Reply To:

Name - Reply Comment

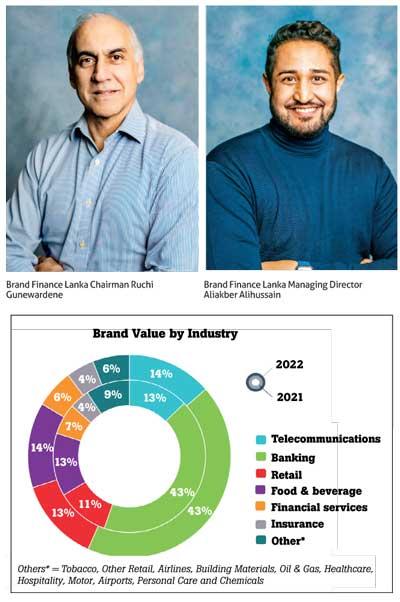

Brand Finance Lanka, the pioneering brand valuation and strategy firm, has released its 19th annual review of Sri Lanka’s most valuable brands.

While the total value of Sri Lanka’s most valuable brands in the year under review increased slightly by Rs.6 billion or one percent versus last year, it still falls short of the total value recorded in 2019.

While the total value of Sri Lanka’s most valuable brands in the year under review increased slightly by Rs.6 billion or one percent versus last year, it still falls short of the total value recorded in 2019.

According to Brand Finance Lanka Chairman Ruchi Gunewardene, “The year by all accounts was even more tumultuous than the previous COVID-19 year, due to the gradually worsening economic situation. The future outlook is even bleaker, as the country battles an unprecedented economic crisis, which will have significant impact on consumer purchasing power and buying habits amidst shortages and rocketing prices. In such circumstances, the brands that a company owns are arguably now even more critical than ever before to sustain and grow the business.”

The newly-appointed Brand Finance Lanka Managing Director Aliakber Alihussain said, “Brands can take decades to build. However, once built, they are resilient and can sustain a business during difficult times; this is what we see in this year’s results. our analysis shows that those businesses that have systematically and strategically built strong brands have withstood the vagaries of uncertain times, performing significantly better than their weaker counterparts.”

Winning brands

Dialog has retained its position as the most valuable brand in Sri Lanka for the fourth consecutive year. This is only slightly ahead of the No. 2 brand Bank of Ceylon, with just Rs.136 million separating them. Commercial Bank has moved into the third position by displacing People’s Bank, which now sits at the fourth place.

To round off the rest of the top 10 brands, they are NSB, Keells, SLT-Mobitel, Sampath Bank, HNB and Cargills Food City in that order.

As part of Brand Finance Lanka’s process, in addition to brand value, we measure brand strength. Dialog has been able to retain its position at the top of the value table because it is still one of the strongest among the 100 brands. The simple equation is that stronger the brand (which operates in a particular sector), greater the potential to grow future value. However, the strongest brand this year is the Keells supermarket (with a AAA rating), which is indicative that it has potential for future brand value growth.

Sector overview

The banking sector is by far the single most valuable in the Brand Finance index, accounting for 44 percent of the Sri Lanka 100 total brand value (including the addition of three new investment banking brands to the table this year).

The next biggest sectors at 14 percent each are food and beverage and telecommunications, both of which have increased in share over the previous year. The retail sector too has grown by two share points over the previous year and has a 13 percent share.

In the year ahead, the sector contributions are expected to change, as they will have different impacts to the unprecedented financial crisis the country is going through. This year’s valuations are done as at January 1, 2022. In the future, as consumer purchasing power declines, buying habits are bound to change.

Key banking sector

Bank of Ceylon has retained the position as the most valuable brand within the sector, with a marginal increase in brand value.

Commercial Bank has steadily moved up in the ranking, securing the second position, overtaking People’s Bank. This is primarily due to it being the strongest brand among the banks. Stronger the brand, higher the potential brand value it can generate in the future.

For the third consecutive year, NDB claims the title of fastest growing banking brand, with a growth of 7 percent. NDB’s continuous efforts in digitisation and net revenue growth has boosted its brand value growth.

Updating index

The Brand Finance Most Valuable Brands Index is evolving with the times to reflect the external changes in the business environment.

The increasing importance of the Colombo Stock Exchange in the midst of the volatile economic conditions should be noted, with the investors backing financially sound stocks. This makes managing the brands that these companies own that much more important. The Colombo Stock Exchange has also attracted many new listings over last year, which has provided Brand Finance Lanka with a fresh new set of customers facing businesses on its index.

One such brand is Prime Lands; another is JAT’s Seyerlack. We also see the emergence of the first e-commerce brand with Kapruka. Although it is listed towards the bottom of the index, it has potential to escalate up the table, due to the rapid adoption of e-commerce in Sri Lanka.

Future challenges

During times of uncertainty, building resilient brands should be what drives marketing decisions.

As the impact of the unprecedented economic crisis takes full effect in the months ahead, businesses and brands are going to be challenged. Depending on the category, some brands will thrive; others will be striving for growth and some others will be hard pressed to survive.

Within this tumultuous environment, there is much that the brands can do to build reputation by adjusting to the challenges, collaborating with others, taking a leadership role, as it genuinely extends itself to provide services and protect their customers.

On the other hand, there are major challenges for marketers too, who need to be more accountable to its stakeholders in these times of stress. By linking marketing investments with financial impact, greater marketing accountability is established at the level of the board.

Although Sri Lanka is no stranger to rough patches, the road to recovery and hopes are pinned no longer on COVID-19 but on fiscal consolidation, with an eye on the Ukraine-Russia war, which is already leading to escalating oil prices. Brands that survive this crisis unscathed should essentially be even more resilient in the years ahead.

The complete list of the most valuable brands and detailed analyses can be found in LMD’s Brands Annual 2022 and for online report visit www.brandirectory.com.