Reply To:

Name - Reply Comment

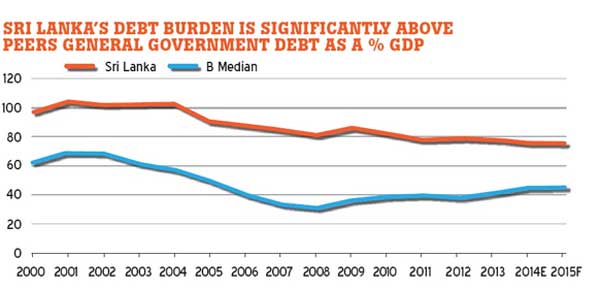

Moody’s Investor Services in a recent report said that Sri Lanka, which has a sovereign rating of B1, has an extremely high rate of government debt compared to similarly rated countries.

As the figure shows, debt remains significantly above the median of 41 percent for B-rated sovereigns.According to the Central Bank, government debt was reduced to 75 percent of GDP in 2014 from 102.3 percent in 2004, and 78.3 percent in 2013, and is expected to fall to 60 percent by 2020.

“These improvements are being recorded at a time when many other countries experienced higher Debt to GDP ratios in 2014,” the Central Bank Road Map 2015 report claimed.It also said that all short-term debt is being converted to long-term debt, and that all short-term debt will be covered by 2018, leading to debt with longer periods of maturity.

Moody’s said that interest payments on debt consume about 40 percent of the government’s revenue.According to the Central Bank, government revenue consisted of 13.4 percent of GDP in 2014 and interest costs consisted 4.4 percent of GDP in 2014 compared to 5.3 percent in 2013. The aim is to reduce interest costs to around 4 percent of GDPby 2020.

“...interest payments on debt (are) among the highest such ratios within Moody’s sovereign rated universe. Moreover, about 43 percent of the government’s debt is denominated in foreign currencies, leaving the government’s financing profile vulnerable to volatility in the exchange rate and international credit markets,” Moody’s said.

However, Central Bank figures estimated around 32 percent of the debt being made out of foreign sources.The previous regime received much criticism for favouring interest heavy loans from China over development based funding.