28 May 2018 - {{hitsCtrl.values.hits}}

Sri Lanka stands mostly at risk among frontier markets from a persistent rupee depreciation against the U.S. dollar as it will present fiscal troubles from bloating debt servicing needs, Moody’s Investors Service said in a special report on impact on Asia Pacific (APAC) sovereigns from currency depreciation.

Moody’s also said Sri Lanka is particularly at risk from the weakening rupee as the island nation has external debt obligations much higher than its foreign reserve stock.

“Prolonged currency depreciation also presents fiscal risks to those frontier economies with substantial foreign currency debt by inflating debt servicing needs, namely Sri Lanka, Maldives and Mongolia.

Sovereigns with high external debt obligations relative to their foreign reserves, such as Sri Lanka and Mongolia, are also particularly at risk”, Moody’s said in a report titled, ‘Currency depreciation will weigh on sovereigns with high external funding needs’.

Moody’s warnings are in contrast to the views of the Central Bank which, last week, strongly defended its reserve position and the ability to service external debt.

“The country’s gross external reserves currently amount to US $ 9.1 billion”, the Central Bank said adding that, “they are expected to increase to about US $ 11 billion by mid-June 2018”.

“It should also be stated that the country’s debt is serviced over a number of years. The weighted average time to maturity on the US $ 8.9 billion debt referred to in the news items is 5.1 years,” the Central Bank said in a tit-for-tat argument with the former Central Bank Governor, Ajith Nivard Cabraal.

“As of end April 2018, the average annual external debt servicing in 2018–2022 is US$ 3.9 billion. The country, therefore, has sufficient reserves to meet its external debt servicing obligations,” the bank added.

Moody’s maintains a B1 speculative grade rating on Sri Lanka with a negative outlook.

Emerging and frontier economies with higher deficits in their current accounts in the external accounts and higher external debt against external reserves remain vulnerable to external shocks coming from weakening local currencies and outflows of dollar denominated assets.

However, the depreciating impact on local currencies this time is less pronounced compared to the taper tantrum in 2013, as most of the APAC countries have accumulated reserve buffers to withstand external shocks.

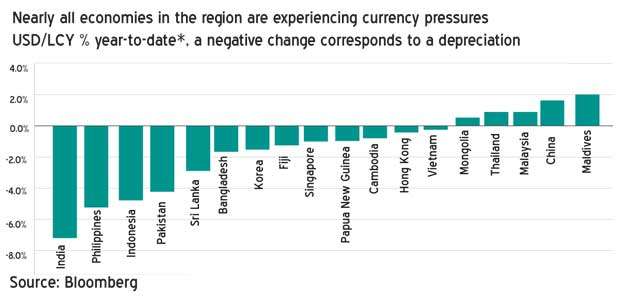

While most local currencies in APAC economies have depreciated against the dollar this year, the largest depreciations were seen in key Asian emerging and frontier markets in India, Indonesia, Philippines and Pakistan.

However in India, the weaker rupee transmitting into weaker debt affordability is limited due to India’s low dependency on foreign currency to fund debt burdens.

The Sri Lankan rupee has depreciated 2.5 percent against the U.S. dollar up to May 24.

18 Nov 2024 28 minute ago

18 Nov 2024 1 hours ago

18 Nov 2024 1 hours ago

18 Nov 2024 1 hours ago

18 Nov 2024 1 hours ago