27 Nov 2021 - {{hitsCtrl.values.hits}}

By Nishel Fernando

A national consensus backed by a common minimum programme, which should be implemented by an independent team of experts, is mooted for Sri Lanka to overcome a potential sovereign default next year.

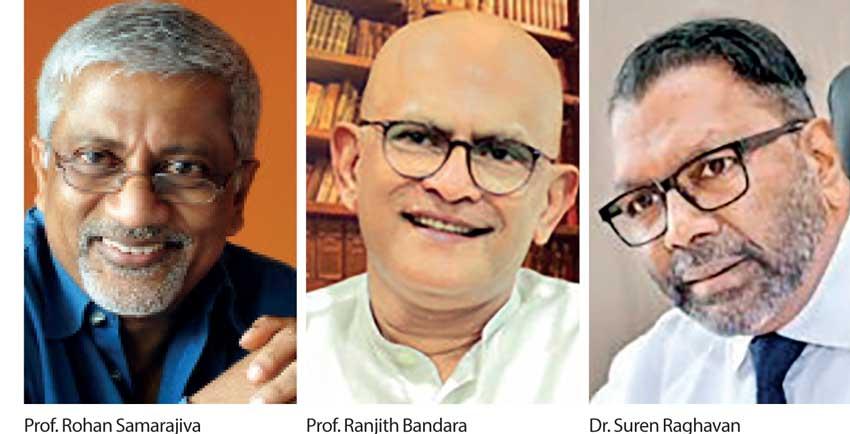

“As the Central Bank (CB) will be a focal point in this process, we need to transform the CB into a real independent and responsible entity, which can work with a national government. It should give priority to technical advices in its decision-making and it should not be an entity, which experiments different theories such as Modern Economic theory,” LIRNEasia Founding Chair Prof. Rohan Samarajiva told a forum organised by Colombo-based think tank Advocata Institute, under the theme ‘A National Consensus for Economy?’, in Colombo, on Wednesday.

In taking part in the panel discussion, ruling-collation MPs Prof. Ranjith Bandara and Dr. Suren Raghavan as well as opposition MPs Dr. Harsha de Silva, Patali Champika Ranawaka and Vijitha Herath, identified the need of a national consensus to overcome the looming crisis.

Ranawaka estimated Sri Lanka’s external debt repayment obligations at a minimum of US $ 3 billion, which include International Sovereign Bonds (ISB) and Sri Lanka Development Bonds (SLDB) for the next eight months, with only US $ 1.5 billion usable foreign exchange reserves in hand.

Sri Lanka has a US $ 500 million maturing ISB in January, next year and another US $ 1 billion maturing ISB in July next year.

He added that the government failed to bring any additional inflows, as earlier pledged, while foreign investors remain wary of investing in the country, due to a potential bankruptcy.

“Six months ago, the Urban Development Authority called for proposals from investors to sell over 50 available pieces of prime real estate, targeting to earn US $ 5 billion but still no buyer has come forward. Everyone has understood that Sri Lanka is heading for a sovereign default, so what’s valued at US $ 5 billion today can be bought at US $ 5 million after such default,” he said.

Further, he stressed that the country has left no friends to bail out from the looming crisis.

“There are no friends left. During our time, we brought four investments to Colombo Port City; it was only short of laying the foundation stone. However, there will be no investments coming to the Port City next year because everyone has understood where we are heading now,” he said.

Therefore, he suggested that the government should make a decision to come up with an appropriate programme through a national consensus.

“Afterwards, we need to let an independence team to take over the implementation part of this programme. Not many know that former CB Governor Dr. Indrajit Coomaraswamy not only reinstated the tainted image of the CB but our economy is still running because of the decision he took back in 2019 to go to international capital markets to raise additional funds as buffers. We need to introduce a similar team to head key institutions in this crisis but if we continue on this path, nobody can stop this crisis,” he elaborated.

In particular, Ranawaka criticised the government’s decision to allocate large sums of funds to mega project in an ad hoc basis, which might not be economically viable now.

Prof. Samarajiva stressed that it’s critical to re-enact the 19th Amendment to the constitution by abolishing the 20th Amendment, in order for independent commissions, which approve the appointments of key officials to state institutions, to become truly independent.

Further, he insisted that the country has no alternative but to go to the IMF.

“We will be facing a massive debt issue. We need to go to the IMF. We need fiscal discipline to get the twin deficits under control,” he said.

Meanwhile, Ranawaka warned of dire consequences, which may last for decades to come, if Sri Lanka declares bankruptcy by defaulting on an ISB repayment.

“It’s not easy to overcome from a default as seen in the experience of Greece and Argentina. At least Greece had the support of the EU. Argentina has gone into multiple bankruptcies over the period. We need to stop this looming sovereign default at all costs,” he added.

Joining the discussion, Dr. de Silva opined that the country needs to move away from the import substitution mindset, which he found as the root cause of the current crisis. Moving forward, he suggested that the country should focus on connecting with global and regional value chains in order to boost the incomes of the people.

“The smartphone that everyone uses is manufactured in 44 countries but we are not part of this; it’s all because of our import-substitution mindset, where we are trying to manufacture everything here,” he said.

For a national consensus, he urged that the government should take the first step by inviting the opposition parties and everyone must look beyond short-term political gains.

24 Nov 2024 23 minute ago

24 Nov 2024 29 minute ago

24 Nov 2024 2 hours ago

24 Nov 2024 6 hours ago

24 Nov 2024 7 hours ago