21 Oct 2024 - {{hitsCtrl.values.hits}}

By Nishel Fernando

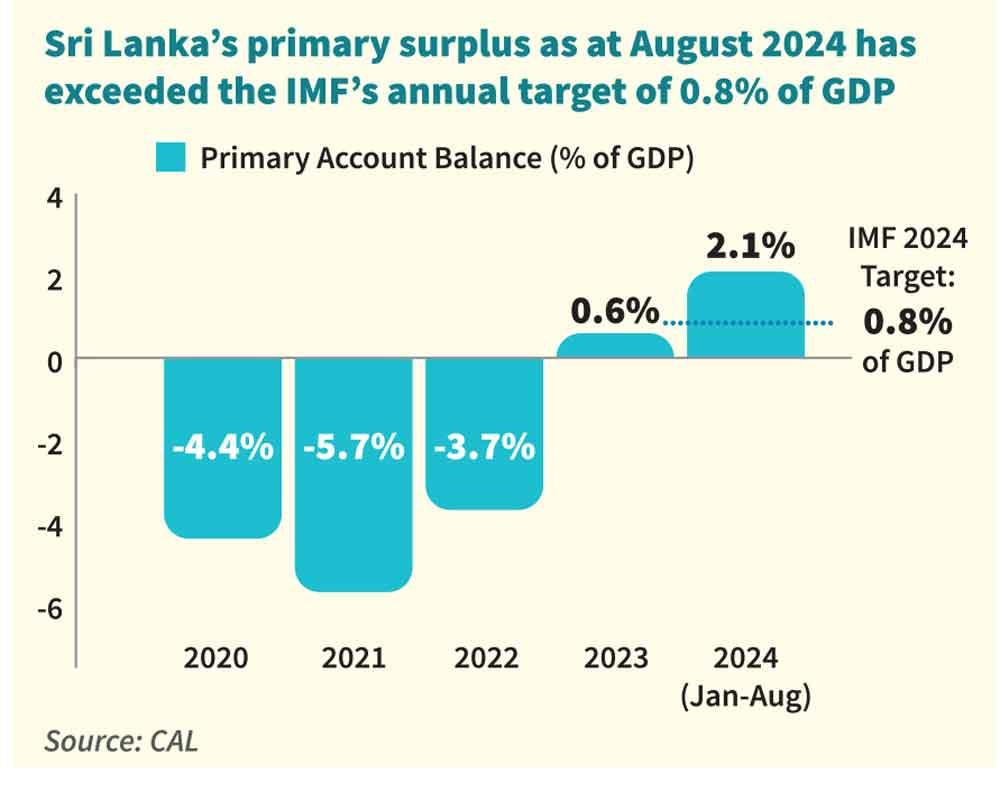

Sri Lanka has exceeded IMF’s annual primary surplus target with the primary surplus reaching estimated 2.1 percent of GDP during the first eight months of the year.

According to Pre-Election Budgetary Position Report 2024 released by the Ministry of Finance last week, the primary balance notably improved to Rs. 648.8 billion in the first eight months of this year from Rs. 55 billion recorded in the same period of 2023.

However, it was down from 3.7 percent of GDP recorded in the first half of this year.

The Ministry of Finance emphasised that the government finances are well positioned to achieve the primary balance of 1.0 percent prescribed under the second review of the IMF-EFF programme.

According to Capital Alliance Limited (CAL), overachieving on this target means that Sri Lanka can reduce its debt faster, improving the country’s financial health and stabilising the economy.

In the said period, the government was able to narrow the budget deficit to Rs. 911 billion from Rs. 1,470.7 billion recorded in the same period of 2023. This was on a backdrop of higher revenue collections and rather slow growth in government expenditure, particularly concerning welfare expenditure.

In the first eight months of 2024, government revenue including grants rose by 40.5 percent to Rs. 2,565.9 billion from Rs. 1,826.6 billion in the same period of 2023.

This marked the realisation of 62.2 percent of the annual estimate of Rs. 4,127.0 billion. In particular, revenue collected from VAT outperformed and surpassed Rs. 694.5 billion of revenue collected from VAT for the entire year of 2023.

However, the Ministry of Finance stressed that positive momentum in revenue generation must be sustained and enhanced over the medium term with a focus on tax compliance, eliminating tax leakages, digitalisation, and minimising corruption vulnerabilities through strengthened tax administration.

Meanwhile, overall government expenditure increased by a moderate 5.4 percent to Rs. 3,476.9 billion from Rs. 3,297.3 billion in the same period of 2023, recording 49.8 percent of the expenditure estimate of Rs. 6,977.8 billion.

This was mainly driven by the increase of salaries and wages by 6.7 percent to Rs. 659.5 billion in the first eight months of 2024 from Rs. 618.1 billion in the same period of 2023 due to an increase in cost-of-living allowance and the increase of interest payments by 2.2 percent to Rs. 1,559.7 billion in the first eight months of 2024 from Rs. 1,525.7 billion in the same period of 2023 owing to the increase in interest payment on domestic debt, foreign debt and domestic loans.

Interest payments for foreign debt increased by 34.9 percent to Rs. 100.0 billion in the first eight months of 2024 from Rs. 74.1 billion recorded in the same period of 2023 partly due to the commencement of repayment of some bilateral loans. However, the interest payments on domestic loans recorded only a slight increase of 0.6 percent to Rs. 1,459.7 billion in the first eight months of 2024 from Rs. 1,451.6 billion in the same period of 2023.

Expenditure on subsidies and transfers increased slightly by 1.5 percent to Rs. 623.8 billion in the first eight months of 2023. Meanwhile, the capital and net lending significantly increased by 22.4 percent to Rs. 435.3 billion in the first eight months of 2024 from Rs. 355.6 billion in the same period of 2023.

21 Nov 2024 2 hours ago

21 Nov 2024 3 hours ago

21 Nov 2024 5 hours ago

21 Nov 2024 5 hours ago

21 Nov 2024 7 hours ago