22 Aug 2024 - {{hitsCtrl.values.hits}}

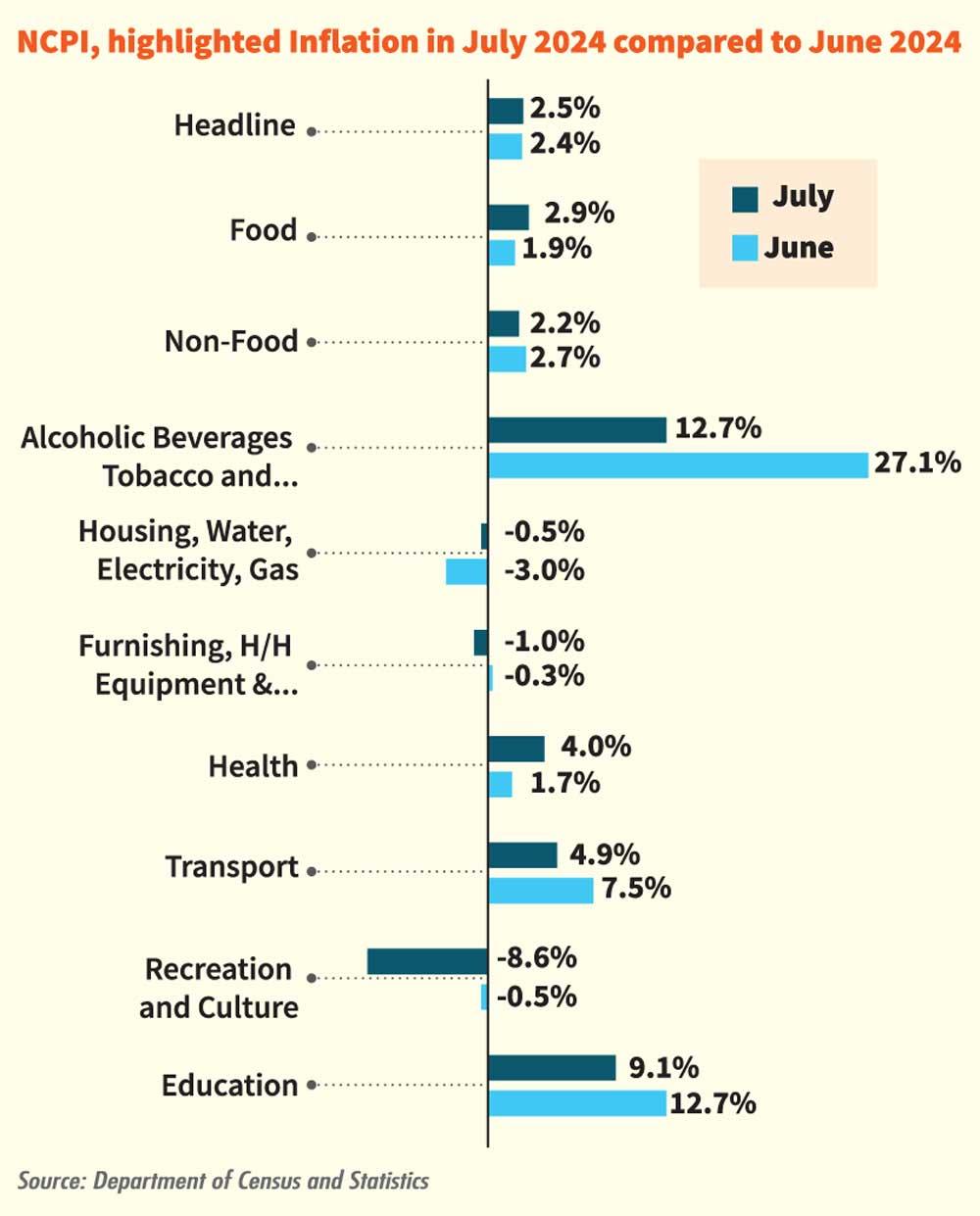

The consumer prices measured nationally were a tad higher in July, rising by 2.5 percent from the same month a year ago, picking slightly up from 2.4 percent through June, as the higher base effects last year were dissipating.

However, the sticker prices of many varieties of food and non-food items fell with the latter especially taking a notable decline, due to the downward revisions in the prices of energy and utilities.

As a result, the national prices measured on a monthly basis fell by 0.6 percent in July, from a 0.9 percent between May and June.

The Central Bank too reiterated last week it is confident of inflation being able to be maintained below 5.0 percent through the first quarter of next year, in fact, in a reference to the Colombo Consumer Price Index (CCPI).

The CCPI is the most widely used price gauge and it recorded 2.4 percent for July, picking up from 1.7 percent recorded through June.

Meanwhile, the so-called core national prices slowed to 3.0 percent in July, from 3.9 percent recorded through June.

The food prices measured according to the broader inflation gauge recorded 2.9 percent in the 12 months through July, up from 1.9 percent through June.

The prices measured on a monthly basis slowed significantly to 0.5 percent, from a 2.4 percent increase between May and June.

The non-food prices meanwhile slowed to 2.2 percent in the year through July, from 2.7 percent through June.

However, the non-food prices measured monthly fell further into decline by 1.4 percent, from a 0.4 percent decline in June.

The non-food prices measured on a monthly basis have been falling from March onwards but the July decline was the deepest, as the government cut electricity tariffs while it revised the fuel and gas prices down.

As inflation is far from a risk, given the current economic conditions, the Central Bank in July cut the key policy rates by 25 basis points to signal that they are committed to the current monetary easing path.

Last week’s indication that inflation would remain below the 5 percent medium-term target would solidify the ability of the Central Bank to remain on the current easing path of its monetary policy.

22 Nov 2024 26 minute ago

22 Nov 2024 2 hours ago

22 Nov 2024 3 hours ago

22 Nov 2024 3 hours ago

22 Nov 2024 4 hours ago