02 Jun 2020 - {{hitsCtrl.values.hits}}

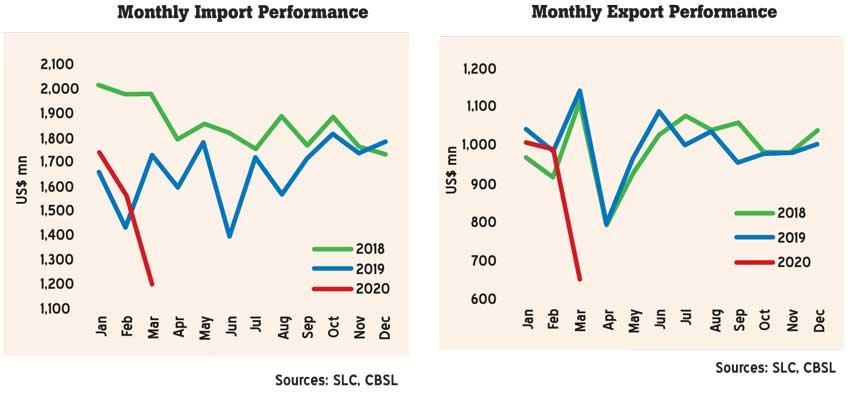

Sri Lanka’s trade deficit narrowed by US $ 43 million in March, driven by a sharp decline in imports amid the COVID-19 impact, decline in oil prices, import restrictions and low demand for export inputs, although export earnings recorded a sharper decline in percentage points compared to the import expenditure.

The trade deficit narrowed to US $ 549 million in March, from US $ 592 million a year ago.

In particular, a 25 percent YoY gain in Sri Lanka’s terms of trade (the ratio of the price of exports to the price of imports) contributed significantly to the marginal improvement in the trade account, with the improving export prices, while the import prices declined substantially in the month.

In March, the expenditure on merchandise imports declined notably by 30.3 percent YoY to US $ 1.2 billion, reversing the increasing trend observed since December last year.

However, merchandise export earnings declined by 42.3 percent YoY to US $ 656 million, reversing the marginal growth momentum in February.

“The selective import clearing process followed by Sri Lanka Customs (SLC), prioritising essential consumer items and the disruption to other import-related services due to the imposition of curfew, disruptions to global supply and logistic chains, lower commodity prices following the COVID-19 outbreak, were the main reasons for this unprecedented decline in the expenditure on imports,” the Central Bank said.

Further, import restriction, including the suspension on facilitating the importation of motor vehicles and non-essential consumer goods, has also contributed to the sharp decline in import expenditure.

The expenditure on fuel, which constitutes the largest component of the country’s import bill, fell by 41.7 percent YoY to US $ 237.7 million in March, as oil prices fell to US $ 37.7 million on average in the month.

Further, the import volumes of fuel except for crude oil also declined in the month amidst the lower demand. The expenditure on non-food consumer goods also declined sharply by 42 percent YoY to US $ 124 million in March, led by a 45.3 percent YoY decline in personal vehicle imports, a 22.1 percent YoY decline in medical and pharmaceuticals, a 46.7 percent YoY decline in home appliances and a 67.5 percent decline in telecommunication devices.

However, the import expenditure on food and beverages rose by 3.6 percent YoY to US $ 143 million in March, driven by imports of vegetables, sugar, wheat, spices (mainly chillies) and seafood (mainly canned and dried fish).

In addition, base metals (mainly iron and steel) and rubber and articles categorised under intermediate goods, were also among the handful of imported goods, which saw an increase in the month, compared to March, last year.

The expenditure on investment goods came down by an almost 40 percent YoY to US $ 236.8 million with imports of machinery and equipment and building materials falling substantially.

Despite the improvement in the trade account for March, the trade deficit widened for the first quarter of the year to US $ 1.85 billion, from US $ 1.6 billion in the corresponding period of 2019.

Further, the country’s external financial account remains weak with the overall balance declining to US $ 143 million at the end of the first quarter of the year, from US $ 912 million a year ago.

In the quarter, tourism earnings and workers’ remittances declined by 31.5 percent YoY and one percent YoY to US $ 956 million and US $ 1.6 billion, respectively, amid the COVID-19 crisis.

“The tourism industry was severely affected with the imposition of travel restrictions globally and the closure of Bandaranaike International Airport (BIA).

Workers’ remittances declined notably in March 2020, with the return of migrant workers from affected countries as well as the reported job terminations of some workers abroad,” the Central Bank said.

Further, foreign inflows to the government in March also remained significantly weak at US $ 821 million, compared to US $ 3.1 billion a year ago, while foreign reserves fell to US $ 7.5 billion in March, from US $ 7.9 billion

in February.

17 Nov 2024 30 minute ago

17 Nov 2024 2 hours ago

17 Nov 2024 3 hours ago

17 Nov 2024 3 hours ago

17 Nov 2024 5 hours ago