07 Oct 2023 - {{hitsCtrl.values.hits}}

Sri Lanka runs at the risk of being designated as a greylisted/blacklisted country, if it fails to implement all the recommendations put forward by the Financial Action Task Force (FATF) before March 2025, the Financial Intelligence Unit (FIU) of the Central Bank said.

As the third mutual evaluation of Sri Lanka’s anti-money laundering/counter financing of terrorism (AML/CFT) framework is about 72 weeks away, not addressing the technical deficiencies will result in the island nation being listed as a country with strategic deficiencies.

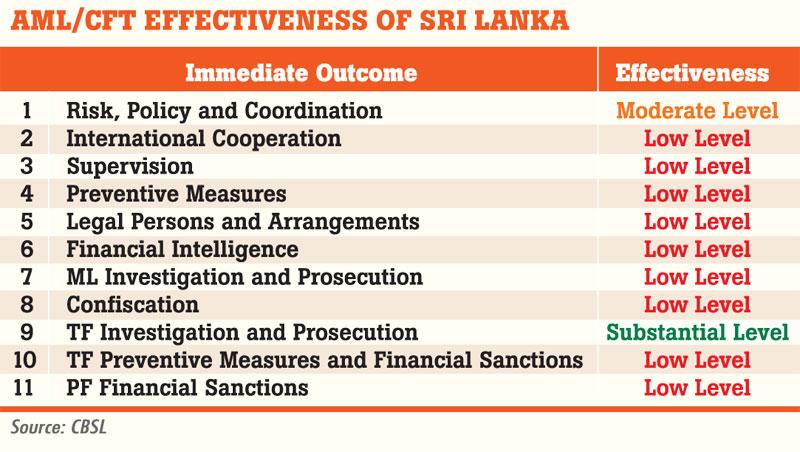

To not fall in that category, Sri Lanka must step up to improve efforts in uplifting the effectiveness of the 11 immediate outcomes set by the FATF, FIU Additional Director Dr. Subhani Keerthiratne said.

According to Dr. Keerthiratne, the FATF does not require its members to take action on countries listed on the ‘grey list’ but only against the blacklisted countries.

However, most countries treat the greylisted countries as of ‘high risk’ and blacklist them. An example of this is subsequent to Sri Lanka’s second greylisting, the Europe Union (EU) included Sri Lanka on its blacklist.

The repercussion of the blacklisting was that several banks in the EU region stopped dealing with Sri Lankan customers and institutions. ‘Handelsbanken’ in Sweden stopped all payments to Sri Lanka, both for individual and corporate customers and Sri Lankan exporters (IT exporters, tourism sector) faced difficulties in getting back their export proceeds.

Some of the negative impacts of the FATF include Sri Lankan corporations, individuals and financial institutions, being subject to extra scrutiny or EDD, foreign investors raising concerns for real estate sector investments, having to deal with higher cost of borrowing– increased interest rates due to additional risk premia, potential downgrading by global credit agencies and doing business indicators, low investor confidence, resulting in declining foreign inflows/possible repatriation of FDIs, reluctance of Sri Lankan business community to engage in import/export trade and concerns of the gem and jewellery sector on the international image for the industry and outlook of Sri Lanka.

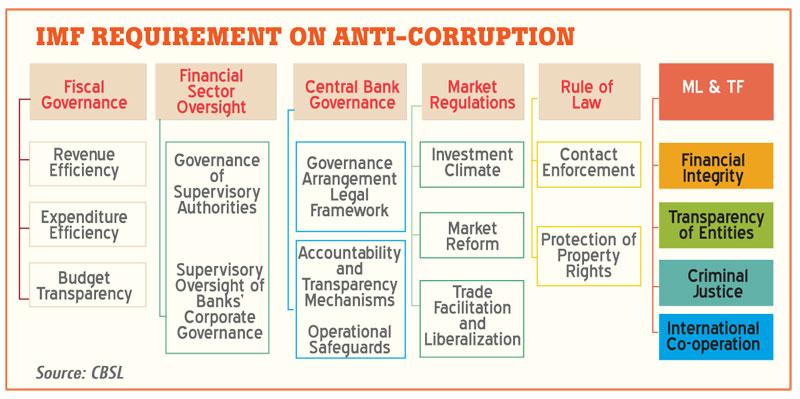

The International Monetary Fund (IMF) External Fund Facility programme also emphasises the need for Sri Lanka to address bribery and corruption and fulfil certain obligations under the AML/CFT pillar.

The IMF has expressed some concerns about Sri Lanka in this regard. Such include inadequate resources and skills present ongoing barriers to an effective AML/CFT regime and lack of successful corruption-related money laundering investigations, prosecutions and convictions, which could help deter and mitigate the laundering of the proceeds of corruption.

The absence of clear strategy and technical coordination mechanisms to pursue money laundering investigation in parallel with corruption investigation was also stressed. When measured against international standards, substantial gaps exist in the current legal framework of Sri Lanka concerning the identification, recovery and return of proceeds of crime.

Further, the low level of successful asset recovery and return relating to corruption reflects the low level of parallel investigations, the existence of complex court processes and lack of technical expertise.

While Sri Lanka does not have well-articulated national strategies and policy objectives for pursuing the proceeds of crime about corruption, it has yet to address the deficiencies relating to transparency of beneficial ownership of legal persons in its legal framework.

Moreover, it has been acknowledged that the lack of effective domestic cooperation on corruption-related issues between competent authorities and law enforcement agencies hampered sound understanding of risks to better inform AML/CFT strategies.

23 Nov 2024 14 minute ago

23 Nov 2024 1 hours ago

23 Nov 2024 2 hours ago

23 Nov 2024 3 hours ago

23 Nov 2024 23 Nov 2024