21 Jan 2020 - {{hitsCtrl.values.hits}}

For the ninth consecutive year, MTI Consulting (via its Corporate Finance practice), in partnership with Daily FT, Daily Mirror and Sunday Times, has concluded the MTI CEO Business Outlook Study, collectively outlining the Sri Lankan business community’s perception for the state of business in 2020.

Supplemented by MTI’s experience as a thought leadership-oriented organisation, the annual survey collated and analysed the perceptions of over 100 Sri Lankan business leaders with regard to their business’ past and expected performance, their predictions regarding the state of the local and global economy in 2020 and the main challenges that they believe Sri Lanka and Sri Lankan companies will face in 2020.

The results of the survey, including its supplementary analysis, will assist organisations in streamlining their strategic decision-making for 2020, effectively enabling them to gear their operations in accordance with the economic sentiments of their peers.

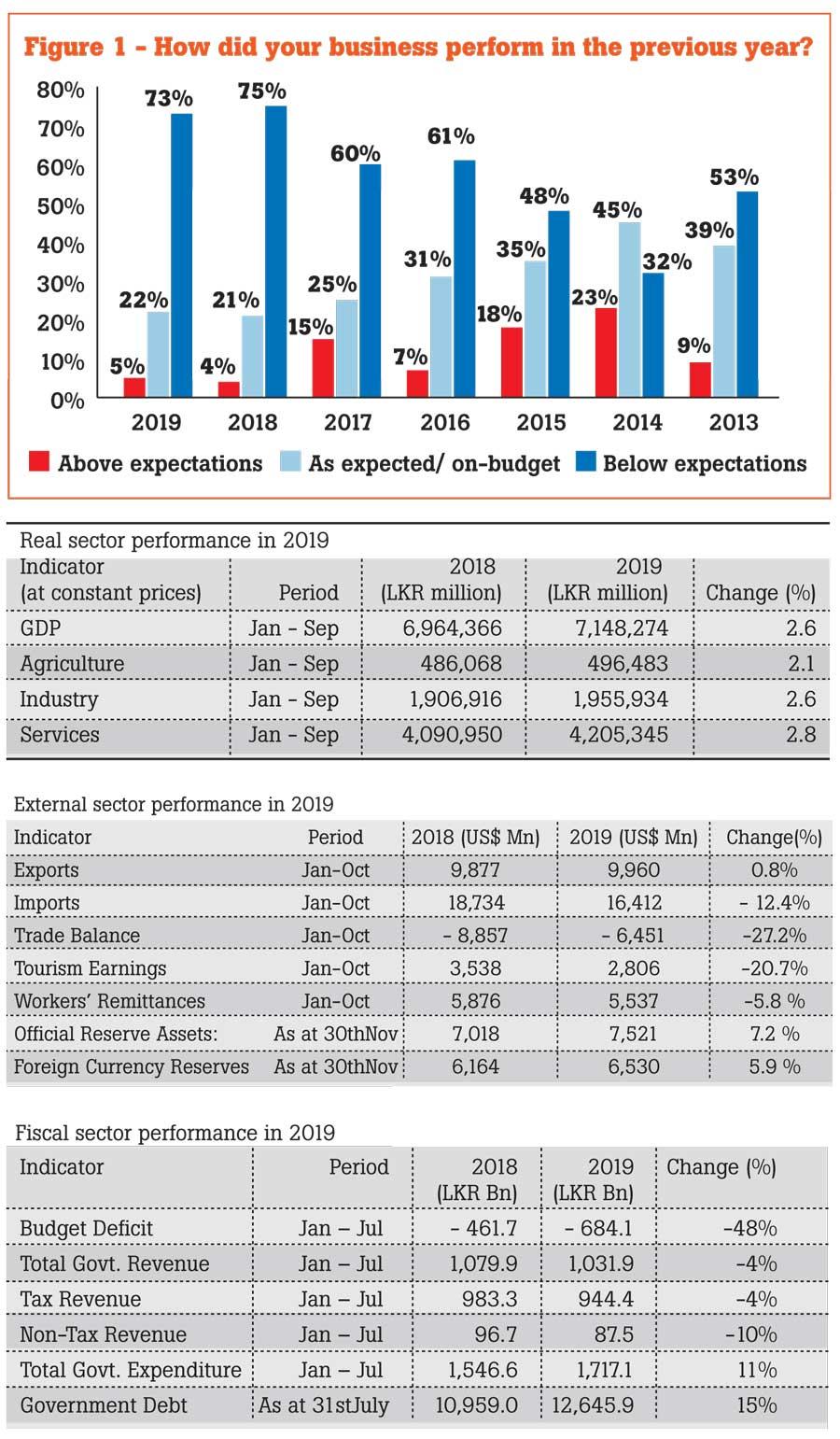

In 2019 businesses performed way below expectations

Nearly three-fourth of the surveyed chief executives were of the opinion that their businesses performed below expectations in 2019.

In contrast, only 5 percent of the surveyed CEOs felt that their businesses performed above expectations, indicating a similar trend as in 2018.

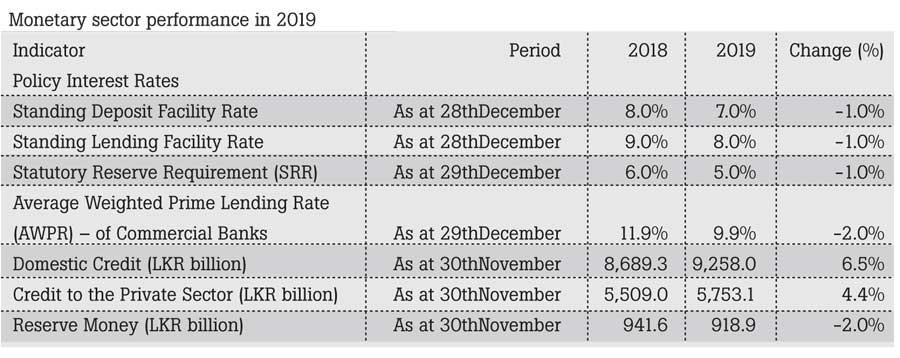

Macroeconomic performance

To supplement the CEO perceptions in 2019, MTI analysed the key macroeconomic indicators of Sri Lanka for 2019.

During January to September of 2019, the Sri Lankan economy recorded a subdued growth of 2.6 percent, compared to the growth rate of 3.3 percent in the corresponding period of 2018. The International Monetary Fund (IMF) expects the real GDP growth of Sri Lanka to rebound to 3.5 percent in 2020, driven by the recovery in the tourism sector.

