08 Oct 2019 - {{hitsCtrl.values.hits}}

The lending rate caps on banks may not yield the desired effect of stimulating credit demand in the short term, as the root cause of the problem lies not with the rates but with the borrower sentiments and subdued economic activity, said Fitch Ratings.

In a note titled ‘Sri Lanka bank lending rate cap may not support loan growth’, released yesterday, the rating agency said notwithstanding the order to lower the lending rates, the banks might extend less credit to the risky borrowers if they cannot price their loans at least up to their hurdle or the minimum rate of return.

This will in turn further pressure the banks’ earnings, which have already been weakened by the higher credit costs and

effective taxes, Fitch stated.

“Lower lending rates may not be sufficient to spur credit demand to stimulate economic growth, given the nation’s weak borrower sentiment and subdued economic activity,” the agency stated.

It was only recently Mirror Business stated that it was not the rates but the sentiments that hold the pickup in lending, which is anaemic. Economic actors – both consumers and investors – wait for policy and the political certainty from the presidential polls planned for November 16 and a fresh government that be established for clear direction, before committing any substantial purchasing decisions or investments. Despite many attempts to lift lending through rate cuts, cut in statutory reserve ratio and deposit rate caps, which were later rescinded, the banking sector loans had contracted by 0.5 percent by end-June 2019, from December 2018,

the Fitch’s data showed.

A fortnight ago, the Central Bank issued an order for all licensed banks to cut their lending rates by 200 basis points by October 15, from their April 30 levels, except for fixed rate loans, which encompass leases and gold-backed loans to spur credit growth.

Meanwhile, the annual interest on credit cards was also capped at 28 percent.

However, the banks are not required to reduce rates if the rate is currently at or below 12.5 percent.

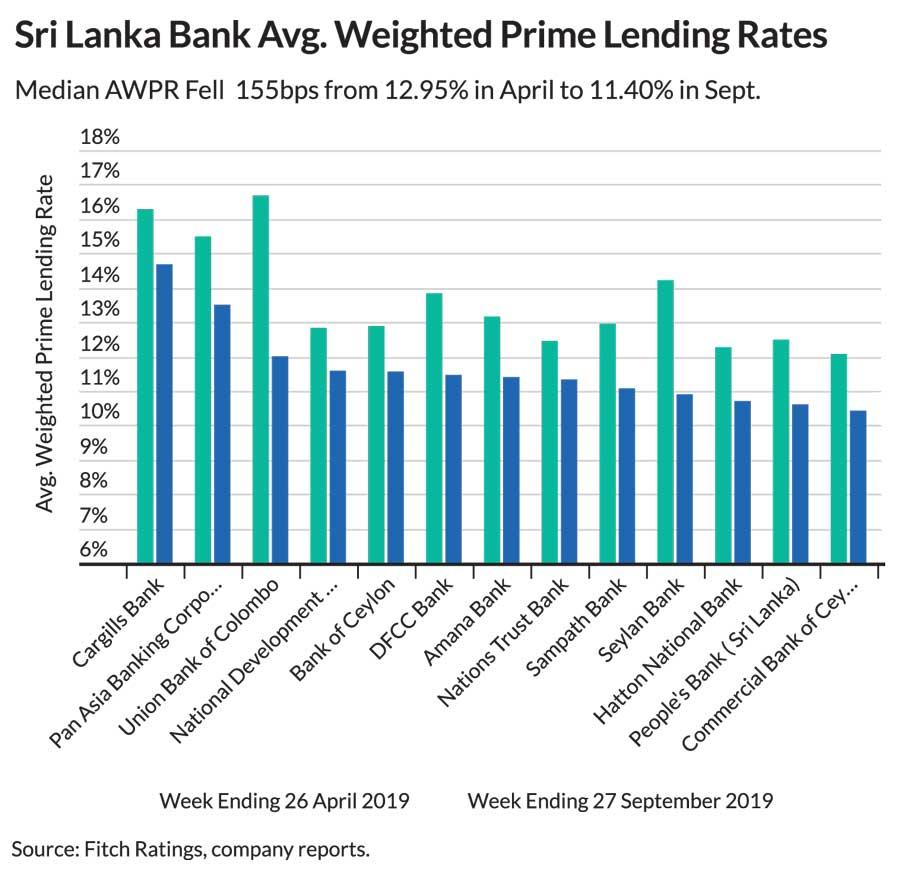

Meanwhile, the banks were also ordered to bring down their average weighted prime lending rate (AWPR) or the average rate at which the banks loan to their prime customers, by 150 basis points by November 1 and 250 basis points by December 27 – both from the levels of April 26.

Fitch stated that already the banks’ AWPR is at least 100 basis points below the April 26 levels.

Pressure on the margins may be limited in the near term from the lending caps, Fitch said, adding that the yield pressure from incremental lending may be partially offset from the lower funding costs, given the progressive repricing of deposits.

“However, the ultimate impact depends on several variables, including the composition of individual bank loan

portfolios,” Fitch added.

Meanwhile, the rating agency is of the belief that the reduction of the penal interest on delinquent loans, which capped at 400 basis points, might not be sufficient to facilitate the reduction in the non-performing loans (NPL) ratio of the industry.

Sri Lanka’s bank NPL ratio continued to climb in 2019 to 4.8 percent at end-June, from 3.4 percent in December 2018.

“Credit risks are likely to linger, reflected in an increase in restructured loans. The reduction in lending rates may help to alleviate pressure on the accretion of NPLs. However, asset quality stresses are expected to remain until economic activity resumes,” Fitch concluded.

25 Nov 2024 1 hours ago

25 Nov 2024 1 hours ago

25 Nov 2024 3 hours ago

25 Nov 2024 4 hours ago

25 Nov 2024 4 hours ago