02 Oct 2021 - {{hitsCtrl.values.hits}}

Ajith Nivard Cabraal

Pic by Pradeep Pathirana

By Nishel Fernando

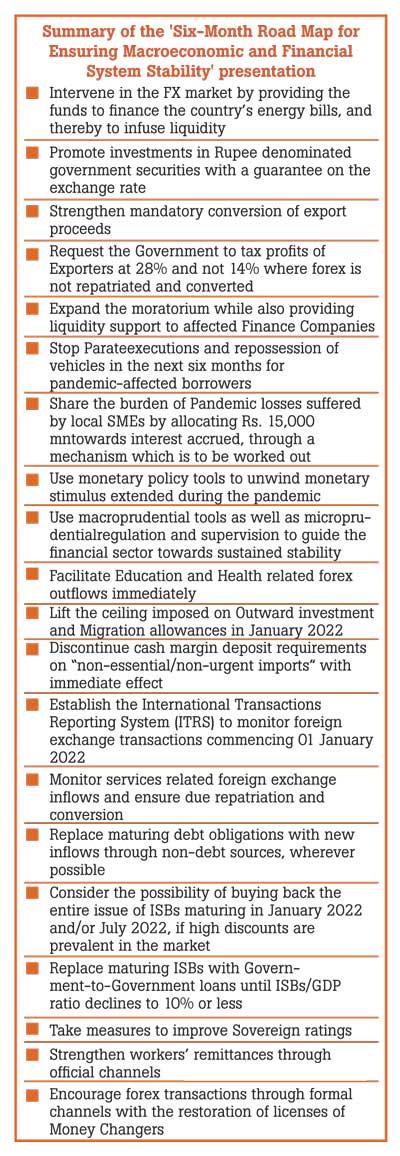

Amid a foreign exchange and a looming external debt crisis, Central Bank Governor Ajith Nivard Cabraal yesterday unveiled the much-awaited ‘The Six-Month Road Map for Ensuring Macroeconomic and Financial System Stability’, with an aim to usher in greater stability to the economy, backed by stable prices and sound macroeconomic fundamentals.

“The framework that we will outline today is a to-do list that will help Sri Lanka to reset its course to face the challenges in the next six months and thereafter. These are not ad hoc measures but carefully thought-out measures,” Cabraal said presenting the six-month road map yesterday morning.

“The framework that we will outline today is a to-do list that will help Sri Lanka to reset its course to face the challenges in the next six months and thereafter. These are not ad hoc measures but carefully thought-out measures,” Cabraal said presenting the six-month road map yesterday morning.

The road map mainly focuses on addressing the more urgent and critical issues in the spheres of debt and foreign exchange, financial sector, macroeconomy, prices and financial system stability.

It plans to respond to these challenges collectively, with the contribution of all key stakeholders.

“This new effort will require coordinated efforts of all stakeholders of the external sector, with vital but moderate contributions from each stakeholder. A single sector would not be overly burdened but all will need to contribute,” he said.

Delivering his road map presentation, Cabraal announced that the CB would lift the 100 percent cash margin deposit requirement on non-essential imports imposed early last month, with immediate effect, based on the expected foreign inflows, in order to provide relief to importers and consumers.

Under the road map, the government is tasked with introducing appropriate tax adjustments to promote domestic value addition of exports and ensure conversion of export earnings and discourage forex leakages through online and informal channels.

Meanwhile, industrialists and property developers were urged to avoid speculative purchases of imported inputs for domestic production and to explore new opportunities through investment in production for the domestic and export markets.

In addition, the CB is expected to issue further instructions to exporters to convert export proceeds that had accumulated since 2020 onwards, on a staggered basis in the next six months and to gradually ease its purchases of government securities.

In order to address the recurring concerns in the financial sector, measures such as expeditious consolidation of the non-bank financial sector, dealing with the six failed finance companies with a comprehensive plan, strengthening and safeguarding the integrity of the financial system via improved payments and settlements platform and reducing reliance of state-owned business enterprises (SOBEs) to meet their funding needs from state banks, were proposed.

The road map also backs the unwinding of the current moratoria on loans gradually and devising long-term plans to support businesses affected by the pandemic-related lockdowns.

Further, the government is expected to provide liquidity support of up to Rs.15 billion to finance interest accrued in loans under moratoria in order for the financial institutes to deal with the effects in a sustainable manner.

In addressing the country’s macroeconomic stability concerns, the road map recommends the government to introduce an ‘investor-friendly’ budget with a tax structure designed for easy compliance and a budget that contains the fiscal deficit in a sustainable manner, with nationalisation of non-essential expenditure.

“Macroprudential policy tools would be used as necessary to ensure the overall stability of the financial system and to support monetary policy,” Cabraal noted.

By end-March, next year, he expects the country’s foreign exchange reserves to increase over a minimum of four months of imports, with the implementation of this framework, while supporting the economy to grow by 5 percent in 2021 and 6.5 percent in the first quarter of 2022, with stabilised inflation at mid-single digits.

“This is a dynamic plan. We will tweak it, fine-tune it or even change some parts, as we move on,” he said.

24 Nov 2024 2 hours ago

24 Nov 2024 2 hours ago

24 Nov 2024 3 hours ago

24 Nov 2024 8 hours ago

24 Nov 2024 9 hours ago