According to the World Bank, the Sri Lankan economy grew at a rate of 2.7 percent in FY 18/19 (ended June 2019), indicating Sri Lanka as one of the poorest performing countries in the South Asian region. Bangladesh leads the South Asian region in terms of economic growth by posting 8.1 percent GDP growth in FY18/19.

Agriculture, forestry and fishing activities registered a moderate growth of 2.1 percent during 3Q of 2019, compared to the 4.3 percent growth in the same period of the preceding year.

Industrial activities and service activities also showed soft growth rates of 2.6 percent and 2.8 percent during 3Q of 2019, respectively, in comparison to the growth rates of 1.8 percent and 4.4 percent in the same period of 2018.

Growth in industrial activities was primarily driven by the recovery in construction and mining and quarrying activities during the period, while the service sector was largely supported by the expansion in financial services, wholesale and retail trade activities and other personal services activities.

During January to October 2019, a marginal growth of 0.8 percent was recorded in exports attributing to the growth of industrial exports (accounting for 80 percent of total exports), which expanded by 2.3 percent, compared to the same period in 2018. Agriculture (-4.4 percent), mineral (-6.3 percent) and all other export segments (-3.6 percent) recorded negative growth rates during the same period, leading to an overall trade deficit in the same period.

The import expenditure during the first 10 months of 2019 declined by 12.4 percent, largely driven by lower imports of gold (-99.5 percent), personal vehicles (-53.2 percent), rice (-90.1 percent), fuel (-5.6 percent) and transport equipment (-17.8 percent).

Tourism earnings recorded a drop of 20.7 percent, owing to the Easter Sunday attacks, which led to a decline in tourist arrivals. Workers’ remittances improved year-on-year (YoY) in October 2019, although a cumulative decline was recorded.

