03 Feb 2024 - {{hitsCtrl.values.hits}}

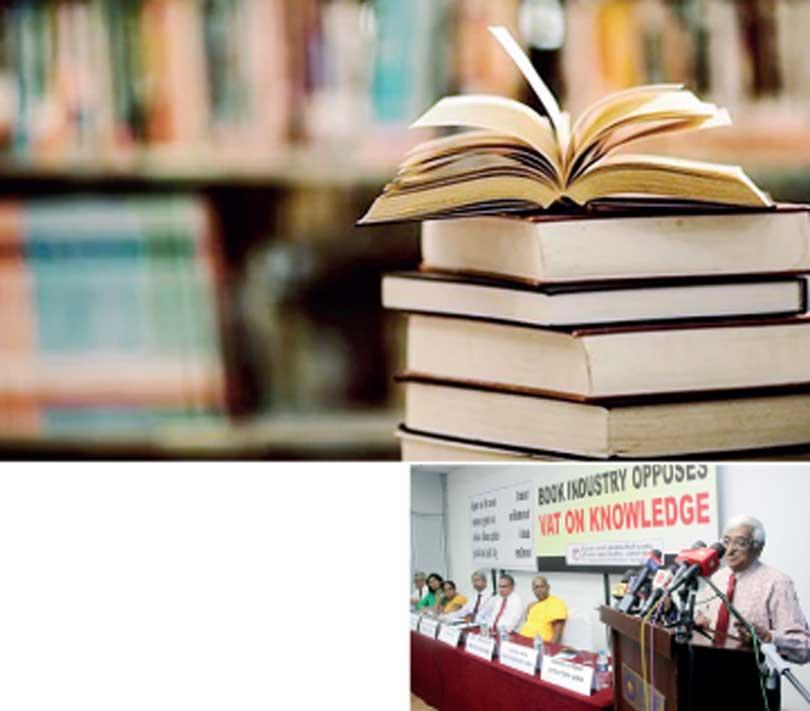

Sri Lanka Book Publishers Association Past President Vijitha Yapa sharing with the media the detrimental impacts on education, due to the VAT imposition on books. Also in the picture are All Ceylon Booksellers Association President K. Samarawickrama, Sri Lanka Book Importers and Exporters Association President Dinushi Abeywickrema, Author Sumithra Rahubadda, Sri Lanka Book Publishers Association Secretary Dinesh Kulatunga, Sri Lanka Book Publishers Association President Samatha Indeewara and Prof. Ven. Agalakada Sirisumana

PIC BY PRADEEP DILRUCKSHANA

Sri Lanka’s book industry yesterday came on to one platform and asserted that the imposition of an 18 percent Value Added Tax (VAT) on books is no different from slapping a tax on reading.

The industry collectively called for an immediate reversal of the decision to tax the sale of books, as it serves as a direct barrier to gaining knowledge.

Associations representing local publishers, printers, booksellers, importers, writers and academics highlighted the pernicious long-term effects the move would have on socioeconomic development, by making access to knowledge unaffordable to many.

“We acknowledge that economic challenges spanning multiple government terms have led to a situation where the broader population has been required to shoulder the financial implications of the gradual national recovery,” Sri Lanka Book Publishers Association General Secretary Dinesh Kulatunga said, addressing a press conference yesterday.

“But is it fair that this short-term requirement to boost government revenue should have the longer-term destructive consequence of retarding the education, culture, intellectual progress and personal development of generations of Sri Lankans and negatively impact the development of the knowledge economy?” he questioned.

The speakers representing different stakeholder groups in the book industry also charged that with the indiscriminate extension of the VAT to a highly sensitive and vulnerable sector such as books, Sri Lanka is also in violation of the UNESCO Florence Agreement of 1950, to which the country was an early signatory and continues to be a Contracting State.

The UNESCO Florence Agreement is a treaty that binds Contracting States to not impose customs duties and taxes on certain educational, scientific and cultural materials that are imported.

“With the imposition of VAT on books, Sri Lanka attains the dubious distinction of becoming one of a very few countries that impose a tax on a vital source of knowledge and information,” Sri Lanka Book Publishers Association President Samantha Indeewara said.

“What this means is that while the rest of the world is trying to make knowledge more accessible and inclusive at the grassroots level, Sri Lanka is trying to use this industry to raise government revenue, heedless of the serious ramifications. It is a textbook case of killing the goose that lays the golden eggs.”

The stakeholders also pointed out that the industry already contributes upwards of Rs.1 billion to the government’s tax revenue via the VAT paid by the importers that supply 90 percent of the raw materials used in the production of school textbooks and other books. The imposition of the VAT on books therefore results in an anomaly of double taxation for publishers, further aggravating a difficult situation.

The government’s decision to impose 18 percent VAT on books has already generated concern internationally, with the International Publishers Association and European and International Booksellers Federation writing to President Ranil Wickremesinghe to voice their objections, urging to reconsider this measure for the benefit of the Sri Lankan literary landscape

22 Nov 2024 9 hours ago

22 Nov 2024 22 Nov 2024

22 Nov 2024 22 Nov 2024

22 Nov 2024 22 Nov 2024

22 Nov 2024 22 Nov 2024