08 Mar 2019 - {{hitsCtrl.values.hits}}

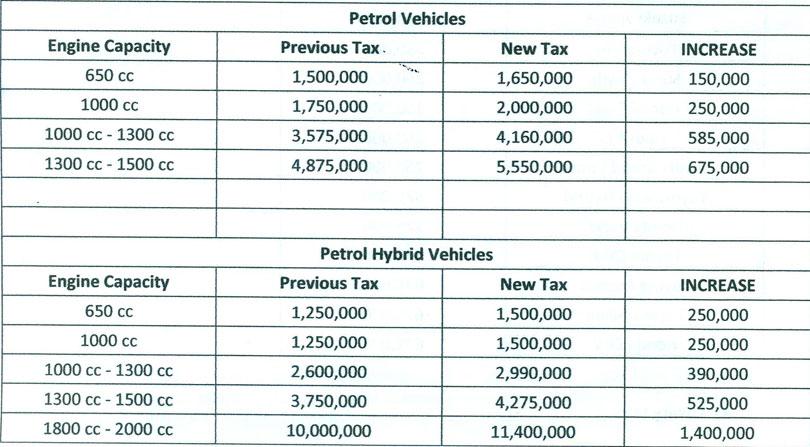

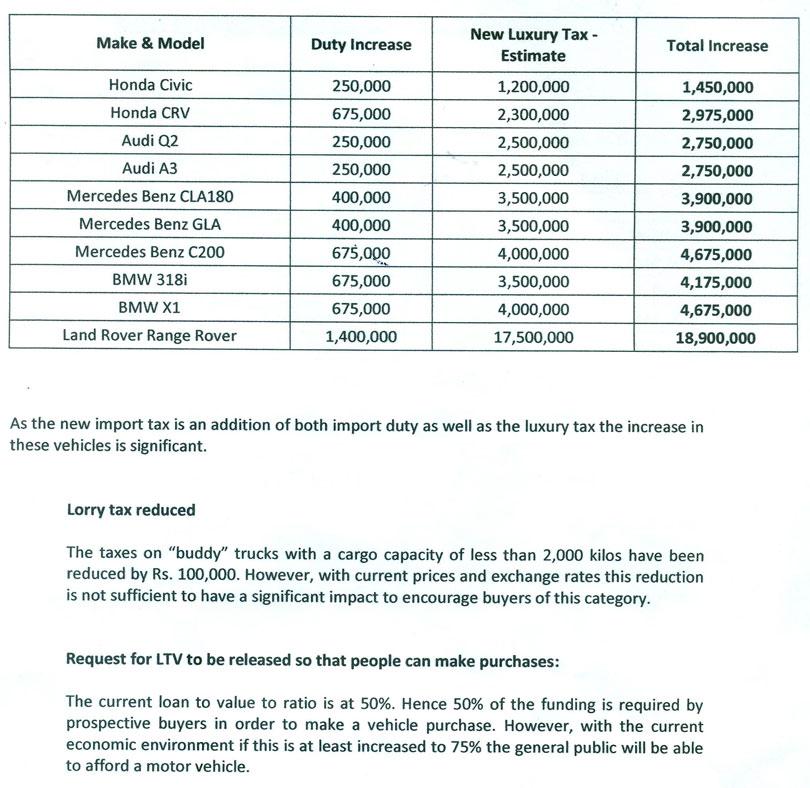

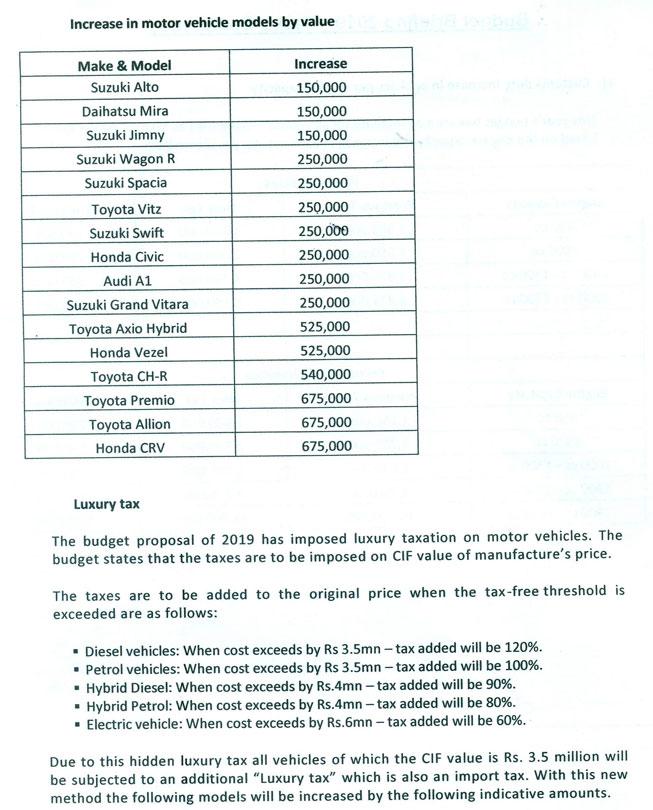

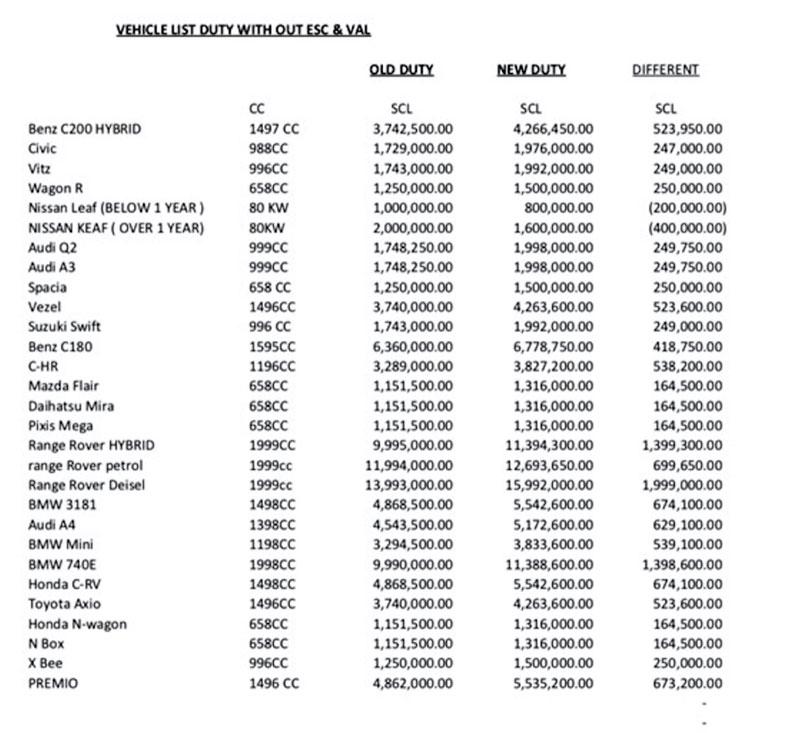

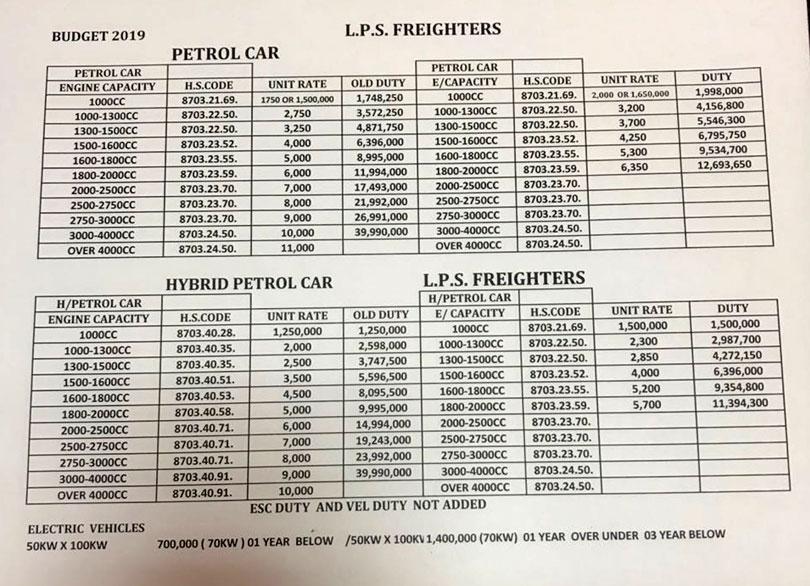

The Vehicle Importers Association of Sri Lanka (VIASL) yesterday said, for the first time in the vehicle import history, a new luxury tax has been imposed apart from the Customs duty, if manufacturing cost of a vehicle exceeds Rs.3.5 million.

Speaking to the media yesterday, VIASL Chairman Ranjan Peiris said this new procedure has been introduced along with the new budget proposal which was presented in parliament.

“After converting the manufacturing cost of a vehicle into Sri Lankan currency, and if the value exceeds Rs.3.5 million, all the vehicles will fall under the luxury tax. Most of the vehicles used by the ordinary people such as Toyota Premier, Toyota Axio, Honda Vezel, Toyota CHR and Honda Grace fall under the luxury tax category,” he said.

“As a vehicle importer, I do not see these vehicles as luxury ones. Luxury vehicles which have engine capacity of more than 1800cc, contain more options and higher in value. This new luxury tax may have been imposed accidentally or by mistakenly by the Finance Minister. He has to look into this issue from the people’s perspective,” he said.

“We think the Minister would take steps to release the vehicles used by the ordinary people from this new luxury tax. As an association, we are not against imposing a luxury tax on actual luxury vehicles.

But this was not fair. According to the new luxury tax, Rs.1,240,000 would have to pay as a luxury tax for a vehicle with a 1,000cc engine capacity in addition to the manufacturing cost. Even the permit holder has to pay the luxury tax according to the vehicle they order,” Mr. Pieris said.

Due to the new taxes, vehicle imports have been decreased by 65 to 70% and simultaneously, the vehicle sales also suffered a sharp decline. While imposing new taxes, the government may have been trying to limit vehicle imports. According to the new mechanism, the new luxury tax is imposed on electric cars too.

The newer electric cars that can run for 300 km are very expensive and Rs.2 million luxury tax was also imposed on those. Therefore the new tax system needs to be streamlined. The tax revision of the imported vehicles would affect the second-hand vehicle market in the future. (Chaturanga Samarawickrama)

Pix by Nisal Baduge

09 Jan 2025 4 hours ago

09 Jan 2025 5 hours ago

09 Jan 2025 8 hours ago

09 Jan 2025 8 hours ago

09 Jan 2025 9 hours ago