According to the Central Bank of Sri Lanka (CBSL), gross official reserves increased to US $ 7.5 billion by November 2019, mainly due to the receipt of the International Sovereign Bond (ISB) proceeds, purchase of foreign exchange by the CBSL from the domestic market and the receipt of the sixth tranche of the IMF- Extended Fund Facility (EFF).

Due to the challenges which arose from the slowdown in economic activities due to the Easter Sunday terror attacks and the delay in implementing certain revenue proposals announced in the 2019 budget, the fiscal sector of Sri Lanka displayed a poor performance during the first seven months of 2019.

The government revenue as a percentage of GDP declined to 6.7 percent in the first seven months of 2019, from 7.5 percent in the same period of the preceding year, driven by the lower tax and non-tax revenue collections.

The decline in tax revenue was mainly due to the underperformance of revenue collection from excise duties on motor vehicles and petroleum products and VAT on domestic goods and services. During the first seven months of 2019, the total government expenditure as a percentage of GDP rose up to 11.1 percent in comparison to 10.7 percent in the corresponding period of 2018, supported by the increase in recurring expenditures.

The government debt rose to Rs.12,646 billion as at end-July 2019, from Rs.10,959 billion at end-July 2018, warranted by the expansion in the budget deficit.

The CBSL adopted a relaxed monetary policy by reducing the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) with a view of fuelling economic activity that was challenged by a high interest rate environment in 2018.

As a result of subdued economic activity and high interest rates, credit to the private sector decelerated to 4.4 percent by end-November 2019, compared to a growth of 16.2 percent in the same period in 2018.

With a view of stabilising inflation to mid-single digit levels over the medium term, the CBSL moved to a Flexible Inflation Targeting (FIT) regime in 2019, in order to sustain price stability and strengthen financial sector oversight.

How have major industries performed?

Banking – As a result of the moderation in loans and advances, the total assets of the banking sector recorded a soft growth rate of 2.4 percent in the first eight months of 2019, compared to 7.3 percent in the same period in 2018. The growth rate of total assets was largely supported by the increase in investments. Consequently, the YoY growth in assets declined to 9.3 percent in August 2019, from 14.6 percent registered at end-2018. Driven by the lower credit growth due to the adverse business environment observed in the first eight months of 2019, YoY credit growth declined to 9.7 percent as at end-August 2019, from 19.6 percent at end-2018. As at June 2019, the banking sector credit was mainly extended to the consumption (18.4 percent), construction (15.4 percent), wholesale and retail trade (15.2 percent), manufacturing (11.0 percent) and infrastructure (8.6 percent) sectors.

Tourism – The tourism sector was adversely affected by the Easter Sunday attacks in April 2019, leading to a noticeable decline of 20.5 percent in tourist arrivals to 1.3 million in the first nine months of 2019. In terms of region, tourists from Western Europe, who accounted for 18.0 percent of total tourist arrivals, declined by 17.5 percent YoY during the first nine months of 2019 while tourists from South Asia recorded a YoY decline of 20.0 percent. In May 2019, an economic relief package was introduced on both capital and interest payments of the loans taken by registered businesses in the tourism industry, which is valid till March 31, 2020. Lonely Planet and Travel+ Leisure magazine highlighted Sri Lanka as the number one destination in the world to visit in 2019, which likely contributed to the slow recovery in the tourism industry at the close of 2019.

Tea – During the first half of 2019, tea production grew marginally by 0.2 percent as a result of the 1.2 percent decline in tea production witnessed in the first quarter of 2019 due to trade union action coupled with the 1.4 percent growth in tea production shown in the second quarter of the year supported by favourable weather conditions. During the first half of 2019, the average tea prices at the Colombo Tea Auction (CTA) declined by 7.3 percent from the corresponding period of 2018. The highest YoY decline in average tea prices at the CTA was recorded for medium grown tea (10.4 percent), followed by high grown tea (8.1 percent) and low grown tea (6.3 percent).

