12 Sep 2022 - {{hitsCtrl.values.hits}}

Amid various efforts by the authorities to increase worker remittance inflows into Sri Lanka’s dollar-starving economy, such incomes rose in the month of August compared to July, though still down from 12 months ago.

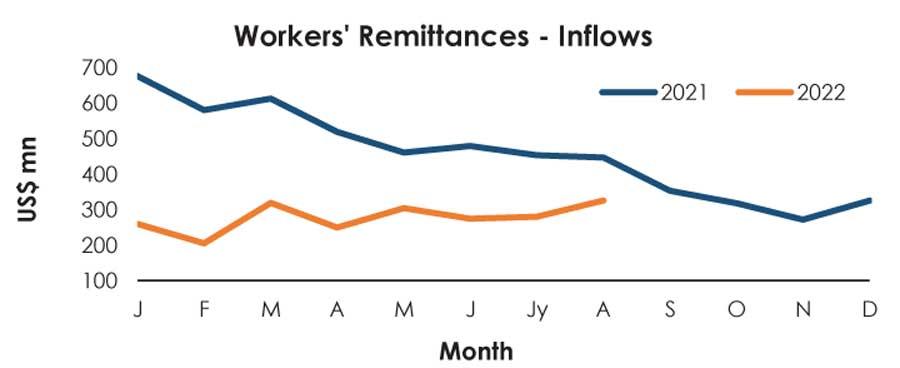

Worker remittance income in August rose to US$ 325.4 million from US$ 279.5 million in July, but is still down from US$ 446.6 million recorded for August 2021.

The cumulative remittance income for the January-August 2022 period was US$ 2.21 billion, down 47.6 percent from a year ago.

At the last monetary policy press conference, Central Bank Governor Dr. Nandalal Weerasinghe said banks had overstated worker remittance income figures for years due to lapses in classifying such inflows from other remittance categories.

“There had been errors in classifying inward worker remittances by the banking sector in the past. Banks in some instances classified all remittance inflows as worker remittances. Export proceeds also come into banks as remittances, and if they fail to identify them, then it leads to a bloating of actual worker remittance figures. This had been the case in the past years,” he said.

Hence, he identified the current worker remittance figures as actual funds remitted by Sri Lanka’s migrant workers as opposed to the average US$ 550 million worker remittance inflows reported per month prior to 2021.

He said the Central Bank came to learn that several reporting errors in classifying worker remittance inflows when it ordered banks to convert 50 percent of worker remittance inflows into rupees last year.

The Central Bank is currently in the process of rectifying these reporting glitches of the banking sector under a new system, he stressed.

Meanwhile, the authorities recently introduced a host of additional benefits to migrant workers who use official banking channels to repatriate their moneys, including increased duty-free allowances and permits to import electric vehicles.

A dedicated entrance called “Hope Gate” was also declared open recently at the Bandaranaike International Airport (BIA) for migrant workers.

Due to the economic hardships faced at presebt, a record number of Sri Lankans—both professionals and unskilled labour—are seeking employment overseas. The government is also encouraging those in the public sector to take up foreign employment by way of an extended period of no-pay leave in a bid to reduce the number of employees in the bloated government sector and also to increase dollar inflows to the country.

At the same time, the Central Bank and the law enforcement authorities have taken measures to crackdown on informal channels such as undiyal and hawala to boost the remittance income via official channels.

Analysts also pointed out that by bridging the trust deficit between the country’s political class and the people, including the migrant workers, remittance income to the island nation could be further increased.

Social media posts by some migrant workers reflect their reluctance to send moneys to Sri Lanka because of the widely-perceived corruption of the country’s ruling class.

07 Nov 2024 9 minute ago

07 Nov 2024 1 hours ago

07 Nov 2024 1 hours ago

07 Nov 2024 3 hours ago

07 Nov 2024 3 hours ago