01 Feb 2022 - {{hitsCtrl.values.hits}}

Sri Lanka’s consumer prices hit a 13-year high in January, as the country continues to grapple with import restrictions, foreign exchange shortages and failed harvests.

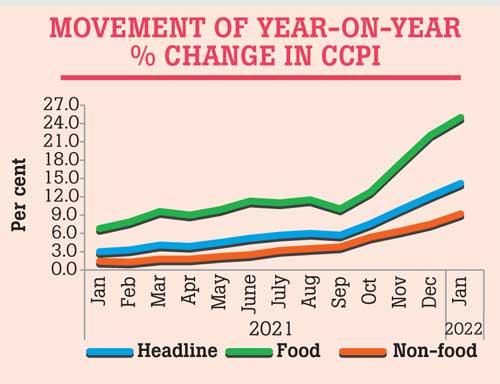

The consumer prices rose by 14.2 percent in January, accelerating from 12.1 percent in December 2021, the prices measured by the Colombo Prices Index (CCPI) showed.

The last time Sri Lanka had over 14.2 percent was in December 2008, when the prices rose 14.4 percent. Meanwhile, food inflation in January surged by 25 percent, accelerating from 22.1 a month ago. However, on a monthly basis, the price increases eased to 3.3 percent in January, from the 5.4 percent increase in December 2021.

The government last week announced plans to allocate Rs.40 billion to compensate the farmers who were affected by its rash organic fertiliser policy. Further, Rs.30 billion was allocated to purchase paddy from farmers at a guaranteed price of Rs.75 a kilo.

All these measures could bring new inflation pressures into the system, as purchasing paddy at higher rates will cause pass through effects. As it happens, the private millers always outbid the government to win the farmers.

Except for items such as coconuts, vegetables, big onions, turmeric powder and limes, all other 28 items in the food basket rose in prices between December and January. The non-food inflation rose by 9.2 percent in January, gaining pace from 7.5 percent in December 2021, while the monthly prices also rose by 1.9 percent, from 1.3 percent, as the fuel price revision, which came into effect in the third week of December, had a substantial impact.

The data suggested that people continued to spend on recreational activities as restaurants and hotels subcategory rose notably, while the spending on education increased with people signing up for more higher education and vocational training programmes.

Further, house maintenance and reconstruction work recorded substantially higher prices in January, reflecting the exponential prices seen across all areas of construction, due to the construction and housing boom seen in the local market and the higher global commodities prices amid the forex crunch at home.

Meanwhile, the core prices, which are measured barring the often volatile items such as food, energy and transportation, also rose by 9.9 percent in January, accelerating from 8.3 percent in December, reflecting the underlying inflationary pressures of the economy. This is the highest core inflation recorded since 2009 May, when the index rose by 13.5 percent.

The Central Bank on January 20 raised policy rates by 50 basis points to tamp down the demand-driven inflation, while keeping the midterm inflation band between its original 4-6 percent levels.

16 Nov 2024 51 minute ago

16 Nov 2024 1 hours ago

16 Nov 2024 2 hours ago

16 Nov 2024 2 hours ago

16 Nov 2024 3 hours ago