Construction – Construction activities grew 4.7 percent in the first half of 2019, in comparison to the contraction of 0.8 percent recorded in the corresponding period of 2018. As reported by the Central Bank of Sri Lanka, construction activities are expected to grow at a higher rate with the acceleration of government-initiated development projects such as the continuation of the Central Expressway and the first phase of the proposed Light Rail Transit System. In addition to the buildings to be constructed in the Colombo Port City, infrastructure developments within and outside the city of Colombo, including an elevated road from the New Kelani Bridge and an underground road connecting Port City to the rest of the Colombo commercial district, are expected to be positive developments in the construction sector for 2020.

Apparel – During the first eight months of 2019, export earnings from textile and garment recorded a growth of 8.3 percent supported by benefits arisen from the restoration of the European Union’s (EU) Generalised System of Preferences Plus (GSP+) facility despite trade diversion due to the US-China trade tensions. The increased production of printing of fabric mainly contributed to the positive developments in the textile industry. The manufacture of wearing apparel subsector registered a growth of 2.8 percent during the first half of 2019, in comparison to the growth of 3.9 percent recorded in the corresponding period in 2018.

Supported by higher demand from Germany, the Netherlands and the UK, earnings from garment exports to the EU market increased by 5.9 percent in the first eight months of 2019, while garment exports to the USA increased by 7.7 percent in the same period.

The Colombo Stock Exchange (CSE) experienced a decline in its yearly turnover and market capitalisation in 2019, primarily affected by the Easter Sunday attacks followed by political volatility.

Notably, on account of the Easter Sunday attack, the All Share Price Index (ASPI) and S&P Sri Lanka 20 index recorded a single day drop of 3.6 percent and 4.4 percent, respectively, on April 23, 2019.

In addition, the policy uncertainty, together with the subdued performance of the corporate sector further fuelled the negative performance of the market, which was amplified by foreign outflows.

Further, the CSE raised Rs.0.4 billion through one initial public offering (IPO) in 2019, a decline from the Rs.2 billion raised through two IPOs in 2018.

World in 2019

Global economy and trade | 2019

Global GDP grew at a subdued rate of 2.5 percent from January to September 2019, affected by US-China trade tensions and slow growth in Japan and Europe. Trade tensions eased in December, as the United States and China agreed on a Phase One agreement on December 13, 2019.

China agreed to sharply increase its purchases of the US agricultural products in exchange of cancelling planned tariff increases and reducing the tariff rate on approximately US $ 120 billion worth of Chinese imports to the United States.

In addition to tariff reductions, China agreed to reportedly make concessions in areas of intellectual property, technology transfer, agriculture, financial services and foreign exchange.

Global financial conditions and commodity market | 2019

Following the announced Phase One agreement, equity markets recorded a positive performance with the S&P 500 rising 2.6 percent since the start of December in 2019.

An upward momentum in oil prices was witnessed on account of the OPEC further limiting oil supply from the previous limit of 1.2 million barrels to 0.5 million barrels a day in late 2019.

Driven by the output shortfalls in some edible oils (especially palm oil), agriculture prices increased by 3.7 percent in November 2019. In addition, as gains in aluminum prices were balanced by declines in nickel, lead and iron ore prices, the metal price index changed up to a certain degree.

Global economy: Expected to recover in 2020

The World Bank forecasts economic growth in emerging markets and developing economies (EMDEs) to reach 4.6 percent in 2020, up from 4.0 percent in 2019. The uptick in the forecast is primarily on account of the waning impact of the financial pressure faced by the EMDEs on the back of the benign global financial conditions of 2019.

The World Bank also expects oil prices to average at US $ 65 per barrel in 2020, down from the price point of US $ 64.04 per barrel in 2019 and US $ 69.78 per barrel in 2018.

Global trade is expected to stabilise to an average of 3.2 percent in 2020 and 2021 due to subsiding of manufacturing weaknesses.

The IMF expects the growth of advance economies to soften to 1.7 percent in 2020 while the US economy is expected to expand by 2.1 percent in 2020. Further, the UK and EU economies are expected to grow at a rate of 1.4 percent in 2020.

