01 Jan 2021 - {{hitsCtrl.values.hits}}

The Sri Lankan stock market ended 2020 on a positive note yesterday, marking a year in which the Colombo Stock Exchange (CSE) has seen indices indicate noteworthy resilience and attract record-breaking levels of trading activity.

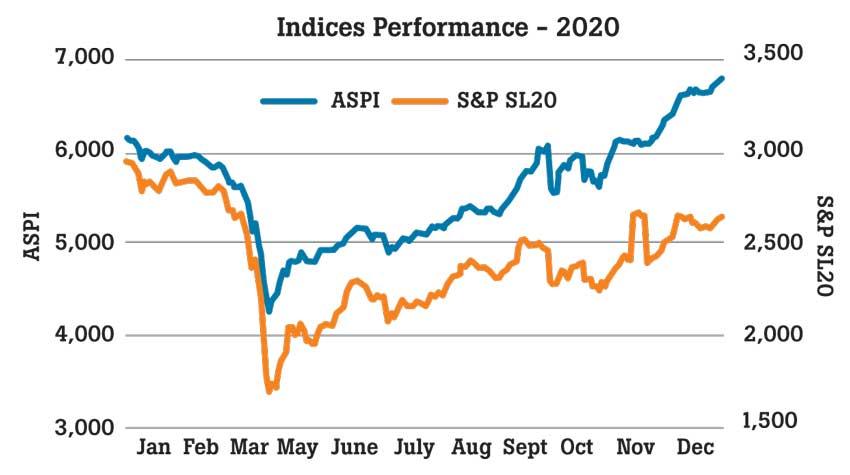

The benchmark All share Price Index (ASPI) closed 2020 recording a growth of 10.5 percent, the highest annual increase the index has seen since 2014 and only the 12th occasion the index has seen a double-digit percentage growth in the CSE’s 35-year history. The ASPI ended 2020 on 6774.22 points.

|

Dumith Fernando |

The ASPI was also recorded as the best-performing stock market index for the month of September 2020, with the index recording a remarkable 12 percent growth during the month.

The ASPI on May 12, 2020 recorded its lowest point in over a decade but recovered from this to post a 59 percent gain by the end of the year. Although the S&P SL20 index, which features the CSE’s 20 largest and most liquid stocks, has declined by 10.1 percent in 2020, the index has recovered substantially, indicating a trend similar to the ASPI, with 57 percent growth since May 12, closing at 2638.10 points, as of December 31, 2020.

The overall value of the stock market, which is represented by the market capitalisation, has also improved, adding Rs.109 billion during 2020 and more substantially by Rs.983 billion since May 12.

The market recorded a daily average turnover of Rs.1.9 billion and this daily average turnover is the highest recorded for a year since 2011. The total turnover for the year was Rs.397 billion, which was also the highest since 2011.

The overall market activity in terms of the average number of trades carried out during a trading day also increased significantly, ending double the average figure recorded in 2019 and triple the figure recorded in 2018. This indicates high investor participation.

Meanwhile, a significant increase in CDS account openings was observed in 2020, with 17,600 new investors entering the market, which is 70 percent higher than the number of new investors in 2019 and 56 percent higher than 2018. The local investors have contributed to approx. 79 percent of the total market turnover in 2020, which is higher when compared to approx. 63 percent in 2019 and 55 percent the year prior to that.

The year 2020 has also seen a greater interest among younger investors in the retail segment, with 46 percent of the total accounts opened being attributed to the 18-30 age group. This marks an interesting development considering the fact that a large portion of retail stock market investors have traditionally been above 50 years of age.

On the foreign investment front, 2020 has recorded a net foreign outflow of Rs.51 billion, largely in line with the foreign fund outflow trend recorded in emerging and frontier markets.

However, it is noteworthy that Sri Lankan equities attracted purchases worth Rs.53 billion during 2020 by foreign investors, ending close to the Rs.56 billion figure recorded in 2019. The stock market at present continues to indicate attractive valuations relative to the other markets in the region.

Meanwhile, the CSE also introduced a number of progressive growth measures during the year to enhance operational efficiencies and the attractiveness of the Sri Lankan stock market in the perspective of both investors and issuers.

The digitalisation drive of the Sri Lankan stock market, which was implemented in 2020, has enabled end-to-end connectivity electronically at all stakeholder touchpoints and was implemented as an industry-wide exercise, bringing substantial convince to investors and operational efficiencies to stakeholders.

During the year, the CSE also expanded the eligibility criteria for initial listing of shares on the Main Board and Diri Savi Board, to enable a wider spectrum of companies to qualify for a listing. Rule revisions, which were also carried out during the year, brought about changes to the IPO timelines and the basis of allotting shares, which were done to complement Sri Lanka’s rapidly developing commercial landscape comprising multiple business models and segments. The revisions were directed at improving the efficiency of the listing process while offering greater flexibility to companies listing

on the CSE.

Commenting on the key developments to be expected in 2021, CSE Chairman Dumith Fernando said, “In 2021, major market infrastructure developments, product diversification, widening of the investor base, building a sustainable business model and more importantly, working with the government and the regulator to position the CSE as a pivotal point for capital raising, are all on the cards. Increasing the number of companies listed on the exchange is one of the CSE’s key strategic objectives and we are making steady progress on this front. We look forward to enhancing the listing process and establishing a single window within the CSE for potential listings that would make a public listing on the exchange a smooth and efficient process.”

Fernando went onto say, “Similar to the Real Estate Investment Trusts frame work, which was introduced in the final quarter of 2020, we are working on the creation of an OTC market for REPOs on corporate debt, trading of gold-backed products and stock borrowing and lending. On the regulatory and governance fronts, we believe the new SEC Act will be an important development covering the regulatory changes required for continuing to safeguard the investor rights, enabling the demutualisation of the CSE, facilitating new product development and strengthening the effectiveness of market regulation and of course, we see many of the value drivers, which have supported strong market performance since May, continuing into the new year. Thus, we are entering 2021 on a hopeful but positive note.”

19 Nov 2024 7 hours ago

19 Nov 2024 8 hours ago

19 Nov 2024 19 Nov 2024

19 Nov 2024 19 Nov 2024

19 Nov 2024 19 Nov 2024