25 Jun 2024 - {{hitsCtrl.values.hits}}

- Food prices eased while non-food prices remained nearly unchanged

- There is a possibility for prices to change course in June and record a bump

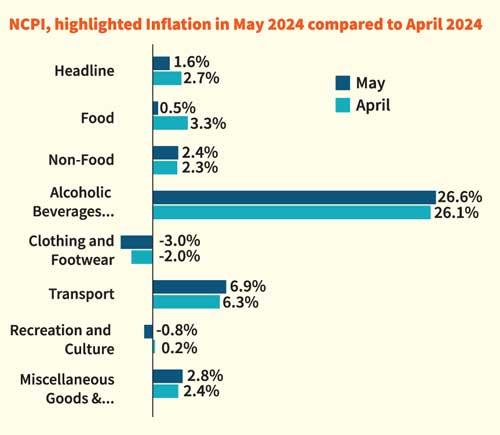

The National Consumer Price Index decelerated sharply to 1.6 percent in May, from 2.7 percent in April, as the food prices eased while the non-food prices remained nearly unchanged, measured from a year ago.

But the prices measured on a monthly basis showed that the national inflation fell by 0.9 percent in May from the levels in April, as both the food and non-food prices fell, continuing their months-long deflationary

trend.

trend.

Compared to the Colombo Consumer Price Index, the national inflation measures the average prices throughout the country and hence, comes out with a 21-day lag.

There is however a possibility for the prices to change course in June and record a bump up, given the substantially higher prices of vegetables, caused by the incessant rains.

The slight reversal seen in the rupee appreciation in May and June is yet to be reflected in the prices predominantly, due to the energy prices, which remain at a benign level, globally.

Meanwhile, the fuel and gas prices were cut in Sri Lanka, beginning June, to provide relief to the public, ahead of the elections. Meanwhile, the prices measured barring the often-volatile food, energy and transport prices, rose by 3.1 percent in the year through May, from 3.0 percent in April.

In May, the food prices rose by 0.5 percent, slowing sharply from 3.3 percent in the year through April but the monthly food prices fell 1.6 percent, adding to the 1.4 percent decline in April.

The non-food prices rose by 2.4 percent in the year through May, edging up from 2.3 percent from a month ago. But the prices measured monthly continued to decline by 0.3 percent, on top of a 0.5 percent decline in April.

The Central Bank maintains its medium-term inflation target at between 4 and 6 percent.

There are upside risks to inflation at present but they just aren’t at threatening levels.

The Central Bank in 2022 botched inflation fight by raising interest rates to exponential levels, thinking that the price spiral was caused by the demand pressure.

But in its own study this year, the Central Bank showed that the 2022 inflation spiral was caused almost entirely by the supply squeeze.

17 Nov 2024 17 Nov 2024

17 Nov 2024 17 Nov 2024

17 Nov 2024 17 Nov 2024

17 Nov 2024 17 Nov 2024

17 Nov 2024 17 Nov 2024