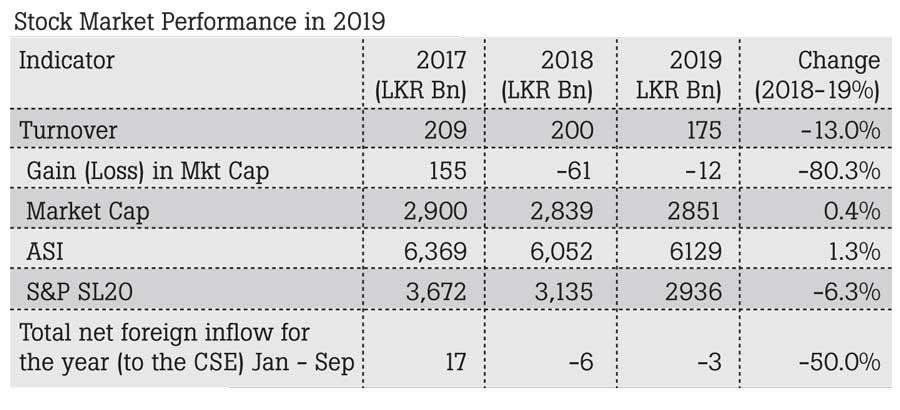

On average, business leaders in Sri Lanka expect that the global economy will remain subdued in 2020. While nearly half of the surveyed CEOs have noted a negative sentiment towards global economic growth in 2020, 46 percent of the surveyed CEOs have taken an optimistic view that the global economy is expected to recover or take off in 2020.

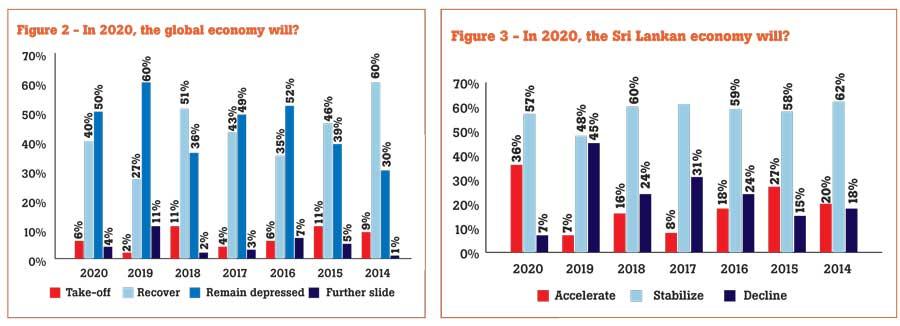

2020 expected to be a recovering year for Sri Lankan economy

The survey results reveal a growing confidence among business leaders for the Sri Lankan economy in 2020, as the statistics supporting the acceleration of the Sri Lankan economy is at its highest when analysing the survey results with the past years. This is further confirmed with the dramatic drop (from 45 percent to 7 percent) in the number of surveyed CEOs who have cited that they expect a decline in the local economy.

More than half of the surveyed CEOs expect the local economy to stabilise in 2020, indicating an overall optimistic view in terms of the Sri Lankan economy in 2020.

Sri Lanka in 2020

The IMF expects the real GDP growth of Sri Lanka to strengthen to 3.5 percent in 2020, as the country is on the path to recovery from the negative impact of the Easter Sunday terrorist attacks in April 2019.

According to the World Bank, local economic growth is expected to reach 3.3 percent in 2020 and 3.7 percent in 2021, supported by recovering investment

and exports.

According to the Asian Development Bank’s (ADB) Country Operations Business Plan (COBP) 2020-22, the proposed lending programme for Sri Lanka for the three-year period is estimated at US $ 2.46 billion. The lending programme is expected to focus on transport focus on transport (39 percent of the total lending), followed by water and other urban infrastructure and services (16 percent); agriculture, natural resources and rural development (14 percent); energy (12 percent); education (8 percent); multisector (6 percent) and finance (5 percent).

The projects implemented under the programme will include railways, roads, secondary education, power system reliability, irrigation, water supply, urban development and rural livelihoods.

