14 Mar 2024 - {{hitsCtrl.values.hits}}

By First Capital Research

The secondary market witnessed a day marked by subdued sentiment, attributed to limited activities and thin trading volumes.

Notably, the short to mid tenures, including 15.12.26, 01.05.27 and 15.12.28, enticed trades at 11.29 percent, 11.90 percent and 12.18 percent, respectively.

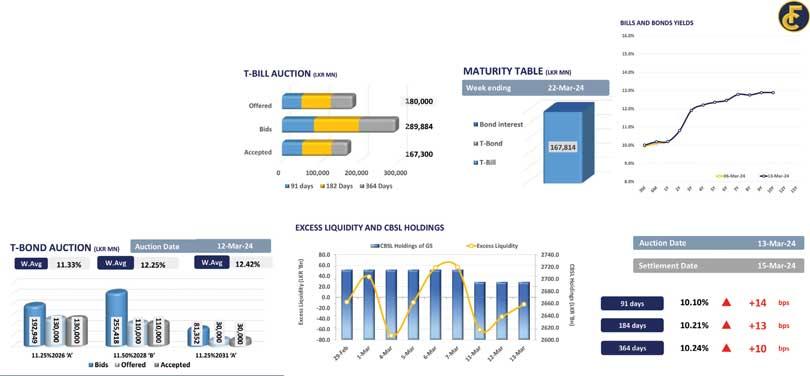

Meanwhile, at the weekly T-bill auction held yesterday, the Central Bank partially accepted Rs.167.3 billion from the total of Rs.180.0 billion offered, whilst the auction yields slightly increased by over 10 basis points (bps) across the board.

The 91-day maturity experienced higher reception, with the Central Bank accepting Rs.51.6 billion (surpassing the total of Rs.50.0 billion offered), at a weighted average yield rate (WAYR) of 10.10 percent (+14bps), whilst Rs.75.0 billion was fully accepted for the 182-day maturity, at a WAYR of 10.21 percent (+13bps) and Rs.40.7 billion was accepted for the 364-day maturity (below the total of Rs.55.0 billion offered), at a WAYR of 10.24 percent (+10bps).

Furthermore, the overnight liquidity continued to remain negative for the third consecutive day, recording a deficit of Rs.13.2 billion, whilst the Central Bank holdings remained stagnant at Rs.2,695.62 billion.

On the external side, the Sri Lankan rupee continued to appreciate against the US dollar for the fourth consecutive week, closing at Rs.306.6 during the day.

27 Oct 2024 2 hours ago

27 Oct 2024 2 hours ago

27 Oct 2024 2 hours ago

27 Oct 2024 27 Oct 2024

26 Oct 2024 26 Oct 2024