16 Feb 2021 - {{hitsCtrl.values.hits}}

The rapid transition of banks and their customers on to digital platforms from the conventional brick-and-mortar banking helped the former the most, as such shift saved billions of rupees in near-term costs alone but questions linger to what extent such cost savings were passed on to the customers.

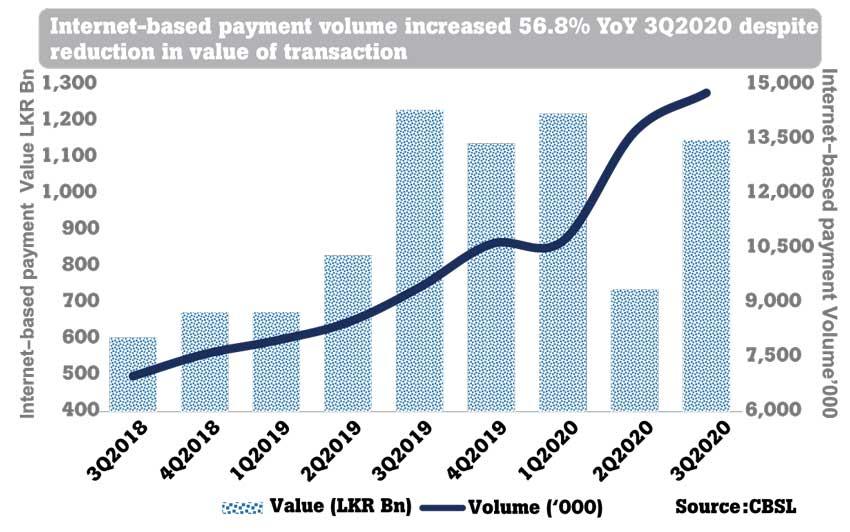

According to the data parsed by First Capital Research (FCR) through the third quarter of 2020, Internet-based payment volumes surged by 56.8 percent in July-September, compared to the same quarter in 2019, albeit with some reduction in the transaction volumes in rupee terms.

COVID-19 upended how banks operated and brought in at least three to five years of digital advancement into a single year in 2020. “COVID-19 shapes up banking mega-trends with digitalisation taking centre stage, while the digitalisation drive saved the banks to get through COVID-19 lockdowns, building long-term residence and using technology for strategic cost transformation,” FCR said in its latest report on the country’s banking sector.

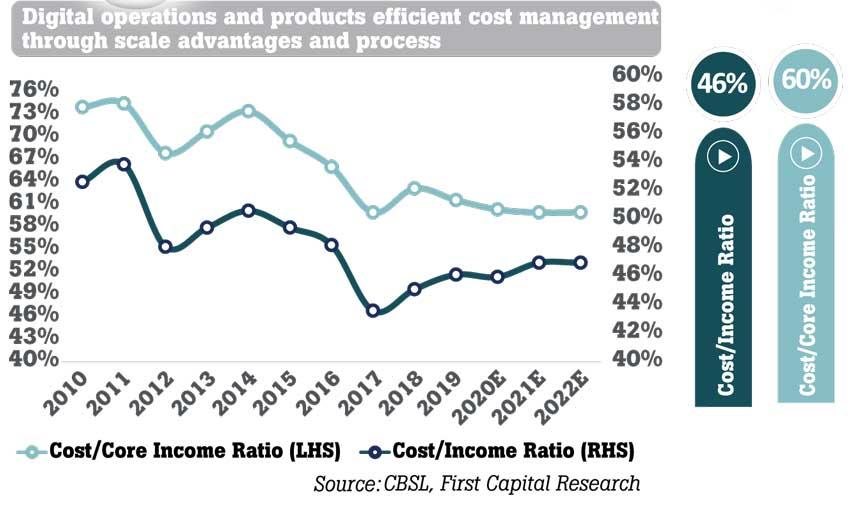

This pushed down the banks’ cost base significantly, as seen from their cost-to-income ratio. This is amid the incomes of banks coming under pressure from the anaemic loan growth and the massive build-up of deposits during 2020.

Hence, the decline in the cost-to-income ratio becomes much more pronounced when the incomes started rising in the banks as expected from 2021.

This is because much of the IT infrastructure has already been laid and it is just a matter of on-boarding more customers to reach scale.

However, it is yet to be seen whether the banks are passing some of the cost savings to their customers, as they continue to slap various fees and commissions on facilities and other services, which most of the times increase the customer’s transaction cost.

20 Nov 2024 5 minute ago

20 Nov 2024 52 minute ago

20 Nov 2024 2 hours ago

20 Nov 2024 2 hours ago

20 Nov 2024 2 hours ago