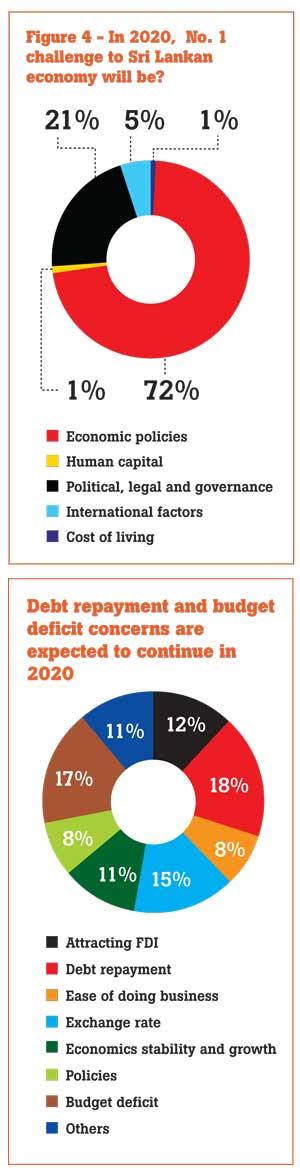

Economic policies – Main challenges for Sri Lanka in 2020

Seventy two percent of the surveyed CEOs have identified that economic policies will be the biggest challenge to their businesses in 2020, followed by political, legal and governance issues, which were a concern for 21 percent of the respondents.

The concern for political, legal and governance issues as well as economic policies in 2020 remain unchanged when compared to the previous year’s survey, as political and economic tensions witnessed in 2019 continued to hinder business and investor sentiment in 2020.

Other issues cited as business challenges in 2020 were human capital, cost of living and international factors, which amounted to 7 percent of the overall challenges.

Debt repayment and budget deficit concerns expected to continue in 2020

Debt repayment and budget deficit were cited as key economic challenges in 2020 as the overall budget deficit was financed largely through domestic sources leading to a significant increase in government debt stock in 2019.

The exchange rate stability (15 percent) and attracting FDI (12 percent) are seen as the third and fourth most challenging economic factors for 2020, respectively. This is mainly attributable to the depreciation of the rupee and the adverse impact from the Easter Sunday attacks in April 2019.

The economic stability and growth (11 percent) is the next most concerning economic factor with the effect of recovery in the tourism sector.

The monetary policy and business confidence were less cited economic challenges for businesses in 2020.

Political stability concerns expected to continue in 2020

Concern for the lack of political stability and corruption and good governance are the key political challenges that were cited by the CEOs for 2020, on the back of key political events such as the presidential election, which took place in the latter part of 2019 and the upcoming parliamentary election in 2020.

Corruption and good governance accounted for one-fourth of the overall challenges highlighted by CEOs, signifying the importance of regenerating business confidence.

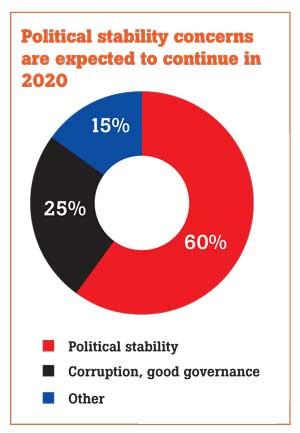

Positive business outlook for 2020

Since the inception of CEO Survey in 2012, a record high of 61 percent of the surveyed CEOs believe that their businesses will perform better in 2020, compared to 2019. Meanwhile, 36 percent of the CEOs believed that their business will achieve the same level of growth in 2020 as in 2019.

Only 3 percent of the business leaders are expecting a lower growth in their business for 2020, indicating the lowest negative outlook since the initial survey in 2012.

As a whole, there appears to be a positive outlook for business performance with the expectancy for the recovery in global economy as well as in the local economy in 2020.

