15 Mar 2022 - {{hitsCtrl.values.hits}}

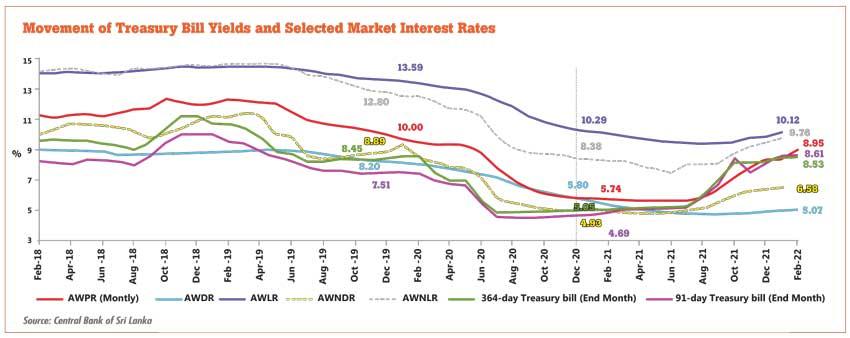

The average lending rate of commercial banks jumped above 10 percent in the final week of January, well ahead of the March policy rate hike, indicating that the era of single-digit interest rates is effectively over for Sri Lanka after a

short-lived cycle.

According to the latest data available, the average lending rate of the commercial banking system was at 10.12 percent by January-end, up from 9.87 percent in December 2021.

This was the highest since December 2020, when the rate was 10.29 percent.

Sri Lanka’s economy, among most other economies in the world, is coming out of the ultra-low interest rates prevailed since the initial days of the pandemic, as the central banks around the world slashed rates to rock bottom levels— to negative territory in certain cases—and injected trillions of dollars worth of liquidity to support the people and businesses from going bust.

When responding to a question a fortnight ago at a congressional hearing, United States Federal Reserve Chairman Jerome Powell said their monetary easing tools, including quantitative easing, helped the US to avoid a prolonged recession and prevent millions of job losses and thousands of businesses going bust. However, a segment of economists are propagating the notion that the central banks’ liquidity injections or money printing in common parlance, is the mother of all evils.

They call Powell delusional and cite four-decade high inflation as a direct result of money printing.

They do not appreciate that COVID-19 lockdowns and restrictions forced factories to shut down and choked supply chains as millions of workers stayed at home.

Meanwhile, analysts are betting on another 200 basis point increase in the policy interest rates in the remainder of the year from the Central Bank, mostly in the back half of the year.

However, there is a potential for another 100 basis-point hike at the coming meeting scheduled for April first week or even prior to close the arbitrage opportunity available for the bond investors and also to further contain the demand-driven inflation.

24 Nov 2024 4 hours ago

24 Nov 2024 5 hours ago

24 Nov 2024 5 hours ago

23 Nov 2024 23 Nov 2024

23 Nov 2024 23 Nov 2024