21 Jun 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

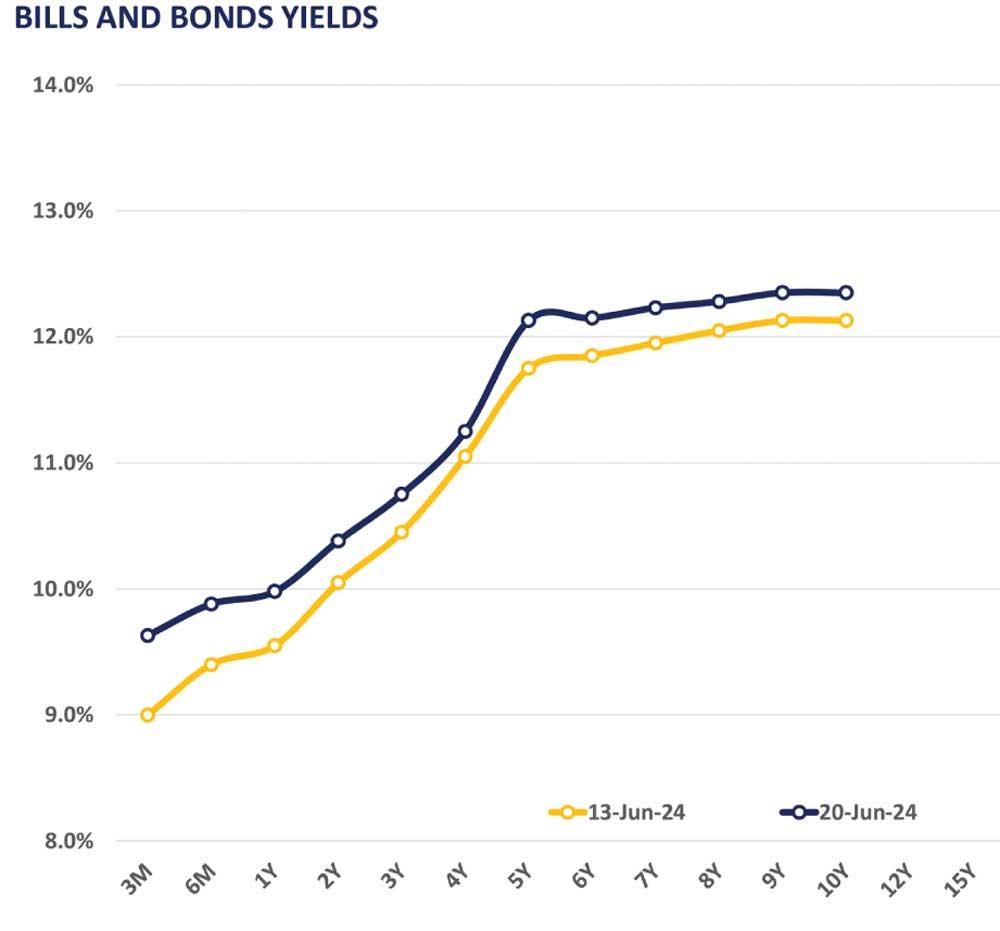

The secondary bond market saw mixed activities across mid to long tenors during yesterday although the overall market witnessed limited activities with thin volumes.

