12 Feb 2021 - {{hitsCtrl.values.hits}}

The indices at the Colombo Stock Exchange (CSE) saw some wild fluctuations during intra-day trading yesterday, with negative sentiment creeping in mainly as a result of forced selling, though they closed on a strong note regaining some of the lost ground.

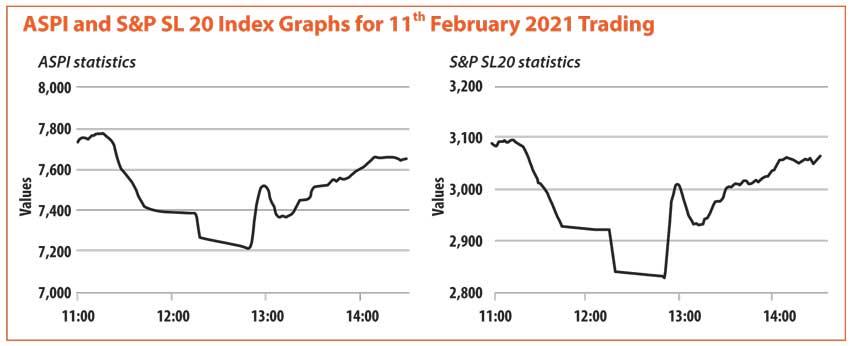

The benchmark All Share Price Index (ASPI) hit an intraday low of 7, 215 points, driven by forced selling, but recovered during the final trading hour to close at 7, 597 points, still down 134.52 points or 1.74 percent from the previous close.

The more liquid S&P SL20 Index triggered two circuit breakers, as it fell over 7.5 percent, of which the first was within the first 45 minutes of the market opening. Following the 30 minute cooling off period, the second circuit breaker was triggered 3 minutes after trading restarted.

Subsequently, the S&P SL20 Index gained significantly, to close at 3, 309.28 points, still down by 48.43 points or 1.57 percent from the previous close. The index hit an intraday low of 2, 822.76 points.

The day’s turnover was Rs.4.38 billion, significantly lower compared to the recent double-digit turnovers recorded in the last few weeks.

“Price losses in Vallibel One, LOLC Holdings and Expolanka Holdings resulted in 24 percent benchmark index losses. Price losers outperformed the price gainers by 162 to 49,” NDB Stockbrokers said.

They also said high net worth and institutional investor participation in the market remained subdued yesterday.

“Some investors feared that the regulator was going to curtail broker credit, which added to the negative sentiment. Also, there were certain amount of forced selling in the market yesterday,” a stockbroker on the grounds of anonymity told Mirror Business.

“However, the market’s recovery after the massive slide gave hope to a lot of investors and brokers alike. It indicated that the momentum hadn’t been totally lost,” he added.

The recent circulars issued by the CSE asking for broker credit information caused much consternation in the market, although both the CSE and the Securities and Exchange Commission (SEC) maintained that the request for such information was merely routine.

Meanwhile, on a positive note, foreign investors who had been net sellers throughout, emerged as net buyers yesterday, recording a net foreign inflow of Rs.31.1 million against a net outflow of Rs.335.1 million on Wednesday.

Foreigners net sold over Rs.50 billion worth stocks in 2020, and up to Wednesday they remained net sellers.

20 Nov 2024 8 minute ago

20 Nov 2024 10 minute ago

20 Nov 2024 40 minute ago

20 Nov 2024 49 minute ago

20 Nov 2024 2 hours ago