Reply To:

Name - Reply Comment

In a significant stride towards fostering transparency and informed decision-making within South Asia’s real estate landscape, the Research Intelligence Unit (RIUNIT) unveiled a series of reports during the eighth Islamic Finance Forum of South Asia, held recently at the Shangri-La hotel in Colombo.

These reports provide a holistic view of the real estate markets in Sri Lanka, the Maldives and Bangladesh, shedding light on key facets, including apartment supply, pricing trends, rental values and absorption rates.

Among the three nations under scrutiny, Bangladesh emerged as the leader in terms of the sheer volume of apartment supply. Notably, the country recorded the highest number of apartment units available. However, it is noteworthy that the apartment/population ratio in Bangladesh stands at 0.09 percent, highlighting the vast potential for growth in this sector.

Sri Lanka, with 28,273 apartment units, presented an apartment/population ratio of 0.13 percent, reflecting a substantial supply to meet the growing demand. The Maldives, on the other hand, demonstrated a lower number of units (5,204), yet remarkably, the highest apartment/population ratio of 0.92 percent.

The Maldives stood out with the highest apartment prices, primarily due to robust demand within the capital city of Male, coupled with modern apartment projects in Hulhumale commanding premium rates. In contrast, Sri Lanka faced challenges, particularly concerning currency depreciation and economic instability at the onset of 2022, which adversely affected apartment prices. On a more positive note, Bangladesh’s average apartment market showed a steady 7 percent annual increment in prices.

In regards to the rental market, Sri Lanka experienced a 2 percent decline in apartment rental values when measured in US dollars, primarily due to currency depreciation. Meanwhile, the Maldives showcased the highest apartment rental values, marked by a 3 percent annual increment. Surprisingly, Dhaka in Bangladesh recorded the lowest rental values but saw a 4 percent increment compared to the previous year.

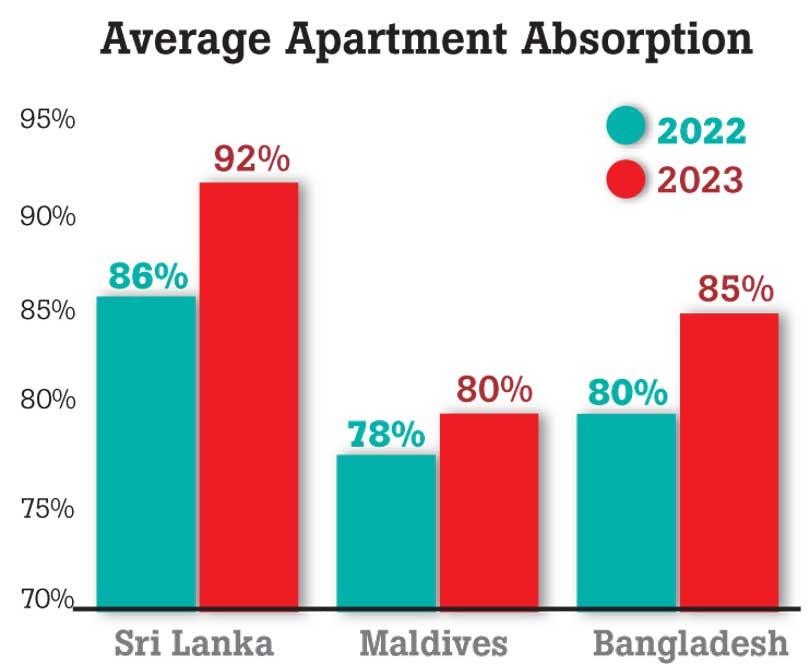

Sri Lanka, driven by a slowdown in new apartment supply since 2021, indicated a higher absorption rate. The old inventory nearly sold out, with few unsold units in ongoing projects. Conversely, the Maldives displayed a lower absorption rate, primarily due to a substantial influx of new apartment projects, particularly in Hulhumale. RIUNIT’s findings suggest that Dhaka has effectively maintained equilibrium between apartment demand and supply in recent years, highlighting the maturity of the real estate market in Bangladesh’s capital.