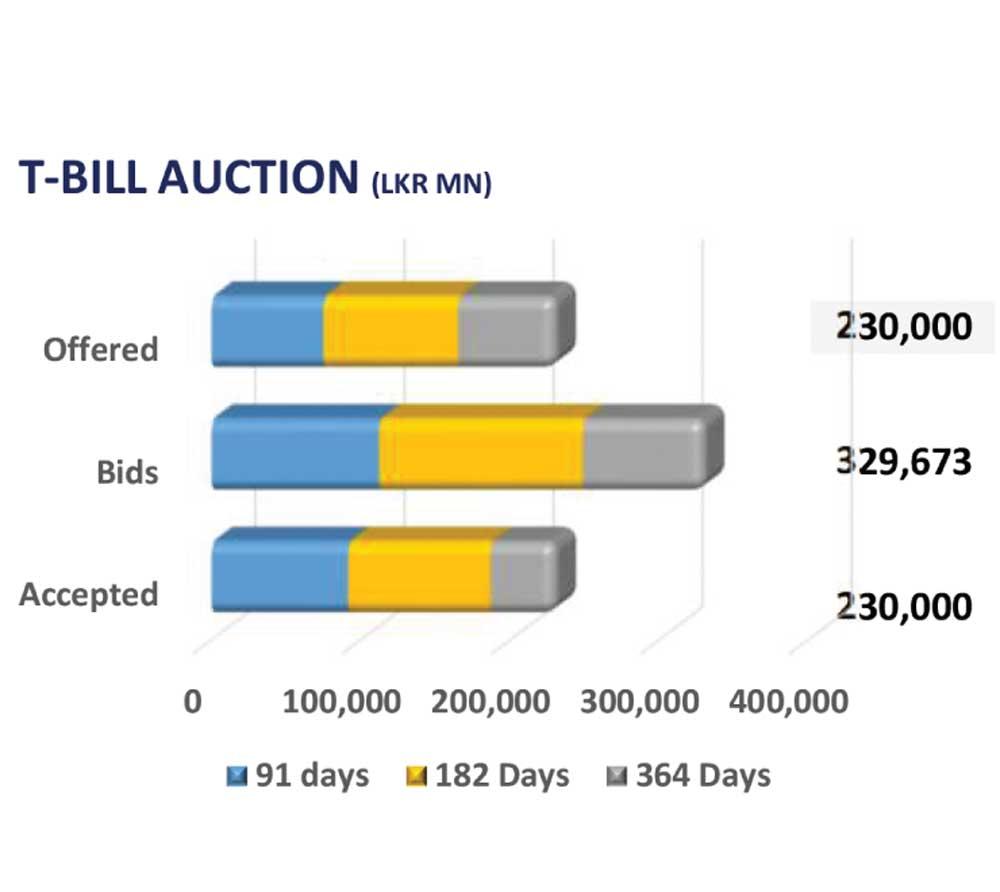

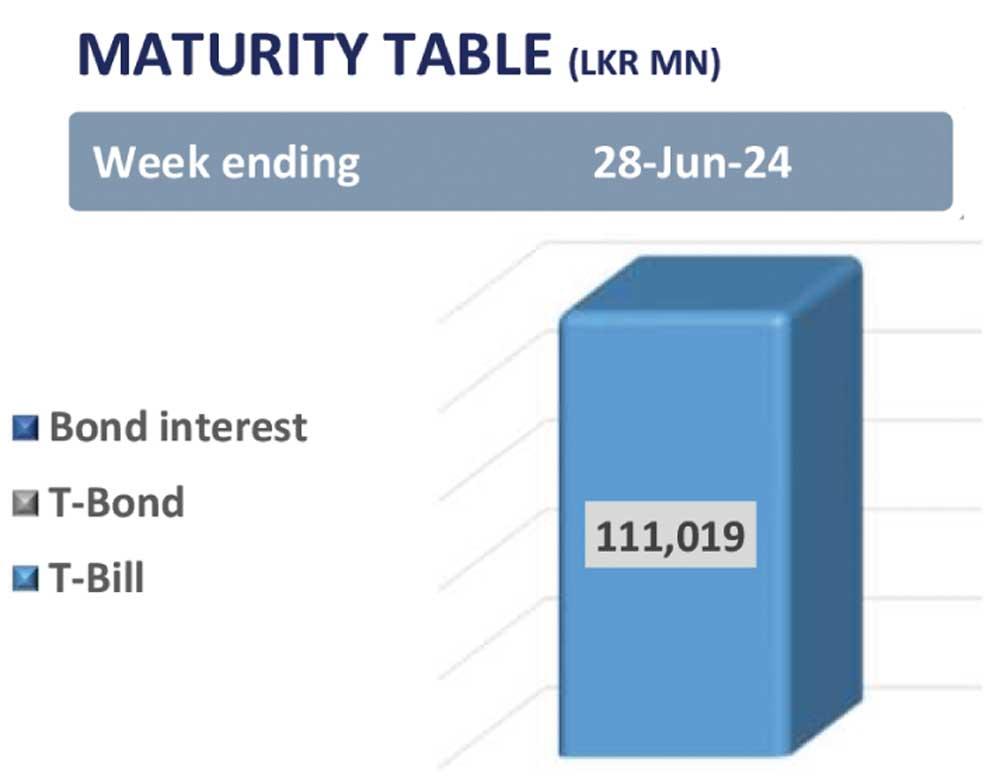

Among the traded maturities, 15.09.29 traded at 12.10% and 01.12.31 quoted at 12.15%. Moreover, CBSL announced an issue of Rs. 160.0bn T-Bills through an auction scheduled on 26th Jun-24, more than the maturity of Rs. 111.0bn which is set to mature on 28th Jun-24.

Out of the total offered, Rs. 40.0bn is to be raised from 91-day maturity, Rs. 80.0bn is expected to be raised from 