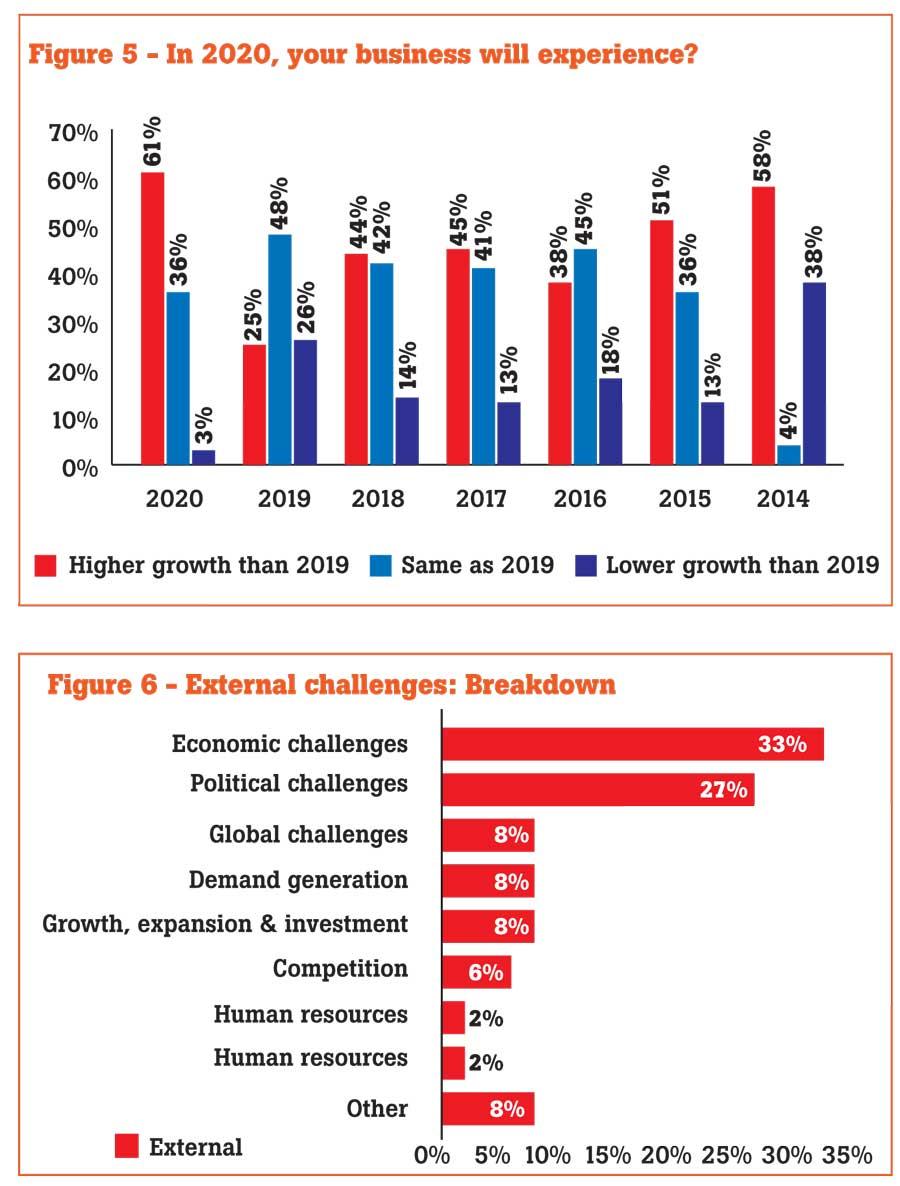

External challenges dominate

Fifty four percent of the CEOs believe that the success of their businesses in 2020 will mainly be affected by factors external to their business, which was recorded as 70 percent in the previous year.

However, 46 percent of the CEOs identified internal factors to be the key determinant of their business performance in 2020, compared to the 31 percent of CEOs who attributed controllable factors as determinants of business performance in 2019.

The main external challenge cited by the CEOs was economic challenges (33 percent), where many CEOs expressed concern over the currency depreciation and inconsistencies in taxation that would lead to a rise in import costs and thus increased costs of living.

Political and regulatory concerns (27 percent) was another key external challenge that was identified due to inconsistent government policies that have been implemented in 2019, the effects of which is expected to continue on to 2020.

Global challenges (8 percent) were seen as an external challenge to businesses on account of issues such as slowing consumer demand and political and economic uncertainty brought about by countries such as the US.

CEOs also pointed out that growth, expansion and investment (8 percent) as well as the demand generation (8 percent) would pose challenges to their businesses due to the lower consumer spending and negative investor confidence.

In addition, the surveyed CEOs found environmental and human resources to be external challenges to their businesses in 2020, although at a much lower frequency than economic and political issues that are expected to arise in the same period.

