30 Aug 2022 - {{hitsCtrl.values.hits}}

Although Sri Lanka may have to consider restructuring its domestic debt in the upcoming debt restructuring negotiations, the government is urged to do its utmost to dissuade the external creditors from such a counterproductive exercise that exacerbates Sri Lanka’s economic woes.

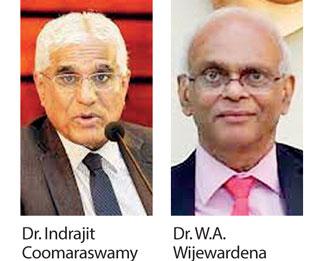

“The solution should not be worse than the problem that you are trying to solve because there could be a blow-back to the financial industry, to government revenue, etc. You have to take all these factors into confederation,” former Central Bank Governor Dr. Indrajit Coomaraswamy said.

“The solution should not be worse than the problem that you are trying to solve because there could be a blow-back to the financial industry, to government revenue, etc. You have to take all these factors into confederation,” former Central Bank Governor Dr. Indrajit Coomaraswamy said.

According to former Central Bank Deputy Governor Dr. W.A. Wijewardena, a potential domestic debt restructuring exercise, involving a capital haircut, could potentially bankrupt the country’s largest pension fund, the Employees’ Provident Fund (EPF), while wiping out the Central Bank’s capital base and heighten risks on the financial sector stability.

“If there’s a 10 percent haircut, the biggest loser would be the Central Bank. It holds around Rs.2.4 trillion worth government securities and could lose Rs.240 billion. This would completely wipe out the Central Bank’s entire capital base and the government will have to put new capital into the Central Bank. On top of that, if you look at the commercial banks, which are also holding Rs.3.9 trillion of government securities, a 10 percent haircut will make them lose Rs.390 billion. It’s a large sum that the commercial banks would not be able to manage. However, the biggest loser would be the EPF because it’s a capital zero fund, which holds around Rs.3.3 trillion government securities. If it loses Rs.330 billion, it could go bankrupt before anyone else,” he elaborated. Commenting on President Ranil Wickremesinghe’s initial statements about a potential domestic debt restructuring, Dr. Wijewardena pointed out that they alone have created concerns on the domestic debt sustainability, with the Central Bank having to only accept 60 percent of the offering at the last Treasury bill auction, due to high yields. “I don’t think we should go for the particular option.

Sri Lanka will have to negotiate with the IMF and advise debt restructuring teams to not to go ahead with local debt restructuring. We have to manage the domestic debt sustainability adapting a different mechanism,” he recommended However, Dr. Coomaraswamy acknowledged that the government has to listen to the external creditors’ demands on equal treatment on domestic debt, if the country requires a higher than expected debt relief via deep haircuts from them, in order to move towards debt sustainability.

“My question is that can one achieve the path towards debt sustainability by restructuring only the debt that has been identified within the parameter as set out on April 12? If this path of sustainability can be achieved, then there is no problem. However, if not or you have to make such heavy demands on the creditors in that parameter that they are not going to accept, then you have to extend the parameter; then it’s a different ballgame. That’s what’s at play now.

My understanding is that authorities will do everything to keep the parameter intact. However, if the debt restructuring advisors feel that the external creditors are not going to accept what’s coming out of that or the IMF feels that it doesn’t get Sri Lanka on to a sustainable path, then we will to consider how to extend the parameter,” Dr. Coomaraswamy noted.

07 Nov 2024 1 hours ago

07 Nov 2024 2 hours ago

07 Nov 2024 2 hours ago

07 Nov 2024 3 hours ago

07 Nov 2024 3 hours ago