31 Dec 2022 - {{hitsCtrl.values.hits}}

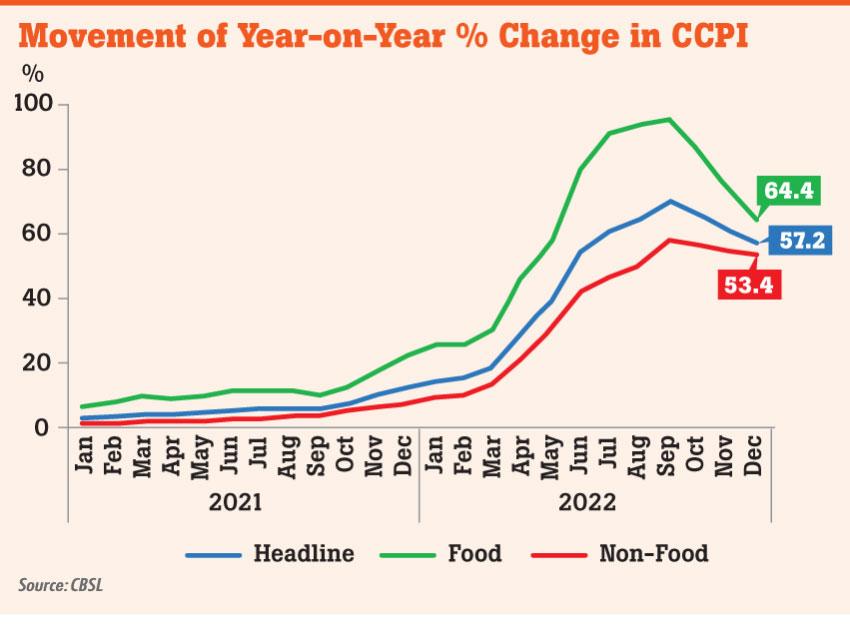

Colombo inflation, measured on an annual basis, eased for the third consecutive month in December, continuing the disinflation path envisaged by the Central Bank after the consumer prices peaked in September.

However, the monthly prices rose, as Sri Lankans are getting ready to welcome 2023 while still carrying heavier price pressures on their shoulders.

The consumer prices, measured by the Colombo Consumer Price Index, expanded to 57.2 percent in December from a year ago. In November, the index was 61 percent, as both the food and non-food prices continued to come off their peaks on an annual basis.

The prices measured on a monthly basis, which offer better visibility over the short-term inflation trajectory, rose by 0.2 percent in December, reversing the 0.5 percent decrease seen between October and November.

This could perhaps be attributed to the year-end festive activities, which typically put some upward pressure on consumer goods, as the supply cannot keep up with the elevated demand.

However, it is noted that more than two-thirds of the country’s population is feeling severe economic hardships, as they are battling runaway prices amid loss of income. The economy crashing early this year sent the prices of everything, from essential to discretionary, to hyperinflationary levels, after throwing millions out of their livelihoods.

As a result, a large majority of the households are practicing some form of coping mechanism, such as trimming food consumption and selling assets to make ends meet, multiple surveys done by international and local institutions revealed.

The food inflation in December recorded a 64.4 percent increase, measured on an annual basis, decelerating from 73.7 percent in November, reflecting the exponential price pressures the Sri Lankans face on a day-to-day basis.

Although the official food prices came off from their 95 percent peak in September, people are still receiving a payment shock at the supermarket or their local grocery store, when they arrive at the checkout counter. The monthly food prices declined 0.3 percent in December, at a slower pace than the 1.5 percent decline in November over the October prices.

What appears to be mostly sticky are the non-food prices, as such prices came off only a little to 53.4 percent in the 12 months to December, from 54.5 percent through November.

The monthly prices increased 0.6 percent in December, from the November prices, which remained unchanged over the October levels.

These price pressures were mainly coming from consumer discretionary such as clothing and footwear during the month, as their prices have risen manyfold after the rupee’s dramatic collapse from 200 to a dollar to 360 to a dollar, doubling their sticker prices on the exchange rate impact alone.

The transport sector continued to put pressure on consumer pocketbooks while the utility prices increased after the L.P. price was raised.

What could turn around the non-food prices was the nearly finalised shock electricity tariff hike slated for January and the water tariff hike, which the authorities are mulling over.

Meanwhile, the so-called core prices, measured stripping out the often-volatile food, energy and transport prices, rose by 47.7 percent in December, from 49.4 percent in November, reflecting still underlying price pressures that engulfed the economy.

While the prices have continued to trend downwards in the three months, the potential inflation risks are emerging from the possible increase in global energy and other commodities prices.

China’s reopening as the world’s second largest economy could put enormous pressure on the world’s resources, after three years of sub-optimal growth, resulting from virus-related restrictions.

On the other hand, China’s reopening is also raising concerns around the world of a possible virus outbreak again in other parts of the world, which could again put upward pressure on the prices, if they decided to reimpose restrictions, straining the supply chains.

Meanwhile, in the home economy, a further delay in unlocking the bailout package with the International Monetary Fund could put a strain on the prices, as the country would continue to grapple with the shortages of imported products, due to the prolonging dollar crunch and devalued rupee.

23 Nov 2024 2 hours ago

23 Nov 2024 3 hours ago

23 Nov 2024 4 hours ago

23 Nov 2024 5 hours ago

23 Nov 2024 7 hours ago