Reply To:

Name - Reply Comment

Recently Sri Lanka became the first country in South Asia to declare e-sports as a national sport, and with 32 million mobile subscriptions and counting, we have been on a fast track to a digitally inclusive society.

Apps are big businesses, and even locally, they have contributed to a surge in the local gaming industry, home-based businesses and overall entertainment. However, limited traditional payment options such as cash-on-delivery & pre-order bank deposits, have created hurdles for localization of the digital experience. Given these limitations, are we truly ready to embrace the rising tide of in-app purchases?

With the emergence of Airtel’s “Airpay” Direct Carrier Billing (DCB) service, it has been clear that most young Sri Lankans are not just open, but are also eager to start transacting online, they just need convenient platforms, easy access and assured reliability. This dynamic can readily be seen in the massive 10x growth that Airpay has recorded on transactions made within the Google Play Store by Sri Lankan youth, leveraging on Airtel Lanka’s increasingly popular DCB service over the past two years since its launch.

What is Airtel Airpay and Direct Carrier Billing (DCB)?

Launched in 2017, Airpay was the first very first Direct Carrier Billing (“DCB”) service to hit the Sri Lankan market. DCB is an online payment method which allows users to make purchases on Google Play Store by charging payments to their phone bill or by using their pre-paid balance.

To avoid accidental purchases, Airpay is bundled with an easy-to-use refund option which is visible immediately on the purchased app and lasts for two hours. Users can keep a full track of their Airpay purchases via the ‘Order History’ in their Google Play account menu.

How secure is Airpay?

Forget instilling multiple buffer zones between fraud and your checking account or your personal cash because Airtel Airpay offers several layers of security when conducting transactions. The most customary security detail is the user verifying their identity by providing their google account password prior to any purchase. Airtel Airpay is directly linked to the user’s phone credit and the DCB service does not call for you to store your card or any other personal information on your device. This means that throughout all your purchases, Airpay will not gather your data or share any data points with a third party. This also means that with Airpay, unlike a card swipe or even an e-wallet, there is no static data which can be skimmed at any future date.

Why is DCB more popular?

You no longer have to own a credit card, debit card or even a bank account to shop on Google Play Store. This is great news for the average Sri Lankan online shopper and even so for younger users as they can be wary of saving card details and personal information online over fears of identity theft, accidental purchases and the additional banking charges.

As more young Sri Lankans flock to online portals to meet their demand for everything from shopping to entertainment, cashless payments would likely take on special significance for young Sri Lankans who live outside of the Western Province, who typically do not have access to credit or debit cards until they leave school or start their first job.

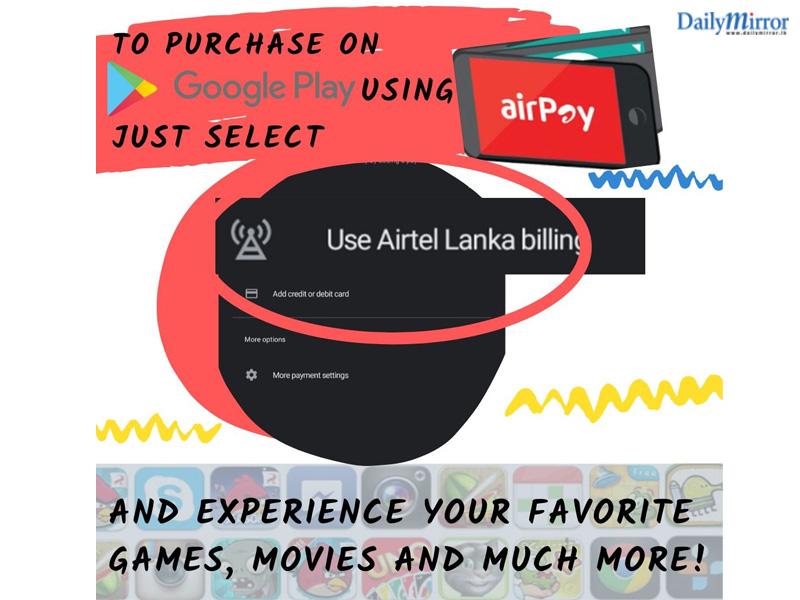

So how do you use Airpay?

Customers can easily access Airpay on their android handsets by adding ‘Use Airtel Billing’ in the payment methods of their Google Play account menu. Once the selection process is complete, the user can simply click on ‘Buy’ on their favourite content, select ‘Bill my Airtel account’ and provide their Google account password to confirm the purchase.