05 Mar 2019 - {{hitsCtrl.values.hits}}

Finance Minister Mangala Samaraweera today presented the 2019 Budget, aimed at ‘growth powered by private enterprise’ and is determined ‘to pursue a liberal outward-oriented economy.’ “This is an extension of the “Enterprise Sri Lanka” concept introduced in the previous “Blue-Green Budget".

However, what I mean by private enterprise is the genuine entrepreneur who uses his ingenuity to compete in a fair market, the small and mid-size businesses that embody the spirit of Sri Lankan trade and commerce and the Sri Lankan companies that compete on the global stage and win,” he said.

In his budget speech, the Finance Minister said, “There is also the other segment of the private sector, which is averse to competition and fair markets. They are the beneficiaries of crony capitalism that thrived in a kleptocracy, which enriched those connected to the previous regime.

These companies grew rich on the rents from walls of tariff protection by driving up costs for 20 million citizens. They benefited from inflated government contracts, the costs of which are still being paid-off today. Some of these oligarchs yearn for the return of a dictatorship, which funnelled so much wealth into their companies and private accounts.

This is a small but powerful and influential segment of the private sector. This is not the private sector that we want to see as the engine of economic growth, but is a vestige of a bygone era. “We are creating a new breed of private enterprise, where success is through merit and a market that operates on a rules-based level playing field. Sri Lanka needs a private sector free from the protectionist mindset that continues to hold back our country’s development and modernisation.

In last year’s budget I presented a programme of economic liberalisation, buttressed by a robust safety net and state intervention to address market failures ensuring social justice. We will continue this framework and strengthen its key elements. “Our determination to pursue a liberal outward-oriented economy is more steadfast than ever. Towards this end, we are continuing the phasing out of para-tariffs and reducing barriers to trade. At the same time, we have built in safeguards with the passage of anti-dumping legislation and the creation of a Trade Adjustment Programme, to support firms and workers, in meeting the challenges of competition.

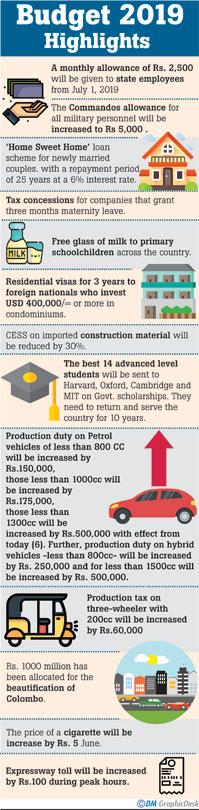

“We will also invest more in social infrastructure and a social safety net. While committing more funds to education and health where the quality of that spending will take precedence. It is also time to revamp our social safety net, which have had a dismal track record in targeting and efficacy. The focus must shift to graduating beneficiaries into self-sufficient and empowered citizens." Minister Samaraweera also focused on new factors in terms of new loan schemes such as ‘Home Sweet Home’ for newly married couples and the 'Sihina Maliga' scheme for expatriate workers.

"Especially to support the middle-income first-time home buyers, the government will launch a concessionary “Home Sweet Home” loan scheme of up to Rs.10 million at an interest rate of 6% with a repayment period of 25 years. This will be for young couples buying or building their first home.

This “Enterprise Sri Lanka” loan scheme will be extended to also purchase mid-range apartments and houses built by the private sector. Migrant workers registered with the Foreign Employment Bureau and currently working abroad, will be able to obtain a loan of Rs.10 million with the government bearing 75% of the interest cost with the loan to be repaid in 15 years, with a two-year grace period," he said. The minister said the government had also focused on families without sanitary facilities and proposed an allocation of Rs.400 million to construct toilet facilities with more than 100,000 toilets to be constructed under the scheme.

“We invite the private sector to manage the toilets which will be constructed in public places,” he said. The Budget also announced a decision not to allow any foreign construction companies to tender for government contracts unless these companies have formed a joint venture with a local company.

Another tax concession announced was the removal of the Nation Building Tax from foreign currency receipts for registered hotels. The Minister said differently-able individuals are being currently paid a monthly allowance of Rs.3,000. “While increasing this allowance to Rs.5,000 per month, we will expand funding to accommodate almost 72,000 eligible low-income individuals.

Rs.4,320 million has been allocated for this purpose. To encourage more inclusive employment, private entities that recruit at least five people with disabilities, will be provided a salary subsidy of 50% of the salary per person, to an upper limit of Rs.15,000 per person a month, for a period of 24 months,” he said.

The Minister announced the payment of an allowance of Rs 2,500 to all public servants and assured to revise pensions and remove pension anomalies. Allowances for security forces were also increased. These included the special commando allowance, uniform allowance and housing allowance. He said a Nation Building Tax will be imposed on cigarettes increasing the price of a stick by Rs 5. “Revision of excise duty on cigarettes will be effective from March 6, 2019 and the introduction of the Nation Building Tax on cigarette manufacturers effective from June 1, 2019.

Accordingly, excise duty on cigarettes, which is more than 60 mm, will be increased by 12%, resulting in an increase of Rs.5 per stick on average,” the Minister said. He said the 200 percent cash margin on vehicle imports will be removed and the revision of the excise duty would have a minimal impact on smaller personal vehicles. “In addition, the 200 percent cash margin requirements on motor vehicle imports will be removed in the near future,” the Minister said. He said a production duty on petrol vehicles under 800 CC will be increased by Rs.150,000, less than 1000cc will be increased by Rs.175,000 and less than 1300cc will be increased by Rs.500,000 with effect from today.

Further, production duty on hybrid vehicles of less than 800 cc will be increased by Rs. 250,000 and for less than 1500 cc will be increased by Rs.500,000. Passport fees will also be revised. The price of all liquor will increase except for gal arrack, which the Minister claimed was a poor man’s drink.

A casino tax will be levied from casinos and the new entrance fee for casinos will be $50. Rejecting opposition claims that the 2019 Budget was an election-related budget, the Minister said it is not so. “We have not aimed at elections in our budget but have focused on all the living, including dogs,” he said. “We would have achieved much more when it comes to the economy if the October 26 conspiracy had not taken place last year. A sum of $1 billion had gone out of the country during the 52-day political crisis," the Minister said, adding that increase of US rates and of the oil prices in the global market, had a negative impact on the country’s economy. “We have managed to pull the economy through and made sure that there is economic stability,” he said. (Yohan Perera and Ajith Siriwardena)

26 Nov 2024 57 minute ago

26 Nov 2024 1 hours ago

26 Nov 2024 1 hours ago

25 Nov 2024 25 Nov 2024

25 Nov 2024 25 Nov 2024