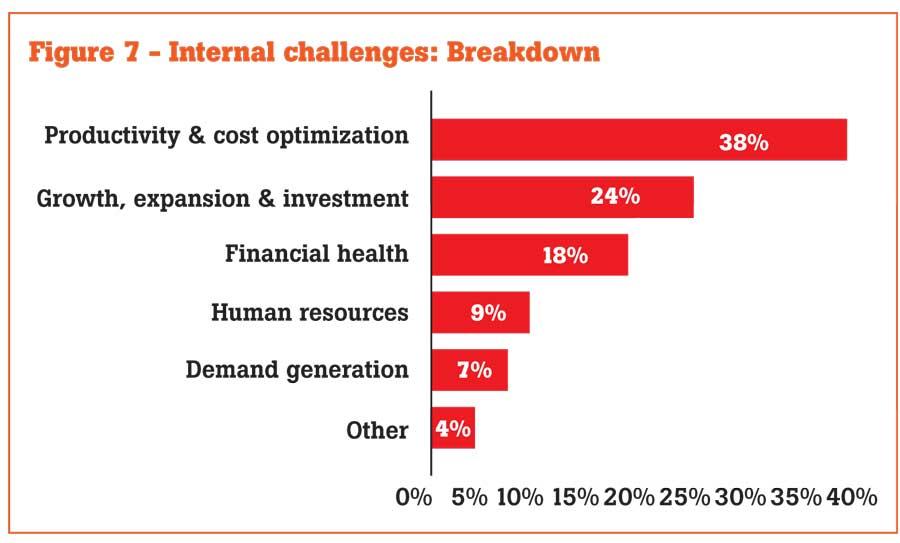

The main internal challenge that the CEOs expect to face in 2020 is productivity and cost optimisation (38 percent), especially considering the challenge of keeping costs of operations at a feasible level with the rising cost of imports.

Another key challenge that was discussed is growth, expansion and investment (24 percent), where safeguarding market share and keeping minimum pressure on company bottom lines were considered as risks.

Financial health (18 percent) was cited as the next most concerning internal challenge followed by human resources, which accounted for 9 percent of the overall responses. CEOs also cited demand generation (7 percent) as a key issue they are likely to face in 2020.

Conclusion

Since the launch of the MTI CEO Business Outlook Survey in 2012, 2020 marks the year in which the most number of surveyed CEOs expressed a more positive outlook in terms of the Sri Lankan economy for 2020.

However, growth forecasts for Sri Lanka and the global economy per the IMF and World Bank remain at a subdued level citing rising debt levels and slowdown in productivity. The policymakers will need to address these challenges to ensure recovery and surpass predicted forecasts to ensure moderate growth in 2020.

The long-term trend (since 2012) of the business environment performing below expectations continued in 2019, where 73 percent of the CEOs expressed dissatisfaction in the performance of their industry in 2019 with a slight drop from the previous peak of 75 percent recorded in 2018. The lacklustre performance was no doubt on the back of a weak economy and a turbulent political environment prevalent during the previous year.

Hence, it was no surprise that external factors continued to challenge the CEOs in their daily operations during 2019, as evidenced by the survey results.

However, considering the continuing trend of businesses citing external factors as their number one challenge, this will be the opportune time for the CEOs to ensure that reasonable firewalls are in place to mitigate the impact that unexpected challenges can create in the long term.

In addition, robust and effective action by industry stakeholders, including the government, are likely to result in opportunities for the business sector to capitalise on in the coming year, despite the political and economic headwinds that are expected to arise in 2020.

TI Corporate Finance

MTI Corporate Finance is the corporate finance arm of MTI Consulting, a boutique strategy consultancy with a network of associates across Asia, Africa and the Middle East. MTI Corporate Finance provides a comprehensive range of services, including due diligence, feasibility studies, funding new businesses or capitalisation of existing ones – from IPOs to private placement facilitation, M&A facilitation and advisory on governance, compliances and risk management.

16 Nov 2024 15 minute ago

16 Nov 2024 47 minute ago

15 Nov 2024 15 Nov 2024

15 Nov 2024 15 Nov 2024

15 Nov 2024 15 Nov 2024