Reply To:

Name - Reply Comment

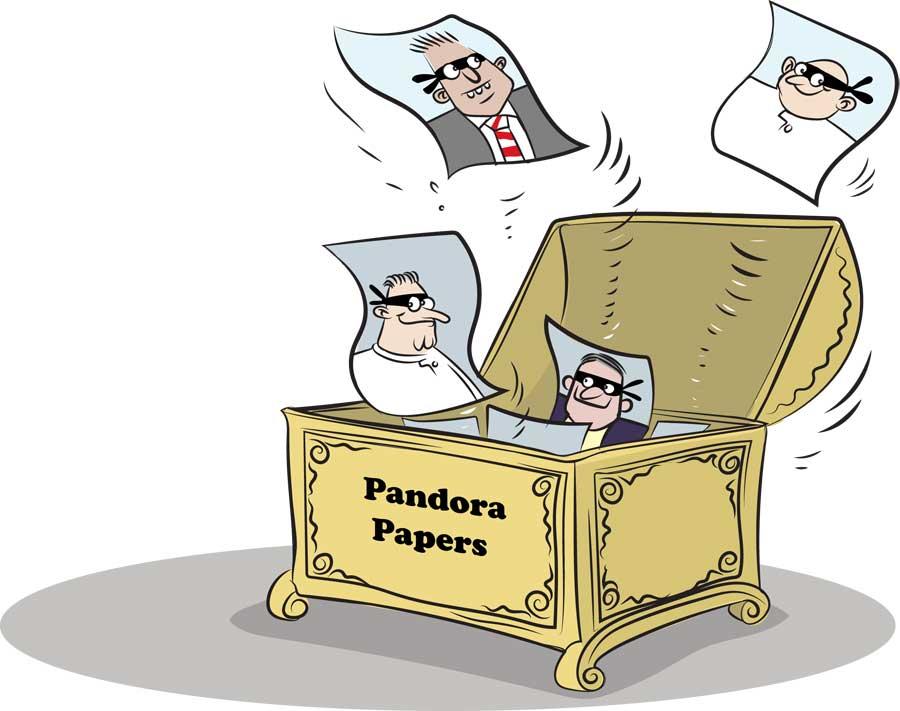

On Sunday October 3, the ‘Pandora Papers’ published by the International Consortium of Investigative Journalists (ICIJ), exposed the secret offshore affairs of 35 world leaders, including current and former presidents, prime ministers and heads of state. They also shine a light on the secret finances of more than 300 other public officials such as government ministers, judges, mayors and military generals in more than 90 countries. It also revealed the names of 300 Indians who are believed to have stashed away billions in offshore accounts.

The ‘Pandora Papers’ exposed established links of offshore activity; more than twice as many politicians and public officials as did the ‘Panama Papers’ of 2016.

The report (the name Pandora comes from the Greek myth about a sealed jar containing the world’s evils) was based on what its authors described as 11.9 million records leaked from 14 firms in the offshore financial services industry, depicting how the wealthy hide their assets.

Off shore banking - a thriving sector of the financial services industry specializes in helping affluent clients obscure their assets and legally minimize the taxes they would otherwise owe. These advantages are achieved through a couple of basic methods, built around the principles of disguised ownership and low regulation.

Hiding wealth is a specialty offered by tax havens such as Panama, Dubai, Monaco, Switzerland and the Cayman Islands, as well as some American states like South Dakota and Delaware. Much of the offshore financial services industry is unregulated or self-regulated. Some of the bankers, auditors and accountants who work in the industry are former officials who know the gaps in the system.

“The Pandora Papers, according to the Independent Commission for the Reform of International Corporate Taxation - a Paris-based advocacy group - said it welcomed the report describing it as revealing the inner workings of what is a shadow financial world, providing a window into the hidden operations of a global offshore economy,”

After more than 18 months’ studying the data in the public interest, the Guardian and other media outlets have begun publishing their findings, beginning with revelations about the offshore financial affairs of some of the most powerful political leaders in the world.

They include the ruler of Jordan, King Abdullah II, who has amassed a secret $100m property empire spanning Malibu, Washington and London. The king said, there would be nothing improper about him owning properties via offshore companies.

Azerbaijan’s ruling Aliyev family has traded close to £400m of UK property in recent years. One of their properties was sold to the Queen’s crown estate, which is now looking into how it came to pay £67m to a company that operated as a front for the family that runs a country routinely accused of corruption.

The leaked files revealed that former British PM Tony and Cherie Blair saved £312,000 in property taxes when they purchased a London building partially owned by the family of a prominent Bahraini minister. The former premier and his wife bought the £6.5m office in Marylebone by acquiring a British Virgin Islands (BVI) offshore company.

While the move was not illegal, the deal highlights a loophole that has enabled wealthy property owners not to pay a tax that is commonplace for ordinary Britons. The tiny island of Sri Lankans however, is not overawed by giants in any field. Just as cricketing greats dominated the world of cricket with their majestic deeds on-field, the ‘Pandora Papers have thrown light on a political personality dominant in the hidden operations of a global offshore economy.

While our country is on the ‘wrack so-to-say’ almost penniless in the aftermath of the Easter Sunday bombings and the ongoing pandemic, a former Deputy Minister and her husband have been exposed by the ‘Pandora Papers’ as having hidden assets amounting to over US$100 million in off shore institutions.

Perhaps our government could take a lesson from Pakistan PM Imran Khan and investigate how a single couple came to amass such a fortune in a country, which needs to seek grants for setting up audio visual facilities in its Courts

of Law.