13 Sep 2022 - {{hitsCtrl.values.hits}}

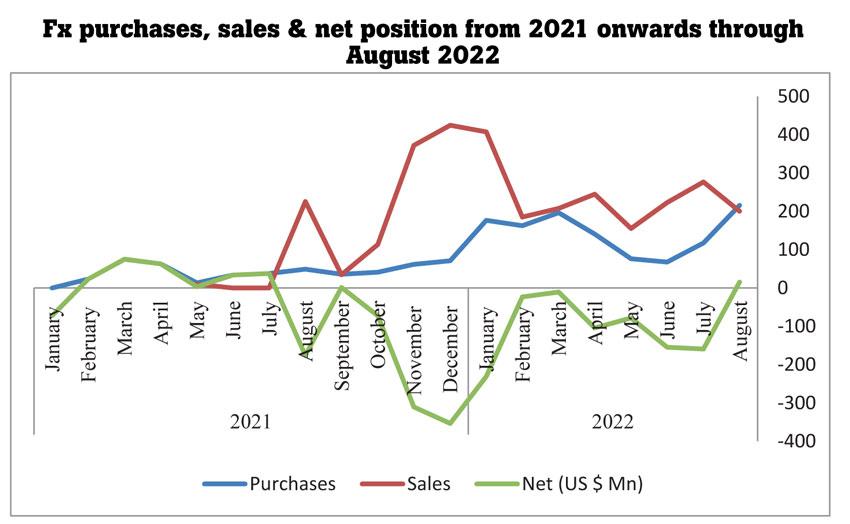

In what appears to be another notable development in the space of external sector advances made as of late, the Central Bank had become a net absorber of foreign exchange after being a net seller for eleven consecutive months since the country started facing foreign exchange shortages since the back half of last year.

According to the data available through August, the Central Bank managed to purchase US $ 215.61 million from the domestic foreign exchange market and the sales amounted to US $ 200.59 million in the same month, resulting in net absorptions of US $ 15.02 million.

Typically, net purchases of foreign exchange enhance foreign exchange reserves but the August reserves showed some slippage from what was there in July. An International Monetary Fund-backed rescue package typically requires rebuilding of foreign reserves out of non-borrowed money, which comes from net forex purchases.

The August foreign currency reserves slid by US $ 100 million to US $ 1,716 million from US $ 1,817 million in July, although the usable cash remained just a paltry of it. A US $ 1.5 billion equivalent Yuan swap with China, which cannot be used for foreign currency-related payments, remains just a nominal figure in the foreign currency reserves.

The last time the Central Bank became a net absorber of foreign currency from the domestic market was back in September 2021 when it managed to purchase just US $ 1.18 million more than what it sold.

However, it was only a temporary blip as the Central Bank effectively ended its months-long reserve collection streak through foreign currency collection in July that year, about the same time the country began facing foreign exchange shortages after it settled US $ 1.0 billion worth of sovereign bonds.

Since then things went awry every month as inflows from tourism and remittances fizzled out both due to the pandemic and the re-emergence of grey market channels while the outflows by way of the imports continued to remain high, both due to the rising global energy and other commodities prices and the relatively higher domestic consumption and investment drive. The promised billions of dollars of inflows from bi-lateral partners mentioned in the Central Bank’s 6-month road map never came to fruition, resulting in the total exhaustion of the remaining reserves which brought the economy to a crashing halt in March.

23 Nov 2024 8 hours ago

23 Nov 2024 8 hours ago

23 Nov 2024 23 Nov 2024

23 Nov 2024 23 Nov 2024

23 Nov 2024 23 Nov 2024