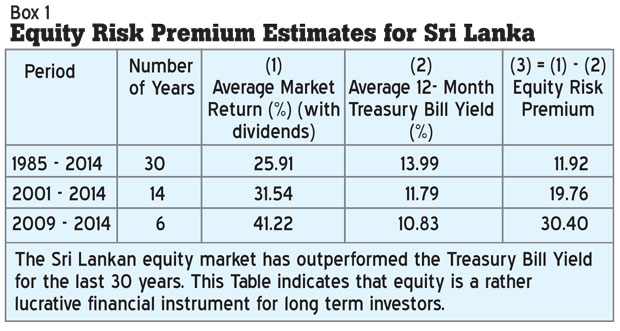

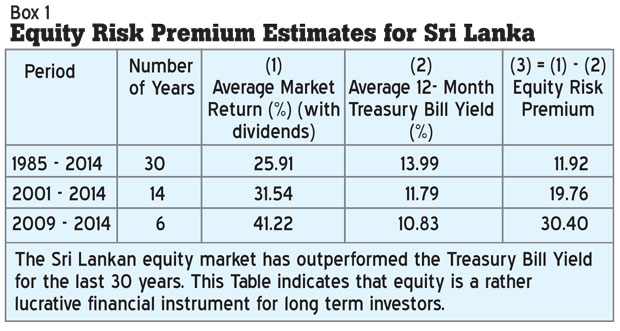

Over the long run, stocks have beaten the performance of any other major asset class by a wide margin (refer Box 1). Stocks have proved their worth and deserve a prominent place in any long term investment plan, such as a retirement account. Yet as stocks are volatile which means that by their nature value rises and falls invest with caution. Ideally, stocks should be held to meet medium and long term goals. In other words, money invested in stocks should not be money that you might need in three to five years.

Over the long run, stocks have beaten the performance of any other major asset class by a wide margin (refer Box 1). Stocks have proved their worth and deserve a prominent place in any long term investment plan, such as a retirement account. Yet as stocks are volatile which means that by their nature value rises and falls invest with caution. Ideally, stocks should be held to meet medium and long term goals. In other words, money invested in stocks should not be money that you might need in three to five years.

Stocks tend to deliver handsome returns over the long run, but volatile markets may not cooperate with your short-term cash needs. Ordinary shares represent a share of ownership in the company that issues the shares. Stock prices move according to how a company performs, how investors perceive the company’s future and the movement of the overall stock market. The following is a guide to understand stocks and how to invest in them.

"Although stocks are unpredictable over the short term, stocks have delivered superior returns over the long haul"

Different flavors of stocks

Growth stocks are shares of companies with the potential to consistently generate above average revenues and profit growth. These companies tend to reinvest most or all of their earnings in their businesses and pay out little or none of their profits to share holders in the form of dividends.

Growth companies expand faster than the overall economy, yet you can sometimes find these companies in mature industries. Note that even fast-growing companies are not necessarily good investments if their shares are overvalued.

Cyclic stocks are shares of companies whose sales and earnings are highly sensitive to the ups and downs of the economy. When the economy is performing well, cyclical companies tend to shine. A contracting economy typically hammers the sales and profits of these companies and hurts their stocks.

Defensive stocks describe shares of companies whose sales of goods and services tend to hold up well even during economic downturns. Examples of industries that are substantially insulated from the business cycle are government contractors and producers of basic consumer products, such as food, beverages and pharmaceuticals.

Income stocks pay out a relatively high ratio of their earnings in the form of dividends. The companies that issue them tend to be mature and have limited opportunities for reinvesting their profits into more attractive opportunities. Stocks that pay large dividends are usually less volatile because investors regularly receive cash dividends, regardless of market gyrations.

Small-company stocks have generated better returns over time than stocks of large companies. Young, small companies tend to grow faster than their larger brethren. But there’s a trade-off: Small-company stocks are much more volatile than shares of big companies. There are a number of ways of defining what constitutes a small company.

The importance of diversification

The importance of diversification

Diversification means spreading your money among many investments to lessen risk. The idea is to avoid a situation in which your investments are concentrated in a few stocks that big declines in the value of just one or two of them wreck your portfolio. You might strive for a mix of stocks that tend to fare well in different economic environments, such as strong, stagnant and inflationary economies.

Perhaps you will want to blend growth and income stocks in the portfolio. The appropriate blend of stocks depends on personal circumstances, including your time horizon (when you’ll need to spend the money) and your tolerance for risk and volatility (your ability to sleep at night when stock prices fall).

How to pick stocks

Broadly speaking, there are two basic approaches to stock picking: one based on an assessment of economic and market factors (known as a top-down approach) and one based exclusively on analysis of individual stocks (a bottom-up approach). Investors— including professionals such as fund managers sometimes combine both approaches in selecting stocks.

The investor begins with an analysis of the economy, markets and industries. Trends in the economy (employment and interest rates) substantially influence company earnings. As some companies operate all over the world, the analysis must often be global in scope. Stocks tend to perform differently at various points in an economic cycle. For instance, financial companies often do well early in an economic recovery or even in anticipation of a recovery. Commodities-related companies often perform well in the late stage of an economic cycle.

