12 Jun 2024 - {{hitsCtrl.values.hits}}

Top 5 gainers in 1Q24

- Commercial Bank

- John Keells Holdings

- Hatton National Bank

- Ceylon Tobacco Company

- LOLC Finance

Top 5 losers in 1Q24

- LOLC

- Brown & Company

- Browns Investments

- Palm Garden Hotels

- Eden Hotel Lanka

Corporate earnings of Sri Lanka’s public quoted companies showed mix results in the first quarter of this year (1Q24).

The corporate earnings of listed entities rose by 65 percent Year-on-Year (YoY) to Rs.124.3 billion in the quarter (Based on earnings filed as at 31st May 2024). However, corporate earnings were down by 32 percent on quarter-on basis.

This also marked the lowest quarterly earnings recorded since the third quarter of 2022.

Meanwhile, the listed entities reported 21 percent Year-on-Year (YoY) increase in revenue reaching Rs.1.64 trillion. This was mainly driven by the food, beverage and tobacco sector, and was a recent high, touching pre-crisis levels.

In the previous quarter (4Q2023), corporate earnings were propped up by Rs.47 billion non-recurring income of LOLC and LOFC, which put diversified financial sector in the first place. However, the banking sector took the first spot in 1Q2023.

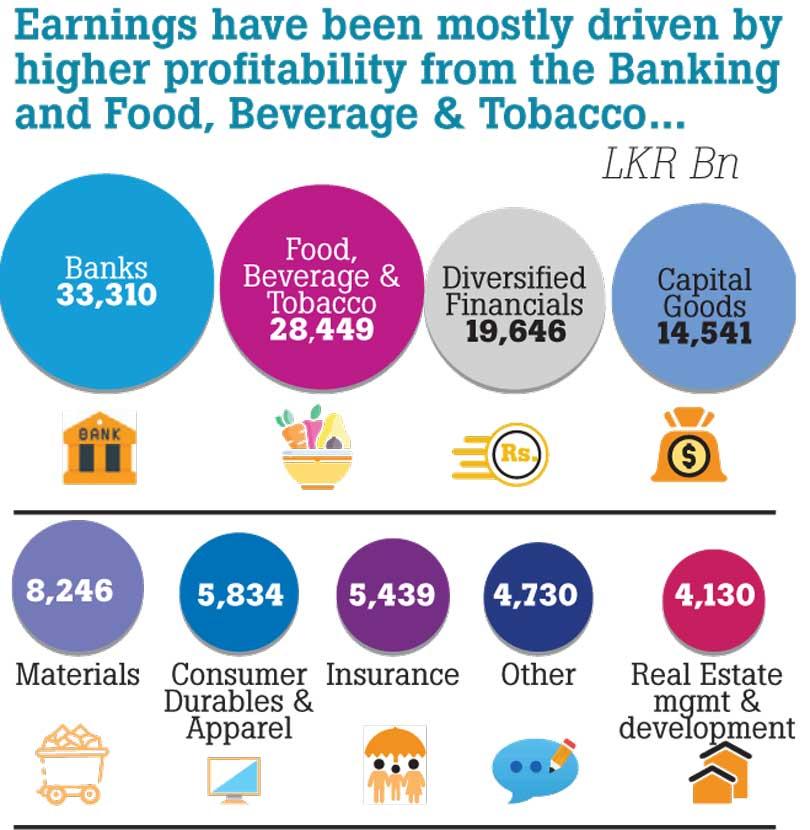

“Earnings have been mostly driven by higher profitability from the Banking and Food, Beverage & Tobacco,” CAL said.

The Banking sector reported Rs.33.3 billion in quarterly earnings followed by Food, beverage and tobacco sector with Rs.28.45 billion and diversified financial sector with Rs.19.65 billion.

Commercial Bank, John Keells Holdings (JKH), Hatton National Bank (HNB) Ceylon Tobacco Company (CTC) and LOLC Finance (LOLF) were the top five gainers of the quarter. Meanwhile, LOLC and its units including Brown & Company, Browns Investments, Palm Garden Hotels, and Eden Hotel Lanka were among the top five losers in the quarter. (NF)

22 Nov 2024 1 hours ago

22 Nov 2024 1 hours ago

22 Nov 2024 2 hours ago

22 Nov 2024 3 hours ago

22 Nov 2024 4 hours ago