30 Oct 2023 - {{hitsCtrl.values.hits}}

Sri Lanka is expected to witness modest growth in the years ahead, but it will have to go the extra mile to not only retain existing investors but harder still, to attract fresh investments in the current inhospitable investment climate, the Institute of Policy Studies (IPS) said.

current inhospitable investment climate, the Institute of Policy Studies (IPS) said.

While an incentive package is currently being considered as a possible policy intervention, the Board of Investment (BOI) finds tax incentives to be an essential component as in most peer countries to attract FDI and develop key industries.

“However, getting the right mix of policies is crucial for its effectiveness. Given the continuing economic crisis, competing with peer countries with an attractive incentive package remains a real challenge in 2023,” the Colombo-based think tank said in its latest State of the Economy 2023 report.

The BOI aims to attract US$ 2 billion in FDI in 2023. The tourism sector remains a key target, whereas other targeted sectors are IT and investments in large projects such as the West Container Terminal in the Colombo Port, the Colombo Port City and the Hambantota Port project.

While some of these investments have been controversial, the IPS noted that in some quarters, FDI fragmentation occurs owing to rising geopolitical tensions as bilateral FDI becomes increasingly concentrated among countries with similar geopolitical views.

Further, the economic crisis, and the country’s sovereign default status can reshape the perception of Sri Lanka as a not particularly attractive destination for foreign investors, the report pointed out.

The IPS noted that aside from the economic meltdown, public protests, strikes and violence would also have kept investors away from Sri Lanka. Stressing that in a highly competitive global environment for FDI, political and policy stability accompanied by a sound macroeconomic setting are key priorities for investors with a wide array of countries to choose from, the report asserted that a country’s business and regulatory environment to facilitate private investments is integral to this landscape.

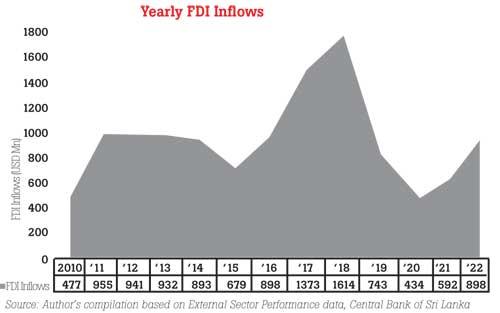

Post-war Sri Lanka saw its FDI inflows peak in 2018, attracting a total volume of US$ 1.6 billion. In 2022, this had dropped to US$ 898 million. Of the total FDI inflows to BOI registered companies, 53.5 percent were invested in infrastructure projects in 2022, while manufacturing and services sector accounted for 33.8 percent and 12.5 percent.

India was the largest source of FDI in 2022 which amounted to US$ 238 million, where the main investments were in petroleum retail, tourism and hotels, manufacturing, real estate, telecommunications, and banking and financial services.

23 Nov 2024 58 minute ago

23 Nov 2024 1 hours ago

23 Nov 2024 2 hours ago

23 Nov 2024 23 Nov 2024

23 Nov 2024 23 Nov 2024