11 Jul 2022 - {{hitsCtrl.values.hits}}

The remittances in June undid even the slightest gains made in May, as the key foreign income earner to the country is continued to be beset by the informal channels, which appear to be still functioning regardless of the actions taken to clamp down on them.

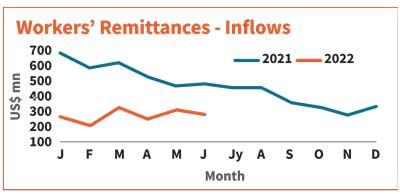

The data showed that Sri Lankan expatriates repatriated only US $ 274.3 million of their earnings in June, falling from US $ 304.1 million they sent in May and sharply down from US $ 478.4 million a year ago when the current descent in the remittance flows set forth in 2021, ending the 13-month streak of gains set off at the beginning of the pandemic.

With June inflows, the cumulative remittance income for the first half of the year was US $ 1,609.9 million, more than 50 percent down from US $ 3,324.4 million received in the same period in 2021. Sri Lanka used to receive up to US $ 600 million in remittances per month via formal banking channels under normal circumstances, making up to an average annual remittance inflow of US $ 7.0 billion,

which together with around US $ 4.2 billion from tourism help the country to offset the trade gap of around US $ 10.0 billion made in the trade account of the balance of payment.

While the tourism trade was decimated during the two years of the pandemic and thereafter by the economic crisis in 2022, the re-emergence of informal channels, which offer a higher premium to that of the formal exchange rate, have drawn many expatriate workers to use such modes since the country started facing foreign exchange shortages a year ago.

The initial uptick seen in the remittance inflows in March when the rupee was free floated fizzled out since April and the subsequent restrictions imposed on open accounts payment terms or consignment account terms brought, expecting to put a damper on the informal market, have done little to nothing to make people use banking channels when they send their money back home.

24 Nov 2024 25 minute ago

23 Nov 2024 23 Nov 2024

23 Nov 2024 23 Nov 2024

23 Nov 2024 23 Nov 2024

23 Nov 2024 23 Nov 2024