10 Feb 2018 - {{hitsCtrl.values.hits}}

AFP: Asian trading floors were a sea of red once again yesterday as the global rout returned with a vengeance on intensifying fears about tighter US interest rates.

Tokyo, Hong Kong and Shanghai were among the worst hit as investors piled into safe haven assets such as gold and the yen.

The sell-off followed another battering for Wall Street, where the Dow suffered its second-heaviest daily points fall on record -- the worst coming on Monday -- after key US Treasury bond yields spiked fuelling the likelihood of higher borrowing costs.

After a blistering 2017 and January, markets worldwide have gone into a spasm in the past two weeks on fears that the booming global economy and rising inflation will lead to higher interest rates.

“There’s some big-money players that have really leveraged to the low rates forever, and they have to unwind those trades,” Doug Cote, chief market strategist at Voya Investment Management, told Bloomberg News. “They could be in full panic mode right now.”

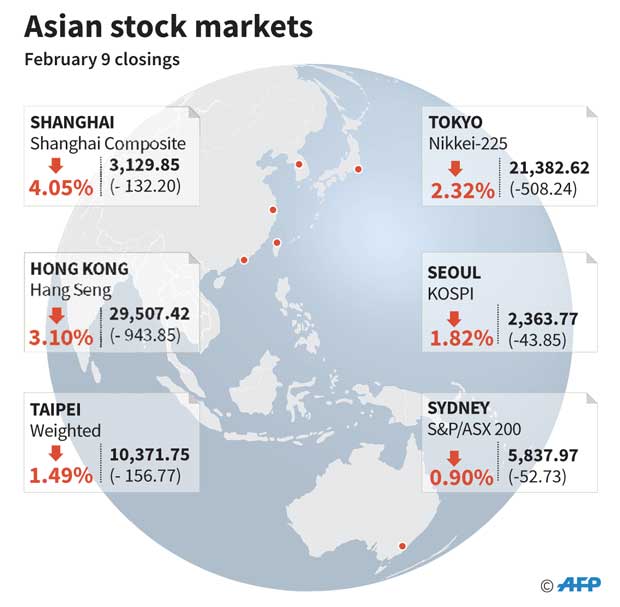

Japan’s Nikkei fell 2.3 percent and is now at levels not seen since mid-October, while Hong Kong dropped 3.1 three percent wiping out its 2018 gains. Shanghai dived 4.1 percent to lows last touched in mid-2017.

Sydney fell 0.9 percent, Singapore shed 1.7 percent and Seoul was 1.8 percent off. Wellington, Manila and Taipei were also hammered.

In early European trade London fell 0.3 percent, Paris shed 0.1 percent and Frankfurt was flat.

A key trigger of the recent pullback was last Friday’s strong US jobs report that also showed rising US wage growth, fuelling speculation the Federal Reserve will lift rates more than the three times already expected this year.

At the same time, the European Central Bank is on the verge of ending its crisis-era stimulus, while the Bank of England warned Thursday that rates will likely rise.

“The message from ECB and Fed speakers, not to mention the Bank of England is that rates will continue to climb because of the strength of the global economy,” said Greg McKenna, chief market strategist at AxiTrader.

With eurozone and British borrowing rates expected to go up, the euro and pound climbed against the dollar.

The greenback edged up against the yen but was still sharply down from Thursday’s levels in Asia as panicked investors sought out safety. The dollar fell to as low as 108.50 yen from almost 110 yen the day before, hit by a weak sale of US bonds, which jacked their yield back close to four-year highs.

However, many analysts are upbeat about the future owing to healthy economic conditions in the US and global economies as well as the positive outlook for corporate earnings after Donald Trump’s massive tax cuts in December.

There was also some good news from Washington where senators agreed a budget bill to avoid another extended government shutdown.

Energy firms around Asia are again taking a beating, with plunging oil prices adding to their woes.

Data showing surging US production has sent crude spiralling downward, with both main contracts about 10 percent off their January highs, and offsetting a cap deal between OPEC and Russia.

Sukrit Vijayakar of Trifecta Consultants said the record high US output figure “suggests that it is now possible to ramp up production even higher quite soon” which would be negative for a market trying to soak up excess supplies to balance them with demand.

19 Nov 2024 2 hours ago

19 Nov 2024 3 hours ago

19 Nov 2024 4 hours ago

19 Nov 2024 6 hours ago

19 Nov 2024 7 hours ago