06 Nov 2024 - {{hitsCtrl.values.hits}}

|

| Krishan Balendra |

Premier blue chip John Keells Holdings (JKH) sustained growth momentum in the second quarter of 2024/25, with strong performances across its core businesses, despite challenges in the leisure sector.

Group revenue rose by 20 percent to Rs.76.96 billion, driven by the bunkering and supermarket segments, among others. Adjusted for pre-opening costs at the Cinnamon Life, EBITDA climbed 8 percent to Rs.9.28 billion.

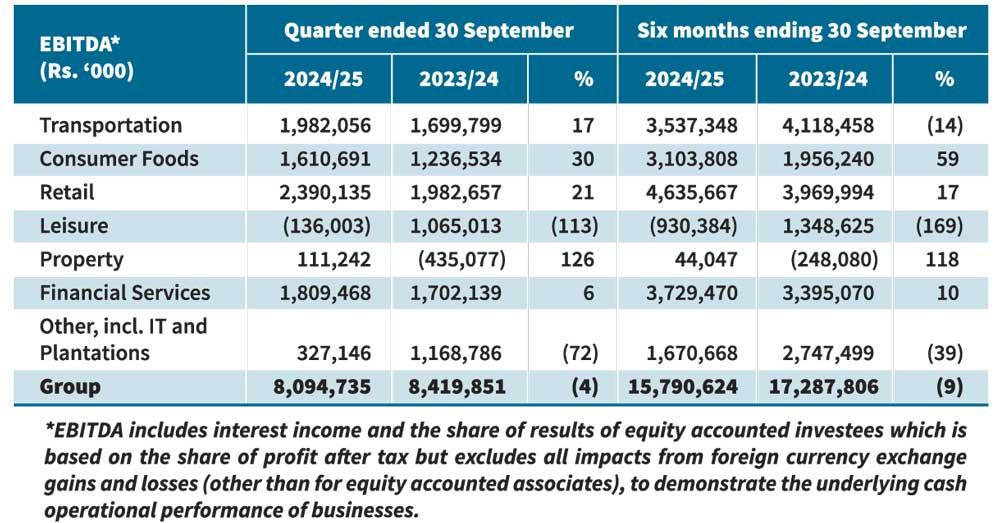

In 2Q25, JKH reported group EBITDA of Rs.8.09 billion, a 4 percent decrease year-on-year, impacted by substantial pre-opening expenses tied to the Cinnamon Life at the City of Dreams Sri Lanka. The 687-room Cinnamon Life hotel, which includes restaurants and banquet facilities, officially opened on 15 October 2024.

Meanwhile, progress on the 113-room Nuwa hotel, gaming operations, and retail mall within the City of Dreams complex remains on track for completion by mid-2025, JKH Chairperson Krishan Balendra said in a commentary that accompanied the interim financial statements for the six months ended 30 September 2024.

Group profit before tax (PBT) increased to Rs.2.27 billion for the quarter, reversing a negative Rs.154 million in the same period last year. This improvement was largely due to lower finance expenses and a non-cash exchange gain of Rs.1.94 billion on the outstanding US$ 213 million term loan at Waterfront Properties (Private) Limited (WPL). Excluding the exchange gain on this loan, group PBT stood at Rs.335 million, an increase compared to 2Q24.

The profit attributable to equity holders of the parent company amounted to Rs.1.37 billion, up from a negative Rs.574 million in the corresponding quarter ofthe previous year.

Across segments, the Transportation industry group delivered increased profitability, boosted by the Ports and shipping business and the bunkering segment. Both the beverages (carbonated soft drinks) and frozen, andconfectionery businesses recorded EBITDA growth, driven by higher margins and increased volumes.

In retail, the supermarket business recorded a strong quarter, with same-store sales rising 14 percent, underpinned by a 12 percent increase in customer footfall.

The property group’s profitability also grew, supported by the sale of residential units at City of Dreams Sri Lanka, real estate transactions in Digana via Rajawella Holdings (Private) Limited, and revenue recognition from the TRI-ZEN residential project.

The Leisure industry group’s performance was dampened by pre-opening expenses at Cinnamon Life, alongside a decline in profitability from Maldivian Resorts due to the translation impact of a stronger rupee compared to the previous year.

Meanwhile, Nations Trust Bank PLC saw robust profitability growth, driven by loan expansion, higher fee income, and lower impairments. Union Assurance PLC reported double-digit growth in gross written premiums, supported by renewal and new business premiums.

Construction on the West Container Terminal (WCT-1) at the Port of Colombo is progressing, with the first batch of quay and yard cranes arriving in September 2024. Commissioning of these facilities is expected in the third quarter of 2024/25, with the terminal’s first phase slated to be operational in the fourth quarter.

As part of its environmental initiatives, JKH reduced its carbon footprint per million rupees of revenue by 11 percent to 0.38 MT, and cut water withdrawals per million rupees of revenue by 26 percent to 6.79 cubic meters, compared to the previous year.

In July 2024, the Company announced a Rights Issue of Ordinary Shares, followed by a Sub-division of Ordinary Shares. The Company raised Rs.24,042,175,200 through the Rights Issue of 150,263,595 new Ordinary Shares at an issue price of Rs.160 per share. The Rights Issue was oversubscribed, and the new Ordinary Shares allotted from the Rights Issue were listed on 22 October 2024.

The Sub-division of Ordinary Shares in the ratio of one (1) existing share post the Rights Issue into ten (10) Ordinary Shares will be completed, with recommencement of the trading of shares on 6 November 2024. Upon the completion of the Sub-division of shares, the total number of shares in the Company will be 16,528,995,520.

25 Dec 2024 9 hours ago

25 Dec 2024 25 Dec 2024

25 Dec 2024 25 Dec 2024