02 Aug 2024 - {{hitsCtrl.values.hits}}

Sri Lanka’s deficit in the merchandise trade account continued to soften on a monthly basis as the earnings from exports rose faster than what the country expensed for imported goods in June.

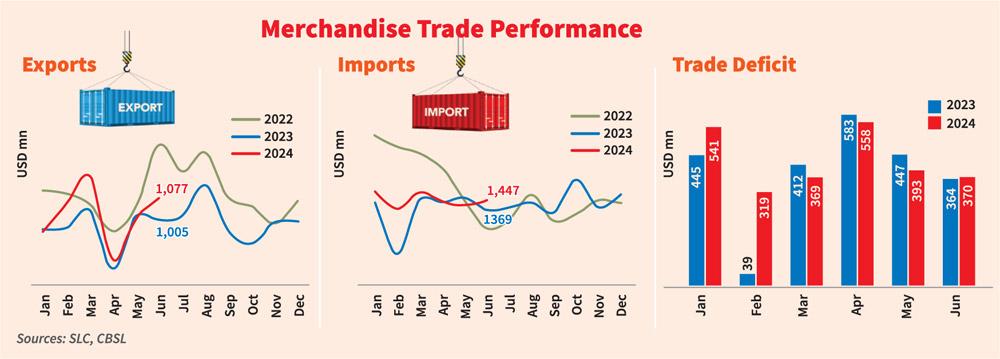

The country sent goods worth US$ 1,077 million in June, brought down goods valued at US$ 1,447.0 million resulting in a deficit in the trade account of the Balance of Payment (BOP) of US$ 370.0 million.

Exports were up 6.5 percent, imports were up 3.0 percent from a month ago resulting in a 5.9 percent lower deficit in the trade account.

In May, the deficit was US$ 393.0 million, which was also down sharply from US$ 558 million in April.

From a year ago levels too, the June exports were up 7.2 percent, imports by 5.7 percent resulting in a 1.7 percent expansion in the deficit.

On a cumulative basis, the deficit in the trade account expanded in the six months to US$ 2,540 million, 11 percent higher from the same period last year.

The high deficit is typical for Sri Lanka, which is largely dependent on imported goods, specially for its energy needs and for many other inputs for other products it manufactures for domestic consumption and exports.

Gradually rising imports bill and hence the deficit are an indication that the economy in the country is returning to normality after runaway inflation, foreign exchange shortage, sharply raised taxes and interest rates that plunged the economy into a deep recession in 2022 and 2023, causing its actors to cut both production and consumption drastically.

Higher deficit isn’t a concern in the short term as long as the country generates sufficient inflows via services exports, other inflows into the current account and the capital account of the Balance of Payment via investments.

Investments and borrowings collected into the capital account of the Balance of Payment must be then used wisely to generate export-oriented industries which can then narrow the gap in the trade account in the medium to long term.

This was something Sri Lanka failed short of doing under successive governments despite the desperate need to do so.

The existing International Monetary Fund programme has made such a process next to impossible due to exponentially higher taxes on all industries.

Meanwhile, the June exports have been led mainly by the export of petroleum products, food and beverage and tobacco, rubber products and tea among others.

Industrial product exports were mainly driven by the increase in volumes of the bunkering and aviation fuel exports.Agricultural exports were pushed by spices, and mainly the higher volumes of pepper followed by tea.

In imports, the June bill was driven by the import of machinery and equipment, textiles and textile articles, chemical products and building materials among others.

Consumer goods imports have declined mainly due to the lower wheat flour and edible oils and medical and pharmaceuticals.

This reflects that the consumption level in the country is yet to reach its pre-crisis levels. Some of the consumer companies cited the same experience through the week.

Meanwhile, the country imported fuel worth of US$ 365.4 million during June, up 26 percent higher from a year ago but the cumulative six months fuel bill still remained down 6.2 percent at US$ 2,209.2 million.

Fuel remains Sri Lanka’s single largest import commodity as the country does not drill oil.

22 Nov 2024 1 hours ago

22 Nov 2024 2 hours ago

22 Nov 2024 3 hours ago

22 Nov 2024 4 hours ago

22 Nov 2024 4 hours ago