27 May 2019 - {{hitsCtrl.values.hits}}

Diversified conglomerate, Aitken Spence PLC recorded a strong March quarter (4Q19) amid strong performance of the group’s all business segments, the interim financial accounts released to the Colombo bourse on Friday showed.

Aitken Spence reported earnings of Rs.4.64 per share or Rs.1.9 billion for the quarter under review compared to earnings of Rs.4.46 a share or Rs.1.8 billion reported for the same period last year.

The revenue for the period rose to Rs.19 billion from Rs.16.6 billion a year ago while the operating profit edged up to Rs.3.4 billion from Rs.3.2 billion.

The group incurred a net finance expense of Rs.272.3 million, up from Rs.249.4 million a year ago.

Meanwhile for the year ended March 31, 2019 (FY19), Aitken Spence reported earnings of Rs.10.04 per share or Rs.4.01 billion compared to earnings of Rs.8.77 per share or Rs.3.6 billion.

The group revenue rose to Rs.55.7 million, 5.6 percent from a year ago.

A company earnings release said revenue contribution from Sri Lankan operations grew 3.7 percent year-on-year (YoY) to Rs.38.1 billion while revenue from overseas operations led by Maldivian resort operations grew at a faster pace of 9.9 percent YoY to Rs.17.6 million.

The group’s tourism sector reported an after-tax profit of Rs.2.1 billion for FY19, down from Rs.2.3 billion on revenue of Rs.28.3 billion, up from Rs.25.7 billion a year ago.

The maritime and logistics sector recorded post-tax profit of Rs.1.7 billion, up from 1.4 billion a year ago. The segments revenue also improved to Rs.9.4 billion from Rs.8.6 billion.

The strategic investments segment, which houses the group’s power generation, printing, plantations and garments business, saw the after-tax profit improving to Rs.1.7 billion from Rs.1.2 billion a year ago, though revenue fell to Rs.15.7 billion from Rs.16.7 billion.

Aitken Spence attributed the segment’s higher profits to turnaround in the garments segment. The group also said its printing and packaging business made an investment in Fiji in a printing business during the financial year.

Aitken Spance already has extensive port management operations in Fiji.

The company also said the state-of-the-art waste-to-energy plant that will be operational in the fourth quarter of 2019/20 will add 10 MW to the national grid.

The group’s services sector, which constitutes the operations of Continental Insurance and agency for Otis elevators, reported improved post-tax profit of Rs.196.3 million on revenue of Rs.2.2 billion.

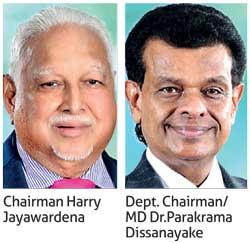

““Despite economic headwinds in key source markets and in their respective locations of operations, we have remained resilient and it is evident in the strong financial performance clearly seen across geographies and sectors,” Aitken Spence Deputy Chairman/ Managing Director Dr. Parakrama Dissanayake said.

Business tycoon Harry Jayawardena-controlled Melstacorp Limited, Rubicond Enterprises Limited and other related parties own 67 percent of Aitken Spence while the Employees’ Provident Fund has 5.07 percent stake being the third largest shareholder.

14 Nov 2024 44 minute ago

14 Nov 2024 2 hours ago

14 Nov 2024 2 hours ago

14 Nov 2024 2 hours ago

14 Nov 2024 3 hours ago