28 Mar 2023 - {{hitsCtrl.values.hits}}

By Nishel Fernando

Sri Lanka is likely to go for another International Monetary Fund (IMF) programme after the end of the current four-year programme, to continue with the structural and institutional reforms.

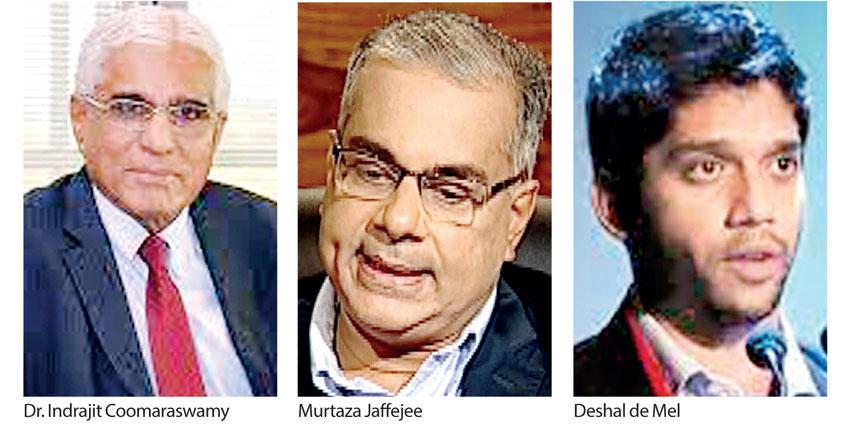

“I think there will be another programme definitely but it will be to support the continuation of reforms, not to support another debt restructuring,” former Central Bank Governor and senior economist Dr. Indrajit Coomaraswamy told a virtual forum organised by the Central Bank.

Meanwhile, JB Securities Managing Director Murtaza Jafferjee opined that the country is unlikely to meet the ambitious targets under the current IMF programme and therefore, it is likely to renegotiate a new programme.

“It’s highly likely that we won’t be able to complete the programme. The reason I’m saying that is, not due to the lack of tax policy but because it will take few years for the economy to recover.

Even if you work on it really hard, it will take at least three years; then you have to give sometime to take it into effect. We will have a bounce back but it will take many years for the economy to grow. Therefore, I’m not optimistic that the recovery will be very strong and very fast,” he said.

Having said that, Jafferjee outlined the reforms would lay the foundation for a new beginning for the economy.

However, Economic Advisor to Finance Ministry Deshal de Mel was cautiously optimistic on the prospects of completing the IMF programme by meeting the targets, including delivering the primary surplus of 2.3 percent of GDP by 2025, from the negative 5.6 percent in 2021.

“It’s ambitious, going from 5.6 percent in 2021 but we are also starting from a low base. The 14 percent revenue target is not particularly high. It’s not an unrealistic target; the way to go is to address through core taxes. Robust structure in these taxes should do the heavy lifting,” he said.

He also stressed that it is paramount to meet these targets, in order to rebuild the confidence of the international market.

“If we miss this chance, it will be difficult to regain the confidence of the international market and community,” de Mel added.

23 Dec 2024 2 hours ago

23 Dec 2024 4 hours ago

23 Dec 2024 4 hours ago

23 Dec 2024 4 hours ago

23 Dec 2024 6 hours ago