30 Jan 2018 - {{hitsCtrl.values.hits}}

The Sri Lanka-Singapore Free Trade Agreement (SLSFTA) signed last week is credit positive for both sovereigns and more so for Sri Lanka as the trade pact is expected to enhance cross-border trade of goods and services and would promote foreign direct investments (FDIs) between the two countries, Moody’s Investors Service said.

The SLSFTA is Sri Lanka’s third FTA and the first with a Southeast Asian nation and under which Sri Lanka will eliminate tariffs on 80 percent of products over 15 years. For Singapore, the agreement will result in SGD 10 million in annual tariff savings.

Sri Lanka already has FTAs with India and Pakistan but the bulk of the trade happens outside the FTA in the case of Indo-Lanka FTA.

Sri Lanka is known for not clinching the best FTA deals as it doesn’t send strong negotiators to the table and shies away from opening certain sectors for trade.

Being the most open economy in Asia, Singapore has 21 bilateral and regional FTAs with 32 trading partners.

Moody’s has assigned Singapore with an ‘AAA’ rating –the highest investment grade rating – with a ‘Stable’ outlook – and Sri Lanka with a ‘B1’ speculative grade rating with a ‘Negative’ outlook.

According to Moody’s Vice President Senior Credit Officer Christian de Guzman, the SLSFTA will have a larger effect on Sri Lanka’s credit quality because the potential increase in current account inflows and inward investments would help reduce its elevated external vulnerability.

“Because Singapore does not impose import duties on 99 percent of tariff lines, the agreement’s trade benefits for Sri Lanka will materialize through the opening of access to the broader Association of Southeast Asian Nations (ASEAN) market and other large economies, given Singapore’s existing preferential trade arrangements with Australia, Japan, Korea and other countries in Southeast Asia,” de Guzman added.

In 2017, Sri Lanka was Singapore’s 37th-largest trading partner, while Singapore was Sri Lanka’s eighth-largest trading partner. Total bilateral trade amounted to about 0.5 percent of Singapore’s gross domestic product (GDP) and 2.5 percent of Sri Lanka’s GDP.

However, Guzman said the extent to which the SLSFTA reduces Sri Lanka’s external vulnerability would depend on its effectiveness at bolstering services and investment flows.

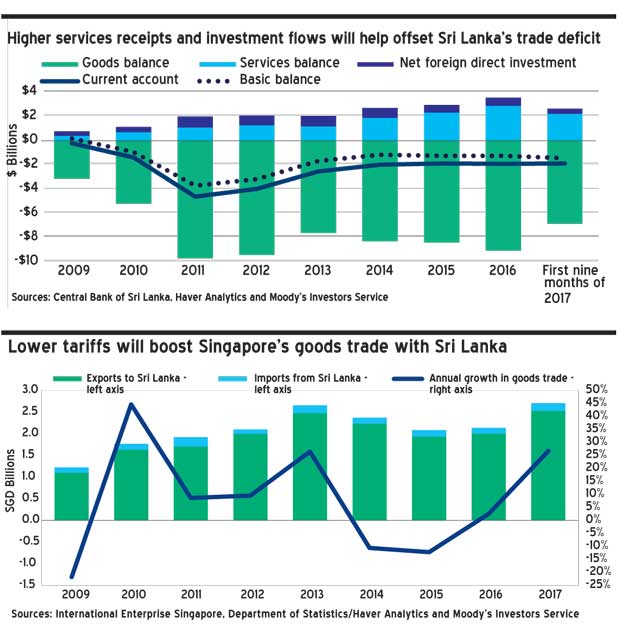

“Sri Lanka’s current account has a structural deficit because a large merchandise trade deficit more than offsets a surplus in services and remittance inflows. Moreover, FDI inflows only partially finance the current account shortfall, resulting in a persistent basic balance (FDI inflows plus current account balance) deficit,” he said.

Meanwhile, the SLSFTA is expected to boost services receipts to Sri Lanka from tourism as Sri Lanka could leverage Singapore’s transportation hub to attract more tourists.

In the area of promoting investments, the agreement is expected to broaden the scope of investment to areas such as infrastructure, logistics, education and healthcare from the current sectors of food manufacturing and real estate.

During the last two decades, Singaporean firms have been active foreign investors in Sri Lanka and they have been among the top 10 investors in the country.

One of the key aspects expected from the trade pact is that it would protect foreign investments from expropriation and would improve transparency through safeguards against discriminatory treatment and provides for a dispute resolution mechanism, all of which create a better investment climate to attract FDI, de Guzman said.

20 Nov 2024 27 minute ago

20 Nov 2024 35 minute ago

20 Nov 2024 45 minute ago

20 Nov 2024 58 minute ago

20 Nov 2024 1 hours ago