01 Aug 2022 - {{hitsCtrl.values.hits}}

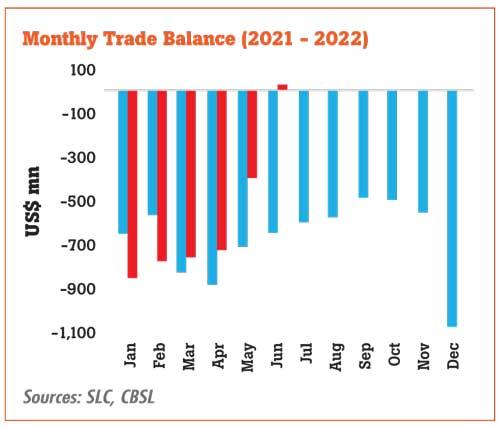

Sri Lanka recorded a rare surplus in the trade account in June after nearly two decades, as merchandise export earnings hit a fresh high while imports continued on the downward spiral reaching new lows.

In June, merchandise export earnings rose by a record 23.9 percent on year-on-year (YoY) to a new monthly high of US$ 1, 248 million while import expenditure fell substantially by 26.1 percent YoY to a nearly two-year low of US$ 1.226 million amid the forex crisis, rupee depreciation and import control measures.

In June, merchandise export earnings rose by a record 23.9 percent on year-on-year (YoY) to a new monthly high of US$ 1, 248 million while import expenditure fell substantially by 26.1 percent YoY to a nearly two-year low of US$ 1.226 million amid the forex crisis, rupee depreciation and import control measures.

Consequently, the country recorded a surplus in the merchandise trade account for the first time since August 2002, when it saw a trade surplus of US$ 110 million.

Accordingly, the cumulative deficit for the first half of the year also narrowed for the second consecutive month during the year on a YoY basis to US$ 3.51 billion from US$ 4.32 billion a year ago.

The increased earnings from apparel, petroleum products and gems, diamonds and jewellery along with sizable reductions on import expenditure on home appliances, sugar and confectionery, base metals, telecommunication devices and machinery and equipment contributed to the improvement seen in the trade account.

In June, the country’s import expenditure saw a broad-based decline due to regulatory measures imposed to curb ‘non-urgent’ imports amid forex shortage.

Expenditure on consumer goods imports halved by 53.8 percent YoY to US$ 89 million with imports of food & beverages as well as non-food consumer goods falling substantially.

Among food and beverages imports, expenditure on dairy products (mainly, milk powder), oils and fats (mainly, coconut oil), vegetables (mainly, big onions, Mysore dhal and garlic), and sugar fell notably despite a sharp increase in rice imports.

In contrast, nonfood consumer imports fell across the board except for clothing and accessories, with notable declines in imports of medical and pharmaceuticals (mainly medicaments), telecommunication devices (mainly, mobile telephones) and home appliances (mainly, televisions).

Despite the non-importation of crude oil in the month, the country’s fuel import bill rose by 201.9 percent YoY to US$ 200 million, due to the increase in volumes and average import prices of refined petroleum products imported from a year ago.

However, on a month-on-month (MoM) basis, the fuel import expenditure was down by over 50 percent.

Import expenditure on investment goods declined by 46.3 percent YoY to US$ 234.1 million resulting from a decline in all subcategories. Almost all types of goods listed under machinery and equipment, building material and transport equipment categories recorded a decline despite some increases in imports of aircraft and electronic equipment parts.

Meanwhile, both industrial and agricultural export categories supported the country to set a fresh monthly record in merchandise export earnings in June.

Export earnings from industrial goods rose by 28.4 percent to US$ 990.3 million with earnings from textiles and garments rising by a nearly 40 percent YoY to US$ 526.4 million.

In addition, gems, diamonds and jewellery; petroleum products, animal fodder and food, beverages and tobacco also recorded notable increases while export earnings from petroleum products continued to improve as a result of increase in average export prices of both aviation and bunker fuel exports. Overall, export earnings from agricultural goods increased by 9.2 percent YoY to US$ 251.5 million despite a 6 percent YoY drop in tea export earnings in the month. Seafood (primarily, fresh and frozen fish) and minor agricultural products (primarily, areca nuts) exports contributed to a major share in the improvement in agri-exports in the month while rubber and coconut-export earnings recorded modest growth rates.

Meanwhile, export earnings from mineral exports declined by 34.8 percent YoY to US$ 2.9 million mainly due to a decline in export earnings from titanium ores categorised under ores, slag, and ash.

23 Nov 2024 23 Nov 2024

23 Nov 2024 23 Nov 2024

23 Nov 2024 23 Nov 2024

23 Nov 2024 23 Nov 2024

23 Nov 2024 23 Nov 2024