Reply To:

Name - Reply Comment

IMF’s Senior Mission Chief for Sri Lanka Peter Breuer (right) with Country Mission Chief for Sri Lanka Masahiro Nozaki.

IMF’s Senior Mission Chief for Sri Lanka Peter Breuer (right) with Country Mission Chief for Sri Lanka Masahiro Nozaki.

In a recent article (“The need for governance-linked State-contingent IMF programmes: A third way for Sri Lanka” April 27, 2023, International Banker), Professors Charles A. Goodhart, Dimitrios P. Tsomocos and I advocate for the need for a reformed IMF programmes that makes governance improvements a pre-requisite for economic and financial improvements. In this article, I run through the core arguments we make there.

In a recent article (“The need for governance-linked State-contingent IMF programmes: A third way for Sri Lanka” April 27, 2023, International Banker), Professors Charles A. Goodhart, Dimitrios P. Tsomocos and I advocate for the need for a reformed IMF programmes that makes governance improvements a pre-requisite for economic and financial improvements. In this article, I run through the core arguments we make there.

The recent sovereign default of Sri Lanka has once again brought attention to the effectiveness of the International Monetary Fund’s (IMF) Extended Fund Facility (EFF) approach. This programmes provides loans of short duration (generally up to four years) with a few disbursements, conditional on a programmes of medium-term macro-fiscal adjustments. However, there is little evidence that this approach yields long-term success. On average, countries experience 2.1 restructuring episodes when entering default, with a typical resolution time of 7 to 10 years.

Currently, debt renegotiation is handled separately from the IMF programmes, based on the view that sovereign-default episodes are primarily a balance-of-payments crisis. However, in cases such as Sri Lanka and others, the crisis is a twin-deficits crisis, involving both a fiscal and balance-of-payments crisis. This crisis is often due to domestic macroeconomic, fiscal, and monetary policies, as well as governance failures, institutional difficulties in implementing evidence-based policies, corruption, and political capture of institutions.

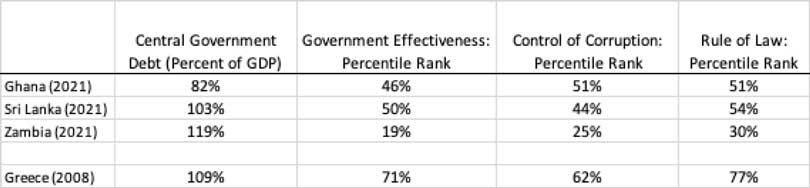

Nishan de Mel of Verité Research has argued for some time that the Sri Lankan crisis is rooted in governance failures. Weaknesses in domestic policies reflect institutional shortcomings, such as difficulty in implementing evidence-based policy, corruption, and political capture. The table summarizing the weaknesses of institutions in Ghana, Sri Lanka, and Zambia is significantly greater than that of Greece, which was also severely criticized for its weaknesses at the time. Developing countries’ institutions tasked with implementing policies for rapid and severe fiscal adjustments are often limited, and cultures of favouritism between governments and elites exacerbate this issue. While the IMF’s governance-related conditionality is now often part of its programmes, they may not be comprehensive, directly linked to disbursements, nor are economic targets always grounded in reality.

My co-authors and I propose a third way for the IMF’s lending programmes in countries such as Sri Lanka,

which includes:

a longer horizon of 15 years with smaller and more frequent tranche disbursements linked to shorter-term macroeconomic, fiscal, and governance targets.

Specific governance-related targets should be met before economic and fiscal targets, and

creditors must agree to initial debt deferment, reprofiling, and additional haircuts on the debt stock when IMF Programmes targets are met. In exchange for these haircuts, the remaining maturity of the debt would be reduced

This comprehensive state-contingent programmes incentivizes the government to implement reforms and policies that do not fluctuate with the political cycle. To meet the EFF’s conditionality during the IMF negotiations that began in March 2022, Sri Lanka has passed a new central bank act to enhance its independence. To ensure a significant fiscal and economic recovery, Sri Lanka should also be required to achieve additional early targets, including establishing an independent debt-management office, implementing professional management and corporate governance over state-owned enterprises, and refraining from announcing any new tax holidays since the debt payments’ suspension. Failure to achieve these milestones will impede the country’s recovery.

Our proposal balances the imperative to implement fiscal adjustments and the challenges of establishing a sustainable and responsible trajectory for government debt. The collaborative efforts of the IMF, multilateral organizations, bilateral partners, and private creditors should focus on adopting measures, targets, and policies that take into account the inherent vulnerabilities and weaknesses of the country, and work towards

addressing them.

“Udara Pieris is a Visiting Associate Professor of Economics at Oberlin College, USA. He was previously a tenured Associate Professor of Finance at HSE University (at the department ICEF) in Russia and has taught at the University of Warwick, and the University of Oxford (both in the UK). His research has a strong policy focus and covers the nexus between the macroeconomy and the financial markets.”