01 Dec 2020 - {{hitsCtrl.values.hits}}

Moody’s Investors Service, in a report issued on the emerging market banks and insurance companies said yesterday that Sri Lankan banks would experience large capital declines without new capital injections over the next two years, due to asset quality concerns, lower profitability due to muted credit growth and thin margins.

“Capital will moderately fall in emerging Asia over the next two years and banks in India and Sri Lanka will post larger capital declines without public or private injections,” Moody’s said.

However, Lankan banks have never shied away from raising capital when it is required and at the moment are not facing much difficulties to raise such funds, either equity or debt.

Also, except for one or two small banks, majority of the banks currently posses adequate capital for them to be comfortably above the regulatory minimums.

In fact, a closer look at the capital profiles of the banks shows that they have improved, as loan growth has moderated and profits have grown higher or remain stable.

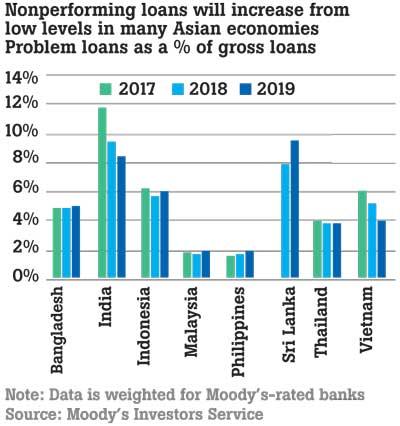

The most recent data available up to end-October showed that the gross non-performing loans ratio of the banking sector has improved to 5.2 percent, from 5.4 percent in August.

Even state lending giants such as Bank of Ceylon (BOC) and National Savings Banks (NSB), which are largely considered as lightweight on capital or non-compliers, are seen raising capital to bolster their capital buffers.

“The uncertain trajectory of asset quality is among the biggest risks for banks as operating conditions remain fragile amid ongoing health concerns. Provisions surged at the outset of the pandemic and 2021 will be a crucial year to determine if more reserves are needed as asset risk crystallises,” Moody’s said referring to banks in Asia, Latin America, Europe, the Middle East and Africa.

While Sri Lankan banks are not out of woods from the pandemic-triggered economic shocks, they have largely remained unharmed due to the proactive regulatory actions and their own internal risk management processes.

Moody’s in April extended a negative outlook on Sri Lanka’s banking sector covering the next 12 to 18 months, saying that the coronavirus-induced economic pain would weaken the operating environment for Sri Lankan banks, dampening the demand for loans and triggering widespread defaults in 2020.

Moody’s in September slashed Sri Lanka’s sovereign rating by two notches to Caa1, from B2, citing elevated debt repayment risks, higher budget deficits, slow reforms and weak institutions.

19 Nov 2024 47 minute ago

19 Nov 2024 1 hours ago

19 Nov 2024 2 hours ago

19 Nov 2024 2 hours ago

19 Nov 2024 2 hours ago