182-day maturity while Rs. 40.0bn is to be raised from 364-day maturity.

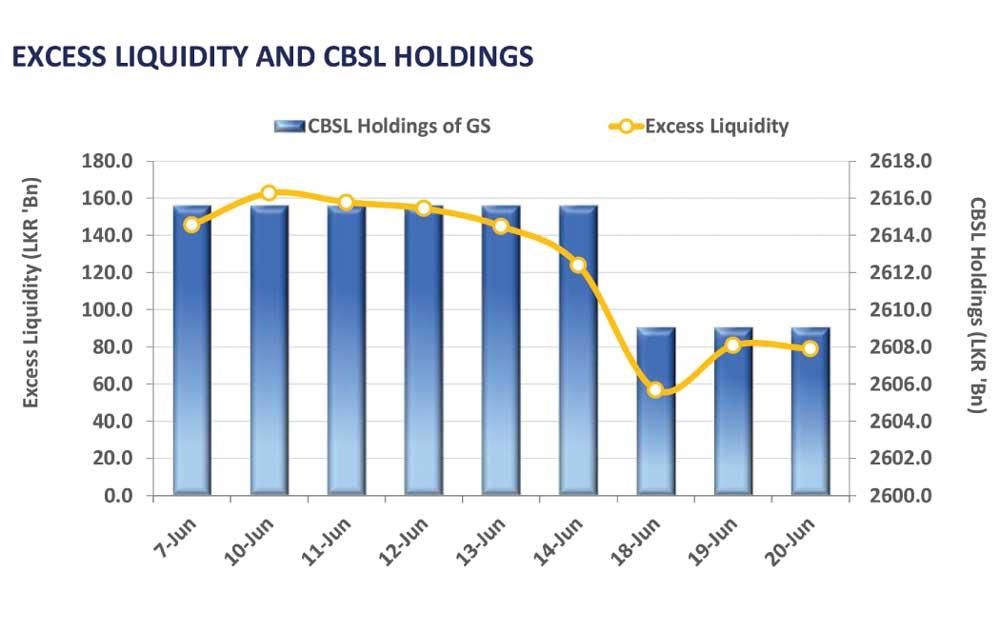

On the external front, the LKR continued to depreciate against the USD, closing at LKR 305.28/USD. Moreover, overnight liquidity for the day was recorded at Rs. 79.1bn while CBSL holdings remained steady at Rs. 2,609.1bn.

27 Nov 2024 1 hours ago

27 Nov 2024 3 hours ago

27 Nov 2024 4 hours ago

27 Nov 2024 4 hours ago

27 Nov 2024 4 hours ago