There are numerous ways to pick individual stocks, some of them quite complex. In general, though, investors prefer companies that deliver solid earnings growth or those whose share prices are cheap relative to the perceived value of the company. Finding the best of both worlds is an even better formula for successful stock picking.

Of course, that is much easier said than done. It’s crucial to understand how stocks are valued. By itself, a stock’s price tells you nothing about its value. A stock that trades for a nickel a share can be expensive, while a stock that trades for Rs 500 per share can be cheap. As mentioned earlier, what matters is how much the share price compares with a fundamental measure, such as a company’s profits or sales. The article published on the 23rd of February 2015 discussed important elements of Fundamental Analysis. It can be viewed on http://www.dailymirror.lk/64407/five-important-elements-in-fundamental-analysis

Finding growth

There are many ways to find great growth stocks. Perhaps the simplest is through your own observations. You may dine at a restaurant chain with an interesting new concept that seems to be opening a new facility every week.

Your teenage kids may tip you off to a new store that all their friends are patronizing. Or it could be a technology company that turns out one blockbuster product after another. As a rule, you should invest only in companies that you can understand. You can find past growth rates and estimated future growth rates for earnings and sales in brokerage reports and on the internet.

When to sell

The decision of when to unload a stock is as important as deciding which stocks to buy in the first place. But the decision to sell is often harder than the decision to buy. That’s because once you own a stock, emotional factors come into play. If you own a stock that falls in value, you may want to hold on to it whether you should or not because by selling and locking in the loss you confirm that you made a bad decision. If you own a stock that performs exceedingly well, you may want to hold on because it has treated you so well, even if the stock has become overvalued. The refusal to sell whether due to unrealistic expectations, stubbornness, lack of interest or mere inattention is the downfall of many investors.

As a long-term investor, you don’t want to cash in every time your stock moves up a few dollars. Commissions and perhaps taxes would cut into your gain, and you’d have to decide where to put the proceeds. By the same token, you don’t want to bail out in a panic in the aftermath of a steep market decline. Here are some clues that will tell you when it is time to consider selling a stock, whether or not you’ve made money on it:

Whether you own shares in a blue chip company or a company most people have never heard of you need to follow the corporation’s prospects, its earnings progression, and its business success as reflected in such things as its products and services, market share and profit margins. Annual reports, news stories, research reports from brokerage houses and independent analysts, the Colombo Stock Exchange website and investment newsletters are fertile sources of such information. If a company’s basic, fundamental measures start to weaken, it’s time to reconsider your investment. An example might be a fast expanding retail chain whose sales per store suddenly decline after rising for years. Or here’s a more obvious case: Suppose you bought a stock because you had high expectations for a new product. If the product turns out to be a dud, sell.

The progression and security of the dividend are important to any stock’s prospects. A dividend cut or signs that the dividend is “in trouble” meaning that analysts or money managers are quoted as saying that they don’t think the company can maintain its payout to shareholders can undermine the stock price.

Beware, of stocks that give unusually high yields relative to their history or to their industries. The yield may be high because the share price has dropped a lot. This often indicates that investors believe a company will cut its dividend.

-

You reach your target price

Many investors set specific price targets, both up and down, when they buy a stock; when the stock reaches the target, they sell. Such guidelines can prompt you to take your gains in a timely fashion and to dump losers before the damage gets too painful. Take the simple step of setting a “mental protective stop.” Watch the stock listings and sell any stock that hits your mental stop point.

You can set your sell level anywhere, be it above the current share price or below the current share price. Once you’ve reached your objective, take the money. If the goals you set are very conservative, you might miss some gains from time to time, but that’s better than holding on too long and falling victim to the Wall Street saying: “Bulls make money. Bears make money. Pigs get slaughtered.”

With any investment, you should judge performance by total return essentially, the change in price plus any dividends you receive while holding the stock. For example, if you purchase a stock for Rs 40, sell it a year later for Rs 50 and receive a Rs2 dividend distribution during the year, your total return is 30% (a 25% capital gain plus a dividend yield of 5%).

Wrap up

Stocks merit a substantial place in your portfolio. Because stocks are volatile assets, they are more suitable for portfolios invested for medium- or long-term goals. Be sure you have a diversified blend of stocks that includes a helping of foreign shares. Do your homework to ensure that you aren’t overpaying for the stocks.

Over the long run, stocks have beaten the performance of any other major asset class by a wide margin (refer Box 1). Stocks have proved their worth and deserve a prominent place in any long term investment plan, such as a retirement account. Yet as stocks are volatile which means that by their nature value rises and falls invest with caution. Ideally, stocks should be held to meet medium and long term goals. In other words, money invested in stocks should not be money that you might need in three to five years.

Over the long run, stocks have beaten the performance of any other major asset class by a wide margin (refer Box 1). Stocks have proved their worth and deserve a prominent place in any long term investment plan, such as a retirement account. Yet as stocks are volatile which means that by their nature value rises and falls invest with caution. Ideally, stocks should be held to meet medium and long term goals. In other words, money invested in stocks should not be money that you might need in three to five years.