million ADB budgetary support loan. Both loans are on concessional terms. The Government has already obtained a US$ 500 million loan from China, and is expecting another US$ 800 million, of which the terms are unknown. The World Bank has already granted a long-term soft loan of US$ 128 million specifically for COVID-19 related expenditure. In addition, the G-20 nations have called for debt suspension for low-income countries. Though Sri Lanka has graduated, we are yet in transition, and the Government could also utilise part of the expected US$ 1,200 million that would be saved in 2020.

The entire amount need not be financed by the Government. Part of this amount, say for daily-wage workers, and some amount of micro-scale self-employed persons, could be direct income-support by the Government. The rest of self-employed entrepreneurs can be financed via the commercial banking system as long-term concessionary finance, guaranteed to some extent by the Government. In terms of the delivery of the income-support package, direct Government support should be almost immediate and could be handed out in either weekly or bi-weekly installments, whereas the other components could be a monthly programme.

However, it is clear that many low-income Sri Lankan households are in dire difficulty with the continuing COVID-19 lockdown, and they need urgent income-support. It is the responsibility of the Government to arrive at a workable solution, given the multiple options available.