Reply To:

Name - Reply Comment

Public debts, that are debts incurred by governments to meet public expenditure, have been increasing over the years. Some countries like Greece, Italy and Japan have very high levels of public debts as a proportion of their GDP. In other words, many countries have been borrowing money, from both domestic and international sources as government revenues have not been adequate to meet the increasing public expenditure. Meanwhile, household debts that are debts incurred by individuals and families have also been increasing over time. Such expenditure usually goes to meet both the day to day needs of family members as well as long term investments like purchase of property. Though household debt is not something entirely new, the credit card revolution has resulted in an explosion of individual debts in many countries around the world.

Public debts, that are debts incurred by governments to meet public expenditure, have been increasing over the years. Some countries like Greece, Italy and Japan have very high levels of public debts as a proportion of their GDP. In other words, many countries have been borrowing money, from both domestic and international sources as government revenues have not been adequate to meet the increasing public expenditure. Meanwhile, household debts that are debts incurred by individuals and families have also been increasing over time. Such expenditure usually goes to meet both the day to day needs of family members as well as long term investments like purchase of property. Though household debt is not something entirely new, the credit card revolution has resulted in an explosion of individual debts in many countries around the world.

The steady growth of both public and household debts is indicative of the fact that both governments as well as individual citizens have tended to spend money that they have not yet earned. In other words, such expenditure is incurred in anticipation of future incomes. While this kind of behaviour on the part of governments and individuals has long been considered as almost inevitable, the contentious issue is whether borrowing money is done in a reasonable and responsible manner. This is an issue with regard to government as well as household/individual borrowing.

International financial institutions usually keep an eye on public debts incurred by governments. Countries that depend on these institutions come under pressure to maintain fiscal discipline and keep the budget deficit within reasonable limits. Yet, some governments do not always act in a responsible manner and therefore, tend to accumulate unsustainable levels of public debt.

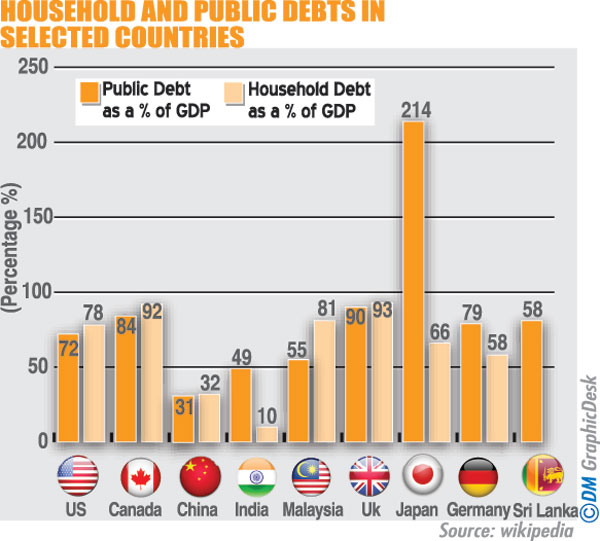

Modern consumption driven economies around the world depend on increasing household and individual expenditure to maintain a higher level of economic growth. Easy availability of consumer credit has enabled individuals and households to spend borrowed money on all forms of consumption. As the following Table shows, household and individual debts are even higher than public debt in many countries. Though public and private debts are still relatively low in some countries, they are increasing everywhere, pointing to a global trend.

The rapid increase in public and household/individual debt is partly a reflection of the widening gap between money supply (monetary economy) and the actual production of goods and services (real economy). Since the money supply today is many times larger than the available supply of goods and services, the former generates inflationary pressures at all levels. Yet, the distribution of financial resources within and across countries is highly unequal and the demand for goods and services is also highly uneven within and across countries. Nonetheless, in general, more and more people in most countries spend more money than they actually have because of the availability of credit from banking and other sources. In other words, they spend borrowed money to consume goods and services today. This in effect amounts to living beyond one’s means. When we spend borrowed money to pay for goods and services today, we are often spending the money that we or our children may earn in the future. In other words, many children become indebted even before they reach the stage of being income earning adults.

The rapid expansion of consumer credit has led to a steady expansion of the demand for goods and services in countries where there is a higher concentration of wealth. Today, this is also evident in rapidly developing countries outside the developed West. The resulting high demand for consumer goods on a global level generates inflationary pressure almost everywhere, forcing people to seek higher incomes. The result is the exodus of labour from low wage to high wage countries. The reverse flow of money by way of private remittances generates wage and inflationary pressures in sending countries and this feeds into a vicious cycle of higher wages, higher prices and a further exodus of labour. What we observe in countries like Sri Lanka is such a vicious cycle, making life more difficult, unpredictable and unstable for a majority of people.

Another important dimension of living beyond one’s means is the steady depletion of non-renewable resources such as oil and minerals. Rapid expansion of the global economy over the last several decades, largely due to increasing production of industrial goods in non-western countries like China, India and Brazil, has led to an unprecedented increase in the demand for non-renewable natural resources. While such resources are not going to last forever, it is widely accepted today that, by over exploiting such resources, we are compromising the life chances of future generations. This is in addition to the massive contribution that the diverse forms of modern, mass consumption make to climate change and environmental destruction.

Public and household debts are increasingly considered by governments and citizens alike as inevitable and necessary. Yet, increasing debts at a country and household level exert considerable pressure on public and private finances, often leading to fiscal crises and personal miseries. In an increasingly unstable global environment, economic and social crises can become more frequent and pervasive, making life more difficult and unsettling for an increasing proportion of the world population, particularly in countries where public and household debts are increasing.

.jpg) Another important dimension of living beyond one’s means is the steady depletion of non-renewable resources such as oil and minerals

Another important dimension of living beyond one’s means is the steady depletion of non-renewable resources such as oil and minerals