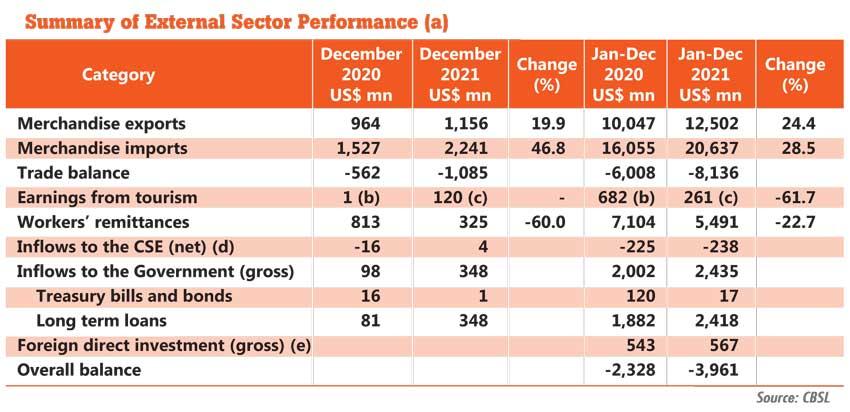

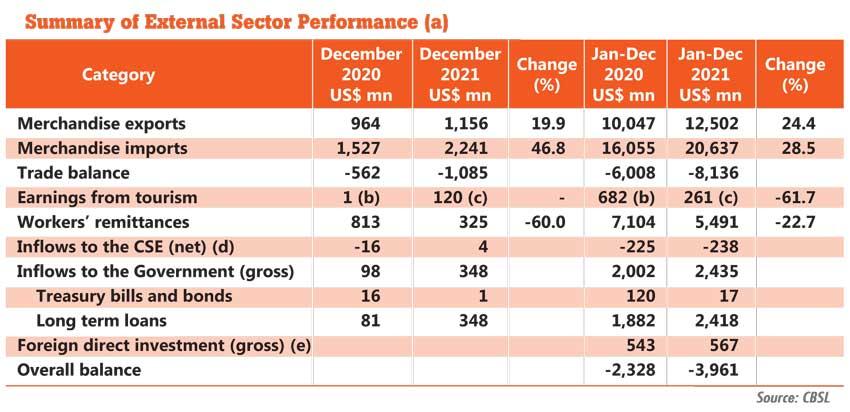

- Higher import expenditure and loss of tourism and remittance incomes main reasons

- Some economists cite money printing as key reason; BOP deficit in 2020 was US$ 2.3bn

- FDI up to September 2021 woefully low at US$ 567mn

Sri Lanka has reported a record balance of payment (BOP) of US$ 3, 961 million for 2021, nearly doubling from US$ 2, 328 million in 2020, as the country’s merchandise import bill surged to a three-year high while it lost key tourism and remittance

income due to the pandemic.

The record BoP was both a cause and an effect of the current foreign exchange troubles experienced by the Sri Lankan economy, which have spiraled out of control into multiple areas such as power and energy and other commodities shortages impacting daily

lives of everybody.

While some economists attribute the record-high BoP deficit and the worst-ever economic crisis to excessive money printing by the Central Bank for nearly three years, Sri Lanka would have been forced to a government shutdown if not for the continuous liquidity support.

The critics of Central Bank liquidity have failed to appreciate how the government was able to fund its virus containment efforts, several rounds of cash transfers to those who lost livelihoods during lockdowns, salaries to public sector and pensions to retirees with printed money.

“While any policy has its excesses, we must appreciate what it (money printing) did during the most trying times to keep the government running,” said one economic analyst.

“Money printing in itself isn’t evil or inflationary as long as you know when to slow down and when to pull back. Also the authorities should make sure the printed money goes to areas where you improve productive capacity. But in Sri Lanka, none of that happened. Policymakers didn’t understand the limits,”he pointed out.

Sri Lanka’s economic problems, stemming from excessive foreign debt mainly lies with the current account of the BoP, and that’s the amount of annual borrowings the country has made over the years, the data show.

Borrowings, either in dollars or rupee are not evil as long as they generate a return sufficient to service the debt and close the gap in the external current account.

But, it did not happen in Sri Lanka and that’s why the country is in this mess,”

he added.

Meanwhile, fiscal data available through September 2021 showed that Sri Lanka has managed to only receive foreign direct investments of US$ 567 million, compared to US$ 543 million in the same period in 2020.

At a minimum, Sri Lanka needs to have 5 percent of its gross domestic product (GDP), which works out to US$ 4-4.5 billion as direct investments per annum.